Romer

Recycles dryer sheets

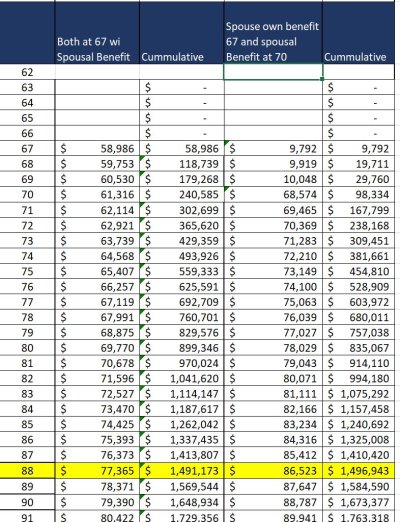

I believe I have this modeled correctly and it shows to me assuming we both live a long time that taking SS a 67 with my wife taking the spousal benefit then is the better option

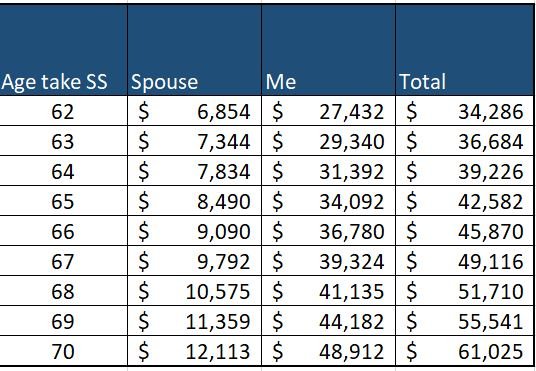

My wife’s SS benefit is lower because she has been a homemaker only working a few years out of the home AND VERY HARD at home while raising our kids

As I understand it, to maximize the spousal benefit she can’t take SS until age 67.

If I wait until age 70 she can take her own at 67 and then switch to spousal once I take it at age 70. At 70, her benefit is the same 50% of my value at 67 FRA. Waiting 3 years only benefits my payout and then her benefit if I die before her. Doing the 70 year route it takes until age 88 to break even per the attached table. That is because we are so far ahead starting at 67 with a combined SS of $59K for 3 years

The downside of taking both at 67, is that if I precede her the payout she gets is $9K less. Doing the math assuming I die right after staring the benefit at 70 we are already $150K ahead and it would take her until age 86 for that $9K to break even

So the evaluation for my circumstances shows I should take SS at age 67 and she then takes the spousal support at 50% of my value

Have I missed anything?

I wasn't aware of the Spousal benefit until recently. I talked to a friend who just retired and neither had he. Hopefully this helps others

My wife’s SS benefit is lower because she has been a homemaker only working a few years out of the home AND VERY HARD at home while raising our kids

As I understand it, to maximize the spousal benefit she can’t take SS until age 67.

If I wait until age 70 she can take her own at 67 and then switch to spousal once I take it at age 70. At 70, her benefit is the same 50% of my value at 67 FRA. Waiting 3 years only benefits my payout and then her benefit if I die before her. Doing the 70 year route it takes until age 88 to break even per the attached table. That is because we are so far ahead starting at 67 with a combined SS of $59K for 3 years

The downside of taking both at 67, is that if I precede her the payout she gets is $9K less. Doing the math assuming I die right after staring the benefit at 70 we are already $150K ahead and it would take her until age 86 for that $9K to break even

So the evaluation for my circumstances shows I should take SS at age 67 and she then takes the spousal support at 50% of my value

Have I missed anything?

I wasn't aware of the Spousal benefit until recently. I talked to a friend who just retired and neither had he. Hopefully this helps others