I'm 62 and single, and feel like I have (but just barely) enough $$$ for the rest of my life. When my late wife and I were in our early 50s we paid off our current house. What a great feeling!

Now that I'm a widower, I am purchasing a brand-new single family home in an Active Adult community. House should be ready next May. Once I'm in the new home, I will get my current home (of 27 years) on to the market. Figuring all expenses (20% down payment on the new place, new furniture, getting the current home up to snuff to sell, real estate agents), I expect to clear around $600K.

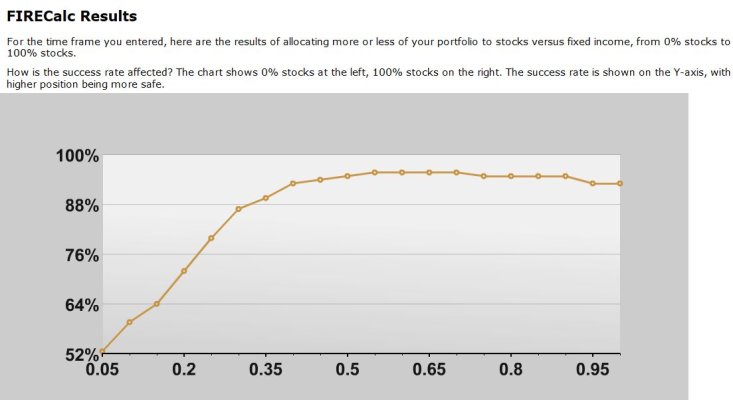

I have absolutely NO thought of paying cash for the new home, though I could easily do so. With 30-year rates under 3%, I feel like paying that out over 30 years (or not ever paying it off; the more likely scenario) is a no-brainer, so that I can put the $600K into the market, probably at a very conservative AA (something like 35/65; I'm all about preservation of capital.)

Am I missing some things? What would you do? TIA.

Now that I'm a widower, I am purchasing a brand-new single family home in an Active Adult community. House should be ready next May. Once I'm in the new home, I will get my current home (of 27 years) on to the market. Figuring all expenses (20% down payment on the new place, new furniture, getting the current home up to snuff to sell, real estate agents), I expect to clear around $600K.

I have absolutely NO thought of paying cash for the new home, though I could easily do so. With 30-year rates under 3%, I feel like paying that out over 30 years (or not ever paying it off; the more likely scenario) is a no-brainer, so that I can put the $600K into the market, probably at a very conservative AA (something like 35/65; I'm all about preservation of capital.)

Am I missing some things? What would you do? TIA.