I searched this site and didn't find a similar thread.

Has anyone here used Monte Carlo tools, for example portfoliovisualizer or others, as a planning tool for a period of time, for example 10 years? Did your view of Monte Carlo become more favorable, or less favorable over time, in terms of the usefulness of MC as a planning tool?

I am not referring to "period of time" in the sense of the number of years parameter in the MC simulation. "Period of time" means calendar years that you have personally used MC in your own planning toolbox.

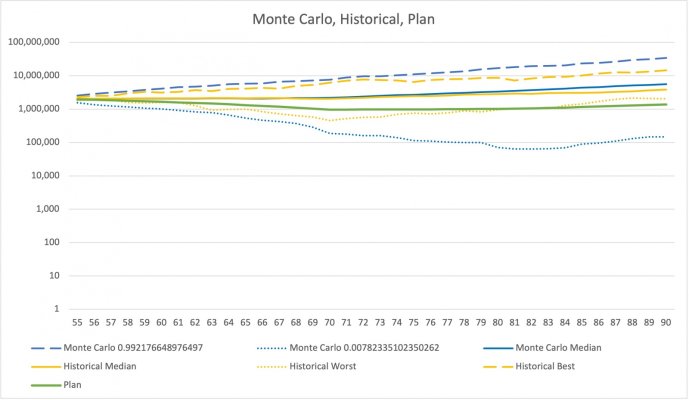

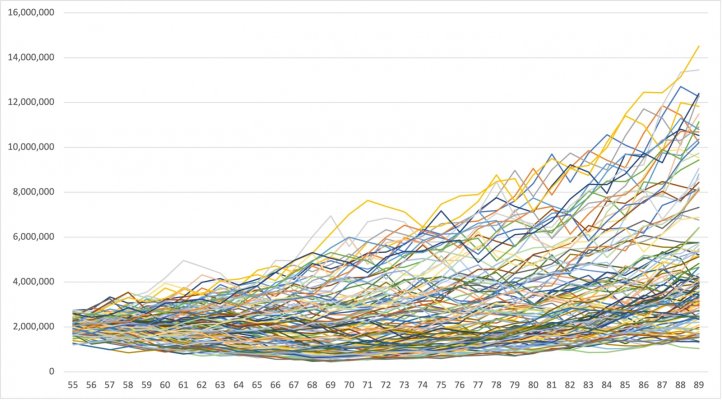

We all know the pitfalls of thinking the future can be predicted with a fancy calculator like MC. However I do believe in robust data sets and robust analytical methods. MC could be one of those - a robust data set and a robust method.

What do people think about MC, after having used it for 10 years? Thanks for any comments.

Has anyone here used Monte Carlo tools, for example portfoliovisualizer or others, as a planning tool for a period of time, for example 10 years? Did your view of Monte Carlo become more favorable, or less favorable over time, in terms of the usefulness of MC as a planning tool?

I am not referring to "period of time" in the sense of the number of years parameter in the MC simulation. "Period of time" means calendar years that you have personally used MC in your own planning toolbox.

We all know the pitfalls of thinking the future can be predicted with a fancy calculator like MC. However I do believe in robust data sets and robust analytical methods. MC could be one of those - a robust data set and a robust method.

What do people think about MC, after having used it for 10 years? Thanks for any comments.