twaddle

Thinks s/he gets paid by the post

- Joined

- Jun 16, 2006

- Messages

- 1,703

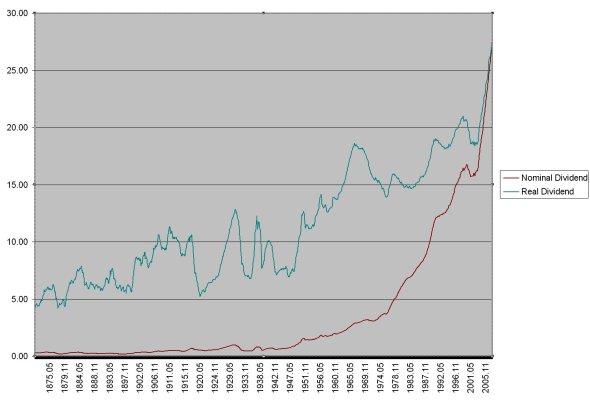

The thread on portfolio survival during a depression got me thinking. How would "living off the yield" have done during the bad years?

It's not really the yield you care about, but the actual dividend amount. So assuming you retired in 1929 or 1968 and decided to forget about stock prices and simply live off your dividend checks, how would you have done?

It turns out that you would have been in a world of pain. The real dividend payment has been cut deeply a few times. About 50% from 1917-1920. From 1929-1934, it got cut by over 60%. From 1968-1978, dividends were cut about 25% in real terms.

The good news is that dividends have grown significantly faster than inflation over the long term. So as long as you make it to see the long term, you should do fine.

It's not really the yield you care about, but the actual dividend amount. So assuming you retired in 1929 or 1968 and decided to forget about stock prices and simply live off your dividend checks, how would you have done?

It turns out that you would have been in a world of pain. The real dividend payment has been cut deeply a few times. About 50% from 1917-1920. From 1929-1934, it got cut by over 60%. From 1968-1978, dividends were cut about 25% in real terms.

The good news is that dividends have grown significantly faster than inflation over the long term. So as long as you make it to see the long term, you should do fine.