You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

astromeria

Moderator Emeritus

- Joined

- Aug 13, 2005

- Messages

- 1,375

Our health insurance has gone up about 15% a year for the past few years (group plan at my husband's employer, a state college).

My guesses as to the reasons: insurance costs are generally going up for everyone, apparently no age discrimination by the college (both my husband and our neighbor were hired in their 50s), every year state taxpayers & their representatives decide to decrease the percentage of the cost of health insurance that they pay for state employees.

My guesses as to the reasons: insurance costs are generally going up for everyone, apparently no age discrimination by the college (both my husband and our neighbor were hired in their 50s), every year state taxpayers & their representatives decide to decrease the percentage of the cost of health insurance that they pay for state employees.

OP

OP

Cut-Throat

Guest

astromeria said:Our health insurance has gone up about 15% a year for the past few years (group plan at my husband's employer, a state college).

My guesses as to the reasons: insurance costs are generally going up for everyone, apparently no age discrimination by the college (both my husband and our neighbor were hired in their 50s), every year state taxpayers & their representatives decide to decrease the percentage of the cost of health insurance that they pay for state employees.

Yeah, we all know about health care. I would leave this entirely out of the discussion. At its current rate no one will be able to afford it, so you can just eliminate it from your budget!

cute fuzzy bunny

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I can see Steve Liesman adding that to his morning cnbc inflation arguments.

"Lets not include energy, food or health care as they're just getting so expensive nobody will be able to afford them!"

The rest of the stuff is going great!

Yay!"

"Lets not include energy, food or health care as they're just getting so expensive nobody will be able to afford them!"

The rest of the stuff is going great!

Yay!"

OP

OP

Cut-Throat

Guest

Cute Fuzzy Bunny said:I can see Steve Liesman adding that to his morning cnbc inflation arguments.

"Lets not include energy, food or health care as they're just getting so expensive nobody will be able to afford them!"

The rest of the stuff is going great!

Yay!"

Well, I included Food and Energy! But how would I even include health care so that it would be relevant? I know we are paying less this year in health Insurance because we chose an option with less benefits. Too hard for me to measure.....

Also, we all know it's high. And it is true that health insurance is so expensive that countless millions of Americans cannot afford it and don't have it!

For me, I put it under "entertainment" (the more I drink, the more "entertaining" I become.. 8) .DanTien said:Are you tucking your wine bill under groceries?

- Ron

Cut: My wife pays all the bills, so have got to admit that I can't back you up by posting anything that verifies your point regarding actual charges.

But I remember your previous posts re: spending in early part of retirement, versus latter part.

You may (or may not) find this interesting, but here goes:

find this interesting, but here goes:

When I retired (just shy of 20 years ago), we were spending just shy of $4,000 a month. (I have kept track of that figure).

Same house, still have 2 cars and a p/up truck.

Still play tournament golf, and fly-fish.

We now spend about about $4300.00 a month.

Plugging in 4% inflation, according to various

computer programs, we should be spending over $8,000.00 a month now.

Needless to say, I am damn pleased with the cost of living over the last 20 years. (Being a veteran of the 60's and the 70's makes it even better by comparison.)

My wife and I do whatever we want, as we did when I first retired. (In fairness for comparisons, our habits have changed somewhat regarding 3 and 4 day trips to Reno, Bay Area, etc.)

Although I didn't address the actual changes in individual items, the point I wanted to get across is that it has been our experience that

plugging in 4% requirement would have been over-kill in our case, and we would have missed out on doing what we wanted to early in our retirement.

I know we discussed this earlier based on an article on this subject. (You have mentioned this a few times, and based on our experience your instincts are correct.

Jarhead

But I remember your previous posts re: spending in early part of retirement, versus latter part.

You may (or may not)

When I retired (just shy of 20 years ago), we were spending just shy of $4,000 a month. (I have kept track of that figure).

Same house, still have 2 cars and a p/up truck.

Still play tournament golf, and fly-fish.

We now spend about about $4300.00 a month.

Plugging in 4% inflation, according to various

computer programs, we should be spending over $8,000.00 a month now.

Needless to say, I am damn pleased with the cost of living over the last 20 years. (Being a veteran of the 60's and the 70's makes it even better by comparison.)

My wife and I do whatever we want, as we did when I first retired. (In fairness for comparisons, our habits have changed somewhat regarding 3 and 4 day trips to Reno, Bay Area, etc.)

Although I didn't address the actual changes in individual items, the point I wanted to get across is that it has been our experience that

plugging in 4% requirement would have been over-kill in our case, and we would have missed out on doing what we wanted to early in our retirement.

I know we discussed this earlier based on an article on this subject. (You have mentioned this a few times, and based on our experience your instincts are correct.

Jarhead

OP

OP

Cut-Throat

Guest

Good to see you posting Jarhead! - You have always been one of my favorite posters!

Jarhead - "voice of wisdom - that has been retired many, many moons!"

Jarhead - "voice of wisdom - that has been retired many, many moons!"

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

Yep. Mr. Jarhead, so I've been informed, is our official ER forum "mine canary".

He's been quiet lately and it sure is nice to hear from him...especially when he's telling me I can spend more now rather than later!

He's been quiet lately and it sure is nice to hear from him...especially when he's telling me I can spend more now rather than later!

haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I had 4 years of data in MS Money, but an unbacked up crash cost me all the old stuff.

One thing I don't understand is your food costs, CT. From Dec 1, 05 thru May3, 06, my "groceries" which includes cheap wine but no beer or liquor cost me $2477. This is just home fixed meals, no meals out. So annualized, it about equals your figure.

I weigh 160#, and I think I have a moderate appetite. I never buy my food without an eye to value- I tend to get what is one sale in the meat counter, etc. I don't often shop for food at Wal*Mart or Costco. Neither one is close enough to be handy or cost-effective considering gasoline,

I sure would like to know how you can feed 2 adults on almost the same $$ amount.

Do you maybe eat out a lot, or something which might keep a lot of your food out of your budget as presented above?

Also, let me add my pleasure at seeing Jarhead posting again.

Ha

One thing I don't understand is your food costs, CT. From Dec 1, 05 thru May3, 06, my "groceries" which includes cheap wine but no beer or liquor cost me $2477. This is just home fixed meals, no meals out. So annualized, it about equals your figure.

I weigh 160#, and I think I have a moderate appetite. I never buy my food without an eye to value- I tend to get what is one sale in the meat counter, etc. I don't often shop for food at Wal*Mart or Costco. Neither one is close enough to be handy or cost-effective considering gasoline,

I sure would like to know how you can feed 2 adults on almost the same $$ amount.

Do you maybe eat out a lot, or something which might keep a lot of your food out of your budget as presented above?

Also, let me add my pleasure at seeing Jarhead posting again.

Ha

I'll admit, we are terrible at budgets. Oh, on the surface we look great, excel workbooks with cash flows, trend lines, etc. But if you look closer at the numbers, you see we do a terrible job itemizing. Every month is ~$3,000 on credit cards, our largest single expense, and it contains gas, groceries, meals out, booze, co-pays for Tori, most of the utilities, etc. We really need to be better about this, because part of our continuing anxiety is not knowing how much of that could be cut back in hard times. We pay the balance off every month, and get cash back, but we really need to start looking at the bills.

Hey Jarhead, buddy! Good to see you again!

Hey Jarhead, buddy! Good to see you again!

maddythebeagle

Thinks s/he gets paid by the post

- Joined

- Jun 15, 2005

- Messages

- 2,450

I can see Steve Liesman adding that to his morning cnbc inflation arguments.

"Lets not include energy, food or health care as they're just getting so expensive nobody will be able to afford them!"

The rest of the stuff is going great!

Yay!"

I think CT did a bunch of remodeling in his basement recently too. Cost of electrical wire has gone up more than 4% over the last few years (copper and plastic). Just about anything that is hauled has a "fuel surcharge".

OP

OP

Cut-Throat

Guest

Maddy the Turbo Beagle said:I think CT did a bunch of remodeling in his basement recently too. Cost of electrical wire has gone up more than 4% over the last few years (copper and plastic). Just about anything that is hauled has a "fuel surcharge".

Yes I did do a lot of finish work this year, but I didn't do it the previous 3 years so I have nothing to compare it to. So, don't lose sight of the point. I only included items that are purchased every year. Also, I didn't include anything in 2006 because it isn't over yet!

REWahoo! said:Yep. Mr. Jarhead, so I've been informed, is our official ER forum "mine canary".

He's been quiet lately and it sure is nice to hear from him...especially when he's telling me I can spend more now rather than later!

ReWahoo: Absolutely feel free to make a $1000.00 wager on the Maverics. (They'll be underway in about 20 minutes.

I have no objection to being a "Mine Canary", but really don't care to be a Pidgeon, so wouldn't be interested in that bet.

Should be an interesting series, and even my wife (not an NBA fan), is looking forward to Shaq and Nowinzki match-up.

Well, you've come this far without itemizing, so the additional knowledge might give you more security but not necessarily a lot more cutback options. We started tracking everything in Quicken because of my nuclear-engineering personality, not because I decided that it was a great idea.Laurence said:But if you look closer at the numbers, you see we do a terrible job itemizing. Every month is ~$3,000 on credit cards, our largest single expense, and it contains gas, groceries, meals out, booze, co-pays for Tori, most of the utilities, etc. We really need to be better about this, because part of our continuing anxiety is not knowing how much of that could be cut back in hard times. We pay the balance off every month, and get cash back, but we really need to start looking at the bills.

You probably already know the broad outlines of what to cut back on. (Sorry, booze.) Every time you haul out your wallet you'll review that heuristic. Every pizza delivery or latté will make you wonder what else you'll have to cut back on. You'll be brown-bagging just about every work meal. You'll be reading the "Dollar Stretcher" newsletter and hanging out at the Simple Living discussion board. Every recurring expense will automatically be eligible for the chopping block. Every insurance bill will be scrutinized for a higher deductible. At some point you'll wonder if you should hire yourself out as a household-finances consultant to get everyone else back on track, too, while being rewarded for learning all these skills.

Your credit-card company might organize your purchases on their website. Not every CC company does this and it might still be a butt-ugly download, but you could figure out the broad categories and capture about 80% of it. Even I feel a little silly trying to properly allocate $53.95 cash back among the groceries, gas, & dining categories.

For more detail than that, you'll end up entering individual transactions. We've done over 100,000 of them, but I admit that it's not with the same zeal today than 14 years ago when we were scraping up $200 every couple weeks to DCA into mutual funds...

REWahoo

Give me a museum and I'll fill it. (Picasso) Give

Jarhead* said:...even my wife (not an NBA fan), is looking forward to Shaq and Nowinzki match-up.

Jarhead, too bad you won't take that wager. I'm betting "Nowitzki" won't end up as a "Nowinski"!

Nords said:Well, you've come this far without itemizing, so the additional knowledge might give you more security but not necessarily a lot more cutback options. We started tracking everything in Quicken because of my nuclear-engineering personality, not because I decided that it was a great idea.

You probably already know the broad outlines of what to cut back on. (Sorry, booze.) Every time you haul out your wallet you'll review that heuristic. Every pizza delivery or latté will make you wonder what else you'll have to cut back on. You'll be brown-bagging just about every work meal. You'll be reading the "Dollar Stretcher" newsletter and hanging out at the Simple Living discussion board. Every recurring expense will automatically be eligible for the chopping block. Every insurance bill will be scrutinized for a higher deductible. At some point you'll wonder if you should hire yourself out as a household-finances consultant to get everyone else back on track, too, while being rewarded for learning all these skills.

Your credit-card company might organize your purchases on their website. Not every CC company does this and it might still be a butt-ugly download, but you could figure out the broad categories and capture about 80% of it. Even I feel a little silly trying to properly allocate $53.95 cash back among the groceries, gas, & dining categories.

For more detail than that, you'll end up entering individual transactions. We've done over 100,000 of them, but I admit that it's not with the same zeal today than 14 years ago when we were scraping up $200 every couple weeks to DCA into mutual funds...

Ugh, I'm feeling too lazy to start all that just yet. And as far as the booze, we're just out to cut discretionary spending, not necessities! Alas, you touch on something critical, perhaps we always had it too good, i.e. too much wiggle room, with enough money to be sloppy spenders and put enough away to pat ourselves on the back. Now that DW is staying home, we are trying to adjust to our smaller budget without pushing out retirement too far.

Hmmm, sounds like she might hold the solution to your laziness issues!Laurence said:Ugh, I'm feeling too lazy to start all that just yet.

Now that DW is staying home, we are trying to adjust to our smaller budget without pushing out retirement too far.

If she's the one doing most of the spending then it's a lot easier for her to do the data entry...

mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,208

only thing that went down over the last 2 years we can see is our auto insurance

C-T

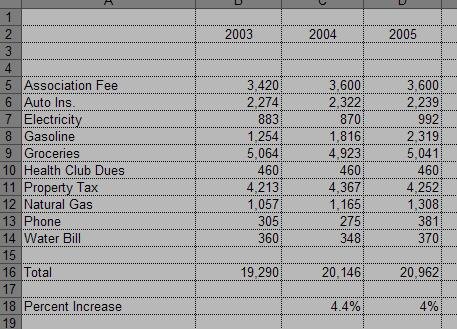

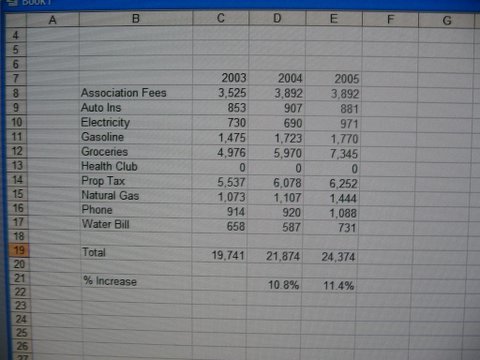

I use quicken and have categories similar to yours. Here are our numbers.

We are pretty much in alignment with your spending.

On Groceries; DS moved in with us to go to college after HS Graduation in 2004 and so our Groceries went up for 1/2 year in 04 and full year in 2005 - we don't worry about left-overs anymore! With my accounting, Groceries includes everything we get at grocery stores, Sams and Trader Joes including beer and wine.

Our Phone expenses include local phone, 1 cell phone, LD, and Internet costs.

Prop Taxes and Water & Sewer here are high.

I'd say that half our %increase is due to DS "eating us out of house and home" for half 2004 and all of 2005. This leads me to the same conclusion you did that the CPI is pretty much in line with the trends of our basic expenses.

JohnP

I use quicken and have categories similar to yours. Here are our numbers.

We are pretty much in alignment with your spending.

On Groceries; DS moved in with us to go to college after HS Graduation in 2004 and so our Groceries went up for 1/2 year in 04 and full year in 2005 - we don't worry about left-overs anymore! With my accounting, Groceries includes everything we get at grocery stores, Sams and Trader Joes including beer and wine.

Our Phone expenses include local phone, 1 cell phone, LD, and Internet costs.

Prop Taxes and Water & Sewer here are high.

I'd say that half our %increase is due to DS "eating us out of house and home" for half 2004 and all of 2005. This leads me to the same conclusion you did that the CPI is pretty much in line with the trends of our basic expenses.

JohnP

Attachments

OP

OP

Cut-Throat

Guest

JohnP said:I'd say that half our %increase is due to DS "eating us out of house and home" for half 2004 and all of 2005. This leads me to the same conclusion you did that the CPI is pretty much in line with the trends of our basic expenses.

JohnP

Interesting!

I would imagine that the increase in Electrical and Natural gas was due to this 'move-in' also. They like long hot showers

C-T - yes part is the long, hot showers and part is the computer central in his corner of the basement - he has one overclocked desktop with a 21 inch CRT, a laptop, and a TV going when he's home from school. Just finishing his second year - now a junior in electrical engineering looking forward to the core EE subjects.

JohnP

JohnP

Similar threads

- Replies

- 61

- Views

- 3K

- Replies

- 51

- Views

- 3K

- Replies

- 454

- Views

- 29K