Sojourner

Thinks s/he gets paid by the post

- Joined

- Jan 8, 2012

- Messages

- 2,595

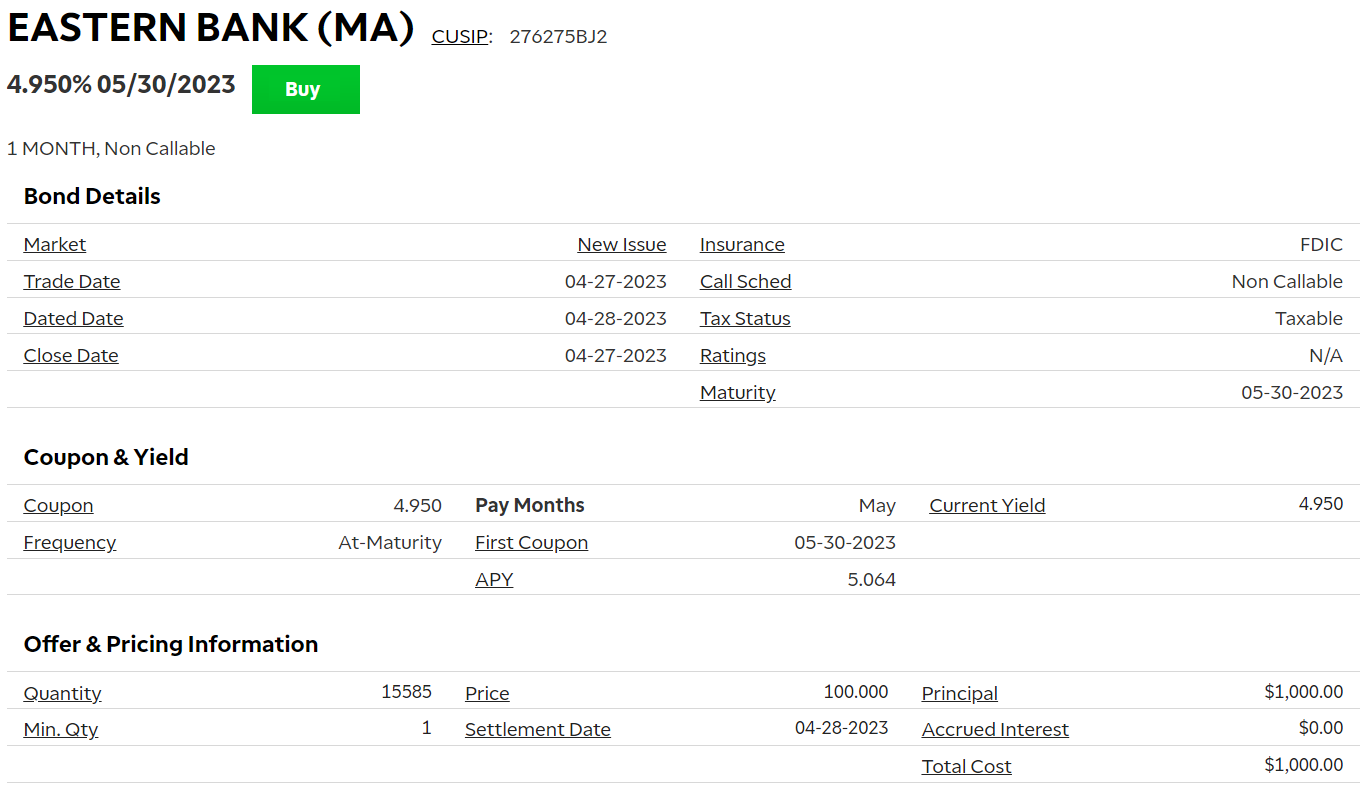

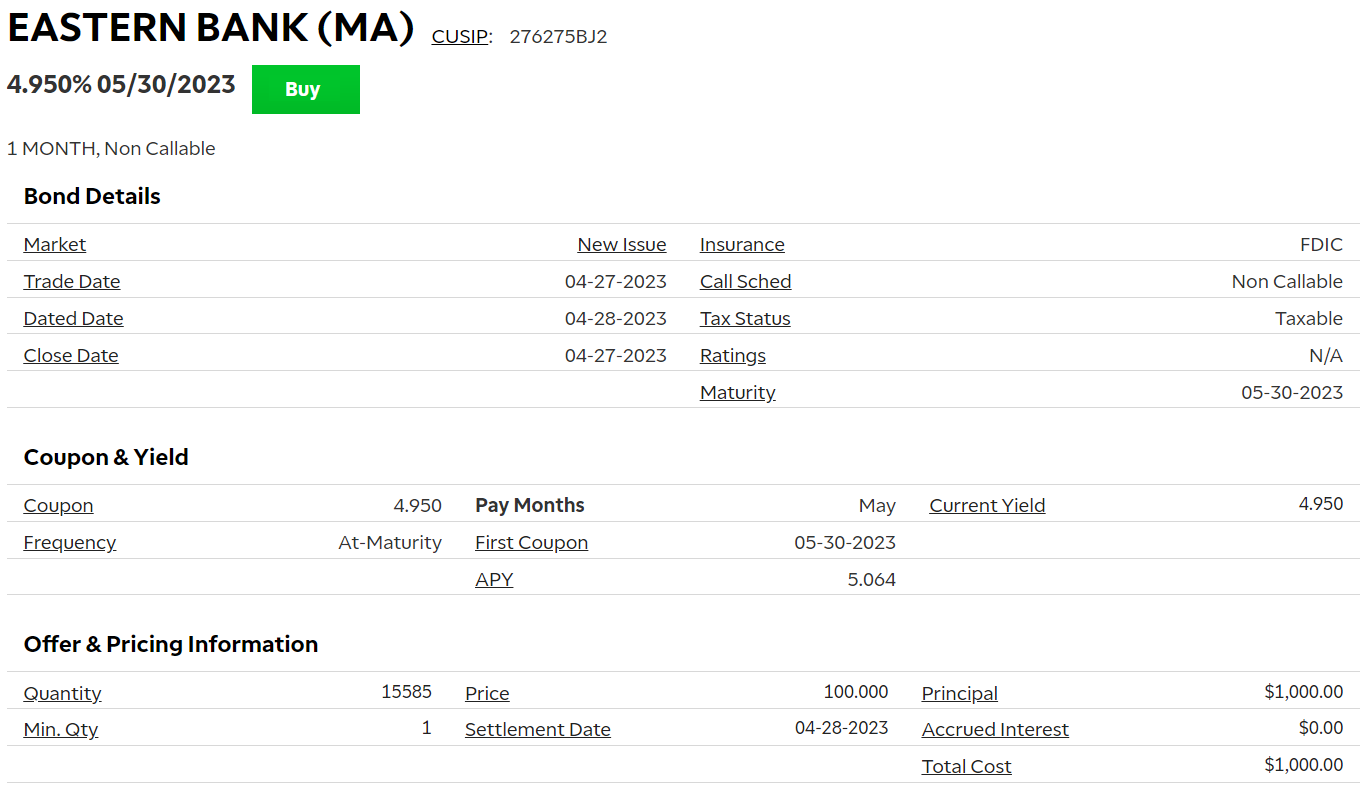

I'm thinking of putting $30k or so of idle cash in my elderly DF's brokerage account into this CD. I would go longer (say, 3-6 months) but don't want to in this particular case. Here are the details.

Is this a good/reasonable choice for a one-month allocation of funds? Any concerns with this particular CD or bank? This will be my first brokered CD purchase and I just want to be sure it's a reasonable choice. Thanks!

Is this a good/reasonable choice for a one-month allocation of funds? Any concerns with this particular CD or bank? This will be my first brokered CD purchase and I just want to be sure it's a reasonable choice. Thanks!