- Joined

- Nov 27, 2014

- Messages

- 9,208

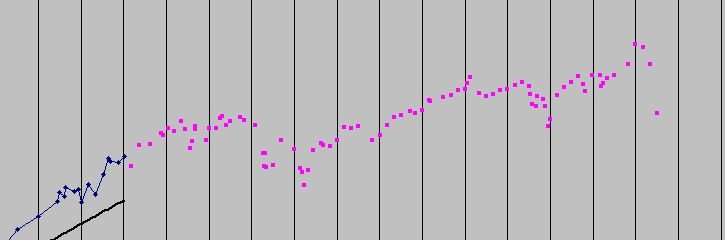

I just did a summary of my statements as I've been doing quarterly for many years. On 3/31/2020, my NW is almost the same as it was on 12/31/2017.

This is interesting (to me) because I retired in January of 2018. Of course financially I didn't retire because I got a severance. None the less, being retired for two years and having my NW be the same as just before retirement feels a lot better than focusing on the losses I've watched in this last month hit my accounts.

On 3/31/2020 I moved most of my investments to cash/mm. I went from 60/40 to 10/90. The equities I have left are in my taxable account and made up of ten individual stocks that I feel are solid companies that have great dividend histories.

I'm going to ride out the next month or so - probably at least the 2nd quarter, as I am, while I think about how to go forward. I've discussed that in other threads but basically, I need to feel that I'm better protecting myself to remain retired and living at the level I planned for when I pulled the trigger. At the very least, I've gained a new appreciation for risk during retirement and what asset allocation really means.

The main reason I posted was to say that I feel a lot better when I see that my NW is no different than the day I retired. If it was good enough two years ago, it will be good as a new starting point (today).

This is interesting (to me) because I retired in January of 2018. Of course financially I didn't retire because I got a severance. None the less, being retired for two years and having my NW be the same as just before retirement feels a lot better than focusing on the losses I've watched in this last month hit my accounts.

On 3/31/2020 I moved most of my investments to cash/mm. I went from 60/40 to 10/90. The equities I have left are in my taxable account and made up of ten individual stocks that I feel are solid companies that have great dividend histories.

I'm going to ride out the next month or so - probably at least the 2nd quarter, as I am, while I think about how to go forward. I've discussed that in other threads but basically, I need to feel that I'm better protecting myself to remain retired and living at the level I planned for when I pulled the trigger. At the very least, I've gained a new appreciation for risk during retirement and what asset allocation really means.

The main reason I posted was to say that I feel a lot better when I see that my NW is no different than the day I retired. If it was good enough two years ago, it will be good as a new starting point (today).