BTW, Merriman suggests kind of a hybrid, but offers no data or testing to support it: a 4% of total annually, kicked up a notch to 4.5% if/when your nestegg grows to 1.25 its original value, then 5% at 1.5x original, etc. (or something along those lines). Seems too arbitrary to me, but there you have it.

quote]

Rich:

Merriman's flexible withdrawal plan is similar to Gummy's plan. Gummy says if you made more in your portfolio than your withdrawal amount last year, then you can take more for your good money management. If you made less, think about a tighter budget.

Merriman says be more mechanical in the process.

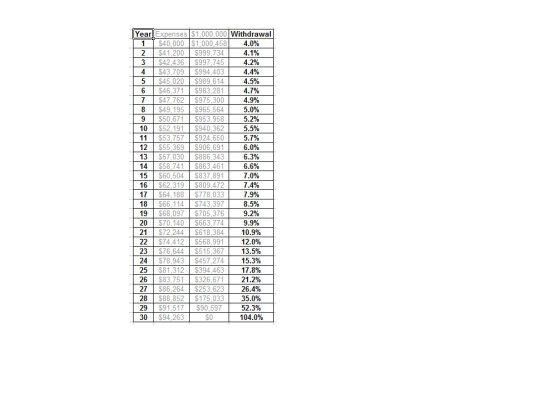

Start with 4% of the current portfolio balance for your year 1 withdrawal. In each subsequent year for each 1% gain or loss in portfolio value you can withdraw an additional (or reduce by) 2 basis points (.02%).

So the example he uses most frequently is if your portfolio year end balance is 25% higher than last year's balance, then the withdrawal rate moves 50 basis points to 4.5%.

On the flip side, however, if you lost 21% of your portfolio balance, your withdrawal should be reduced .42%, or in year 2 that would be 3.58%.

I think one needs to take a look at these schemes based on the portfolio allocation. Both Clyatt and Merriman construct portfolios with value tilts which generally allows increasing amounts of withdrawals (in terms of dollar amount withdrawn) because of lower volatility and dividend yields (in a normal market!!). If one's portfolio didn't have the value tilt, I'm not so sure a flexible withdrawal plan would have lower volatility.

However, in this environment, I plan to use the Gummy method -- that is I'm taking what I need when I rebalance in January (which should be about 4%), then we'll see from there.

-- Rita