I think conventional house often come with a higher price tag than most people realize. Many of the posters I see on forums who have really low expenses but don't live in RVs often live in paid for condos with low HOA fees, they rent or they live in manufactured housing.

I could not get down at the claimed level being discussed here, no matter what I gave up.

I live in a paid for condo, for which in my opinion the dues are too low to adequately maintain the building long term. I currently do not own a car. I do very minimal traveling outside of Seattle, though in the future that might change. I eat few restaurant meals, though a Monday night football at a sport's bar with happy hour prices on good burgers and drinks will set me back $45-50 for two. In my experience, there just is no magic. You want some casual entertainment, you pay for it. You like heat in your house so your hands don't feel like they will fall off, you pay for it. You want medical care, you pay for it, one way or another.

For my condo, I pay 4% of purchase price in property tax and dues alone, and though the dues have been stable the tax goes up as the real estate market recovers. I don't think this amount is outlandish at all, our grounds are nicely landscaped the sidewalks kept clear of leaves and snow, the street-strip grass kept mowed. We get a break on this as a guy who lives here likes to do it, and is good at it, and needs the cash income. Leaves are a big deal, but without the trees along the street, it would be far less pleasing to live here. They are just now fading to yellowish from red, the ones which haven't yet blown down.

Something always equalizes. I used to live in the country where things were cheaper than Seattle. However, when my well pump gave up 400' feet down, that was not cheap. I couldn't walk down the street and go to a coffeehouse or meet a friend, so I put a lot of miles on my car. When I quit commuting I thought I would drive much less, but instead I learned that my amount of driving was largely driven by my needs for diversion, so if driving decreased at all, it was maybe 5%. And I was a 15 minute walk from the Sound, through a park. Still some days I wanted to fish in a river instead of the Sound, or go to town. Living in Seattle, I feel very little need to travel, but when I lived in LA, before I moved to the beach, it was out to the mountains or desert every weekend. Once at the beach, I went no farther than the 3 blocks to the sand, but my rent was higher, and I had to commute farther for work. Beyond a few easy things, frugality means doing without, at some level.

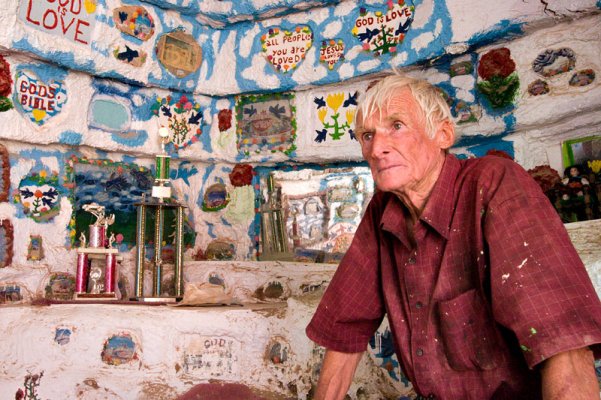

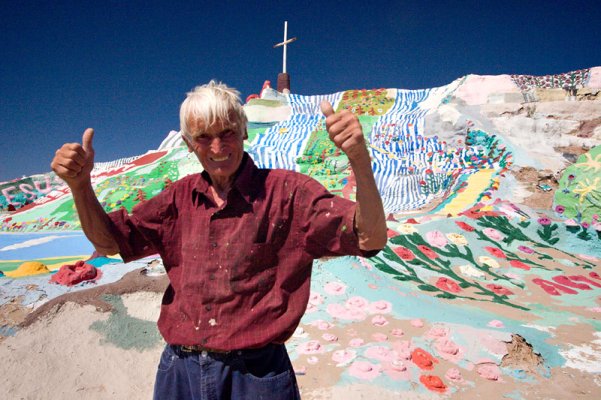

All I have to do when I read a thread like this is ask myself, would anything short of stark need make me choose to live this way? Absolute must-do need might, but I think then I might consider a step van and the Slabs first. Pull out the djembe and watch the dancing girls.

Ha