ownyourfuture

Thinks s/he gets paid by the post

- Joined

- Jun 18, 2013

- Messages

- 1,561

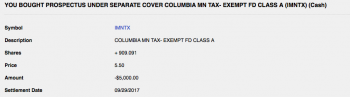

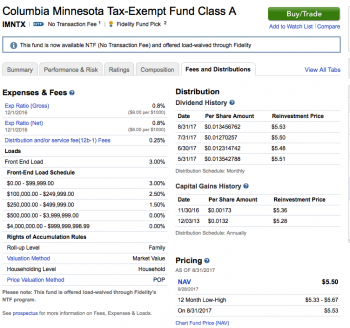

Columbia Minnesota Tax-Exempt A (IMNTX) *3.00% Load Waived @Fidelity*

I contacted Fidelity & talked to a representative sometime ago.

All I remember is when I was done, I still didn't understood the method they use, or the reason ?

If you look at the top line in the file I included, you'll see that the last purchase was for $5,000.00 on September 27th.

The closing price of the fund that day was $5.50, so the quantity shown is correct. 5,000.00 divided by 5.50 = 909.091

Yet it shows a cost basis of $5,008.81 ?

Other than the monthly dividend reinvestments, I've made a total of 10 purchases.

2,500.00 8 times

3,000.00 1 time

5,000.00 1 time

And for each one, it shows a higher cost basis & amount.

My question is, why not show the 'actual cost basis & amount' for each purchase ?

Here’s a link to Yahoo historical prices for IMNTX

https://finance.yahoo.com/quote/IMNTX/history?p=IMNTX

FYI: *The fund closed @ $5.50 on Wednesday & Thursday*

I contacted Fidelity & talked to a representative sometime ago.

All I remember is when I was done, I still didn't understood the method they use, or the reason ?

If you look at the top line in the file I included, you'll see that the last purchase was for $5,000.00 on September 27th.

The closing price of the fund that day was $5.50, so the quantity shown is correct. 5,000.00 divided by 5.50 = 909.091

Yet it shows a cost basis of $5,008.81 ?

Other than the monthly dividend reinvestments, I've made a total of 10 purchases.

2,500.00 8 times

3,000.00 1 time

5,000.00 1 time

And for each one, it shows a higher cost basis & amount.

My question is, why not show the 'actual cost basis & amount' for each purchase ?

Here’s a link to Yahoo historical prices for IMNTX

https://finance.yahoo.com/quote/IMNTX/history?p=IMNTX

FYI: *The fund closed @ $5.50 on Wednesday & Thursday*