Is there anyone who couldn't as of today make it on a 1 million portfolio and Medicare or some type of life time guaranteed health insurance plan.No debt and no mortgage. Assuming age 58 (65 if considering M'care), what would be your asset allocation for the 1 m .

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

One Million and Health Insurance

- Thread starter ferco

- Start date

MasterBlaster

Thinks s/he gets paid by the post

- Joined

- Jun 23, 2005

- Messages

- 4,391

Hopefully there would be some Social Security coming also. To answer your question directly many could make it. However some with higher expectations would feel deprived. It also makes a difference as to what part of the country you reside in.

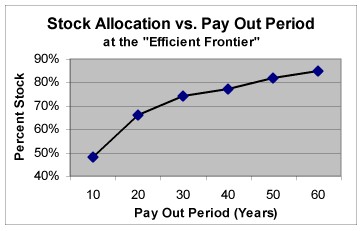

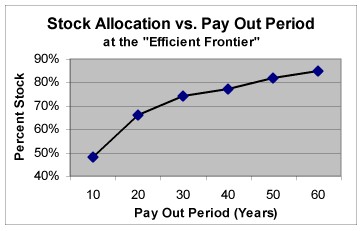

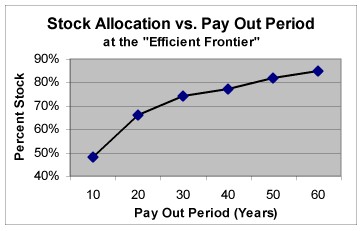

The optimal stock-bond allocation is debated ad-nauseum, however here is one example:

So if you have a 20-25 year life expectancy at retirement then the optimal allocation (at retirement) is 65-75% stocks

The optimal stock-bond allocation is debated ad-nauseum, however here is one example:

So if you have a 20-25 year life expectancy at retirement then the optimal allocation (at retirement) is 65-75% stocks

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Maybe somewhere in flyover country. I'd have a tough time in God's Country (NJ).

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Maybe somewhere in flyover country. I'd have a tough time in God's Country (NJ).

How much of flyover country have you visited?

2Cor521

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

How much of flyover country have you visited?

2Cor521

Lessee, 6 years living in OH (near Cleveland - oh boy!) probably counts. Spent a summer in Denver and periodically return as DW's family live there.

Other places, as far as I can remember (tried to blot out some of these memories, I assure you):

- Dallas-Ft. Worth

- Cincinnati

- Indianapolis

- Several small towns in Nebraska

- Topeka

- Chicago

- Birmingham, AL

- Several places in KY

- Minneapolis

- New Orleans

- Kansas City

- Toledo

- Detroit

- Ann Arbor

- Taos & Sante Fe

- Walsenberg, CO (don't ask)

Narrowly escaped a trip to Chattanooga. Prolly been some other places in "the heartland" that I have successfully blotted out.

Lots of these places would be readily doable with a relatively high standard of living on a milion bucks with house and insurance covered. It would be a LOT easier than if you were in a high cost coastal area, though.

MasterBlaster

Thinks s/he gets paid by the post

- Joined

- Jun 23, 2005

- Messages

- 4,391

Brewer:

You are one well traveled man. What persuaded you to move so much ?

So after all of that relocation maybe you can give some advice on where the best chicken wings can be found !

You are one well traveled man. What persuaded you to move so much ?

So after all of that relocation maybe you can give some advice on where the best chicken wings can be found !

Dawg52

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Maybe somewhere in flyover country. I'd have a tough time in God's Country (NJ).

Surely you don't plan to live in NJ the rest of your life.

FinanceDude

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Aug 3, 2006

- Messages

- 12,483

Maybe somewhere in flyover country. I'd have a tough time in God's Country (NJ).

God's Country is actually the nickname of the Coulee Region of western Wisconsin..........

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Brewer:

You are one well traveled man. What persuaded you to move so much ?

So after all of that relocation maybe you can give some advice on where the best chicken wings can be found !

Heh, most of these places I did not live in, merely visited. Some were places I'd happily never return to. Others I would seriously consider moving to if I chose to vacate God's Country. Many others I could take or leave.

Favorite wings:

- The Feve in Oberlin, OH

- The Blind Tiger in Topeka, KS (about the town's only redeeming feature, IMO)

Is there anyone who couldn't as of today make it on a 1 million portfolio and Medicare or some type of life time guaranteed health insurance plan.No debt and no mortgage. Assuming age 58 (65 if considering M'care), what would be your asset allocation for the 1 m .

Back to the original question...too many "ifs". One person? No problem. 2 people? maybe, family of 6 (like me) with 4 kids to put thru college? probably not.

Could it be done? Absolutely. Even at a 4% SWR, thats 40K to live on...lots of folks get by on a lot less than that, and still have to pay medical and mortgage or rent.

megacorp-firee

Thinks s/he gets paid by the post

- Joined

- Apr 16, 2007

- Messages

- 1,305

under those conditions, no mortgage, no debt, paid health insur., we (2 of us) could make it on 1mil portfolio ... It would make us tighten up a bit, but do-able.

chinaco

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Feb 14, 2007

- Messages

- 5,072

Is there anyone who couldn't as of today make it on a 1 million portfolio and Medicare or some type of life time guaranteed health insurance plan.No debt and no mortgage. Assuming age 58 (65 if considering M'care), what would be your asset allocation for the 1 m .

Yes we could get by @ 58 on 1mm @ 4% ($40k). The allocation would be 60/30/10 (S/B/C). When I say get by, we could live a good lifestyle on that amount. The 40% in Int bonds and cash would cover 10 years of Stock market slump (in a bad scenario).

But, we have plans for a higher income level (won't elaborate) So, our target Portfolio amount is higher.

Alex

Full time employment: Posting here.

- Joined

- May 29, 2006

- Messages

- 696

Yeah, I could make it with $1million. But I wouldn't want to. I don't hate my work so much that I am willing to make that drastic a cut in lifestyle. I am not retiring from a mega-corp job where I sit in a cubicle all day filling out "TSP reports"(lol), I actually enjoy my work... well... parts of it... usually....sometimes....not really.

At any rate, I think I can withstand a few more years of work for the opportunity to build a larger nest egg and a larger income.

At any rate, I think I can withstand a few more years of work for the opportunity to build a larger nest egg and a larger income.

Coach

Thinks s/he gets paid by the post

I'd be living well with $1M and health insurance. Single, no kids, a modest lifestyle. I'd be about 60/30/10 stocks, income producing and cash.

Coach

Coach

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Yeah, I could make it with $1million. But I wouldn't want to. I don't hate my work so much that I am willing to make that drastic a cut in lifestyle. I am not retiring from a mega-corp job where I sit in a cubicle all day filling out "TSP reports"(lol), I actually enjoy my work... well... parts of it... usually....sometimes....not really.

I dunno. Since it is summer and I am trapped in an over-airconditioned office for too many hours a day, lately my mind has been drifting to other summers in my life. In particular, there was a summer I stayed behind at the town where I went to college in Ohio instead of going back to NYC with my family. I didn't exactly have a lot of money, and work was menial stuff minding the office at the gym or doing one-off catering slob work (lots of weddings where people in rural Ohio getting married - never thought I'd see a bride in a miniskirt). But I didn't actually work that many hours and the work generally wasn't taxing. And I had an apartment with modest rent, a beater pick-up truck to run around in (when it ran - bungy cord holding the hood shut was just the start), and several friends who stuck around that summer.

What I had at the time that I don't have now is leisure time and a fair amount of freedom. And the time was memorable, since I can still quite clearly recall many of the events of that summer, while now the dreary work days all just seem to drift by in a blur. I bet I could recreate the freedom bit a lot better with the million bucks and health insurance, especially if I were single and willing to relocate to small-town Ohio. The prospect becomes increasingly attractive (except the single part) as I get older and more burnt out.

unclemick

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

1993. 350k. NO health insurance. Age 49. Fish camp on Lake Ponchartrain.

God's Country? You betcha - cause the SO said so. Like the recent Wachovia TV ad retire or transfer. In my case layed off.

Hindsight at age 63 would I do it again? Who knows?

BTW - you get the 1 mil by being a really cheap bastard in retirement and be lucky enough to have Mr Market do it's 90's thing and no major illness. A 1995 tornado making us homeless for 6 wks and Katrina causing a sight 1000 mile move inland were good tests of adjustments sometimes reguired in ER.

God's Country is now greater Kansas City 'above the Missouri floodplain".

Maybe not Overland Park but something around Faucett near the water tower mabbe a half mil with one hand tied behind my back with my cheap hat on.

heh heh heh - little tongue in cheek bragging. Target Retirement out of the can - take 5% variable and party on. In real life now that I got old(63) - small non cola pension and early SS cover 40% and 60% aka the frivolous stuff from 5% variable.

God's Country? You betcha - cause the SO said so. Like the recent Wachovia TV ad retire or transfer. In my case layed off.

Hindsight at age 63 would I do it again? Who knows?

BTW - you get the 1 mil by being a really cheap bastard in retirement and be lucky enough to have Mr Market do it's 90's thing and no major illness. A 1995 tornado making us homeless for 6 wks and Katrina causing a sight 1000 mile move inland were good tests of adjustments sometimes reguired in ER.

God's Country is now greater Kansas City 'above the Missouri floodplain".

Maybe not Overland Park but something around Faucett near the water tower mabbe a half mil with one hand tied behind my back with my cheap hat on.

heh heh heh - little tongue in cheek bragging. Target Retirement out of the can - take 5% variable and party on. In real life now that I got old(63) - small non cola pension and early SS cover 40% and 60% aka the frivolous stuff from 5% variable.

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Lessee, 6 years living in OH (near Cleveland - oh boy!) probably counts. Spent a summer in Denver and periodically return as DW's family live there.

Other places, as far as I can remember (tried to blot out some of these memories, I assure you):

...

I asked because I live in "flyover country" and interpreted the term somewhat pejoratively. I also lived in central NJ for about three years, spending a lot of time in the Philly-NY corridor with a few side trips to the River Gap area and an Air Force base over in SE Jersey. While the River Gap and central NJ parts are gorgeous, up towards Newark and SE Jersey are not my favorite parts of the world.

2Cor521

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

I asked because I live in "flyover country" and interpreted the term somewhat pejoratively. I also lived in central NJ for about three years, spending a lot of time in the Philly-NY corridor with a few side trips to the River Gap area and an Air Force base over in SE Jersey. While the River Gap and central NJ parts are gorgeous, up towards Newark and SE Jersey are not my favorite parts of the world.

2Cor521

I will be the first to admit that there are wide swaths of NJ that aren't pretty. DW and I refer to a lengthy stretch of the NJ Turnpike as "Mordor" ("the very air you breathe is a poison...").

But it doesn't make me any more eager to return to Dallas ("hey, let's put the stockyard in the middle of downtown!"), or Indianapolis.

unclemick

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Old Bridge, NJ on company business in the 1970's, early 80's.

Probably changed a lot since then.

heh heh heh

Probably changed a lot since then.

heh heh heh

kumquat

Thinks s/he gets paid by the post

I live in "can't be bothered to fly near it country". Yes, here we could live modestly in ER on 1M. If you asked me 5 years ago, my goal would have been 1.4M. Just ER'd on quite a bit more due to luck with employee option plan and still worry that the sky may fall.

nun

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2006

- Messages

- 4,872

Hopefully there would be some Social Security coming also. To answer your question directly many could make it. However some with higher expectations would feel deprived. It also makes a difference as to what part of the country you reside in.

The optimal stock-bond allocation is debated ad-nauseum, however here is one example:

So if you have a 20-25 year life expectancy at retirement then the optimal allocation (at retirement) is 65-75% stocks

What causes the small inflection point in the graph at 40 years?

bosco

Full time employment: Posting here.

- Joined

- Jul 10, 2005

- Messages

- 987

What causes the small inflection point in the graph at 40 years?

Alan Greenspan made a speech some time ago and burped....

unclemick

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The go -go 60's stocks plus the 73-74 pratfall. I think you can still tease the numbers out of FireCalc if you play with it.

heh heh heh

heh heh heh

Similar threads

- Replies

- 144

- Views

- 8K