Delawaredave5

Full time employment: Posting here.

- Joined

- Dec 22, 2004

- Messages

- 699

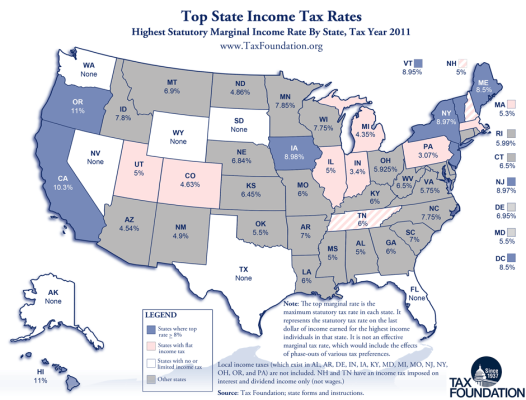

If your state tax is 6% and your income is $50,000, then you pay $3,000 in state tax.

If one moves to a no-state-tax state, obviously no state tax - BUT your federal tax is higher because you cannot deduct state income tax paid from your federal return (because you paid none...) - right ?

So if your Federal bracket is 20%, then your net state tax savings for moving from a 6% state tax state to a 0% state tax state is (100%-20%) x (6%) = 4.8%

Correct ? So the savings in above example would be $2,400 not $3,000.

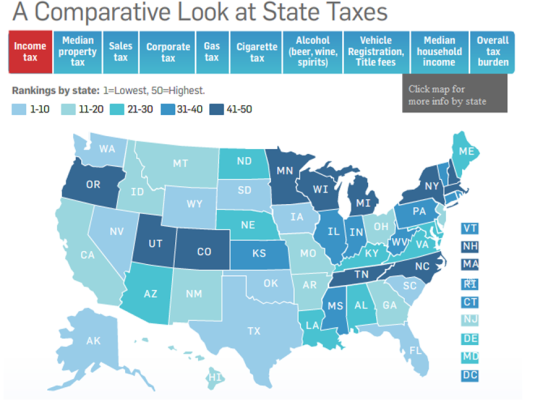

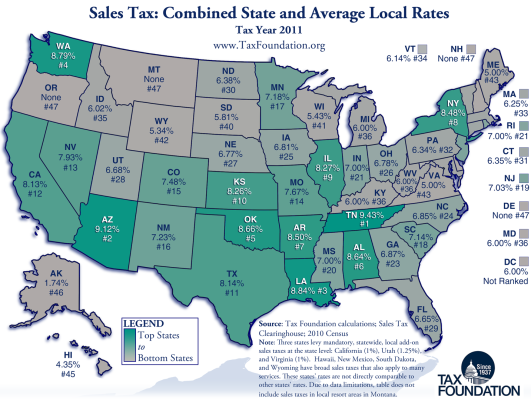

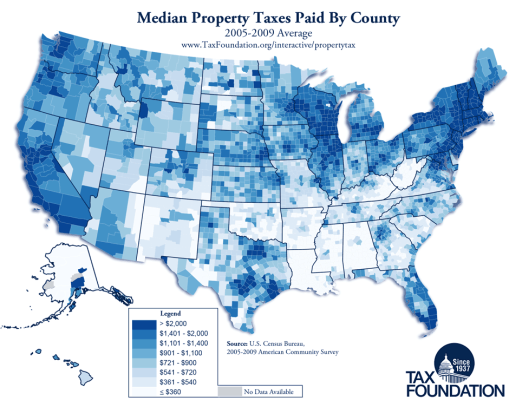

Obviously a lot of other factors about deciding your state residency - cost of living, real estate taxes, etc.

If one moves to a no-state-tax state, obviously no state tax - BUT your federal tax is higher because you cannot deduct state income tax paid from your federal return (because you paid none...) - right ?

So if your Federal bracket is 20%, then your net state tax savings for moving from a 6% state tax state to a 0% state tax state is (100%-20%) x (6%) = 4.8%

Correct ? So the savings in above example would be $2,400 not $3,000.

Obviously a lot of other factors about deciding your state residency - cost of living, real estate taxes, etc.