SmallCityDave

Recycles dryer sheets

- Joined

- Oct 23, 2018

- Messages

- 309

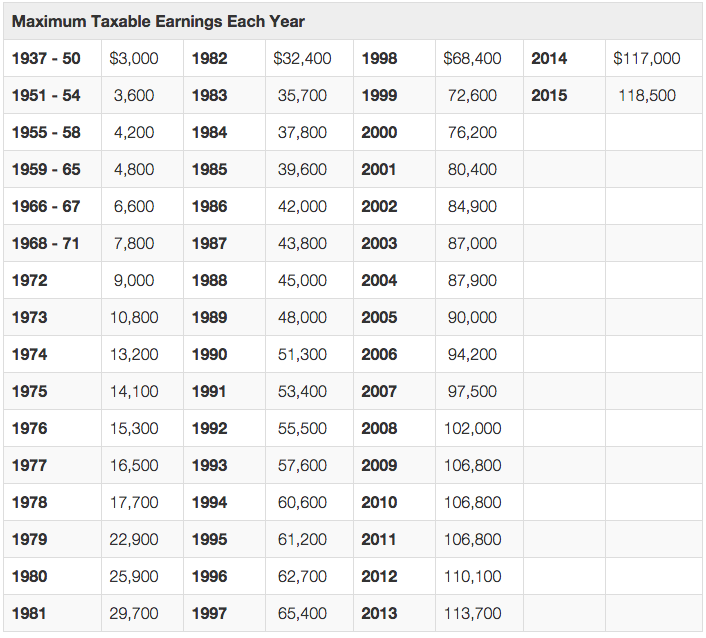

I had breakfast with some friends last week they were telling me they were "earning" just enough to maximize what they would get back in SS benefits so they were are the ceiling and no more. In essence they were saying that if the "earned" $50k per year or $100k their SS benefits would be the same.

My question is is this true and if so what is that magic number.

Thanks and sorry if this has been asked before.

My question is is this true and if so what is that magic number.

Thanks and sorry if this has been asked before.