Delawaredave5

Full time employment: Posting here.

- Joined

- Dec 22, 2004

- Messages

- 699

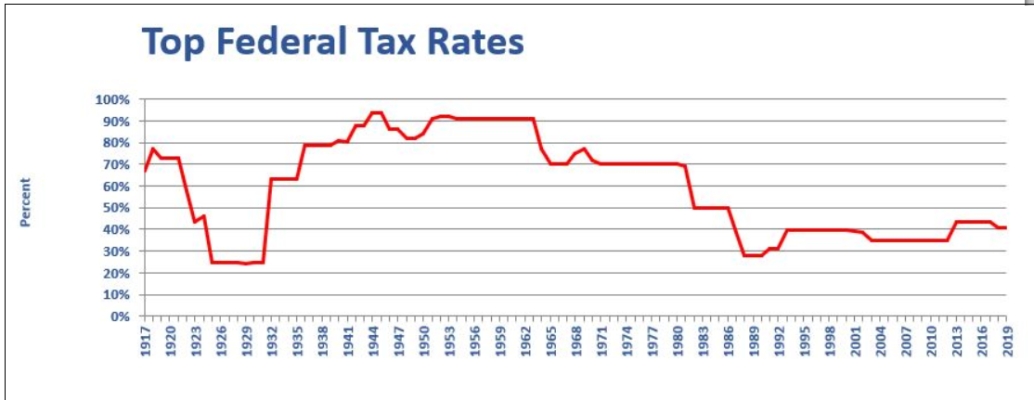

Saw a couple recommendations to do substantial Roth conversions now because "top tax brackets are lowest ever and sure to go up a lot over next couple decades".

If you're in a high/top bracket now, and you expect to be in same high/top bracket through retirement - does it make sense to do large scale Roth conversion now ?

Is there a conversion annual limit ? (conversion, not contribution).

With the current top bracket at 35% (for below $500k), top brackets could easily go to 45% (or higher) - especially true given federal deficit and a "Bernie like" President possibility.

Anybody doing large conversions to take advantage of this ? Thanks in advance.

If you're in a high/top bracket now, and you expect to be in same high/top bracket through retirement - does it make sense to do large scale Roth conversion now ?

Is there a conversion annual limit ? (conversion, not contribution).

With the current top bracket at 35% (for below $500k), top brackets could easily go to 45% (or higher) - especially true given federal deficit and a "Bernie like" President possibility.

Anybody doing large conversions to take advantage of this ? Thanks in advance.