esposla

Dryer sheet aficionado

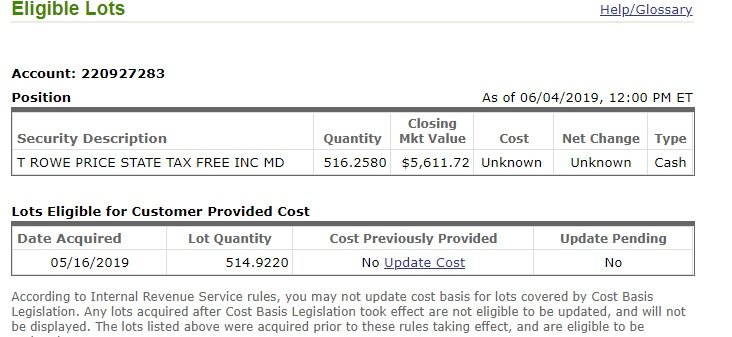

Hi. I am 61yo , married, employed full time. I transferred TRowe mutual fund to Fidelity. I am meeting with Fidelity for 2nd time to review portfolio. A few of these funds have notifications about dividends and mentions updating cost. Is it important to update , how do I and is it important to update before moving these mutual funds to another fund? Or do I need to update cost at all? This is $60k of a $400k portfolio.

I appreciate any input. Thank you.

I’m guessing it’s required, and Fidelity would assist me.

I appreciate any input. Thank you.

I’m guessing it’s required, and Fidelity would assist me.