|

|

05-17-2019, 05:30 AM

05-17-2019, 05:30 AM

|

#21

|

|

Recycles dryer sheets

Join Date: Feb 2018

Posts: 98

|

Quote: Quote:

Originally Posted by JimBob

Been reading the forum for some time, but first post. Excellent forum. I've been struck since I started reading the forum at how many here seem to have exorbitant faith in the market, and allocate accordingly. I wonder if a lot of this is not the conditioning of a 10 year bull market, and if this faith is not misplaced. Would the conversation be different if it was 1954 and the market had still, after 25 years, not recovered its 1929 high?

We are all conditioned by our experiences. My father grew up during the depression, was a WWII vet, and was very conservative with money. Even in old age one of his favorite desserts was left over rice with milk and sugar, because he had grown to love it as a boy when it was the only sweets the family could afford.

I understand the FIRE calculator and that over the last 100 years the market has gone up exponentially. But most of us don't start investing the day we are born, or live 100 years. When we think about retirement we think about 60 year timeframes generally (30 or so working and accumulating, and 30 retired). As the below article shows, in history there have been many periods where the market has been flat for a decade or more

https://realinvestmentadvice.com/str...ends-the-game/

After the longest bull market in history, historical gains, and a world economy and market almost completely dependent on Central Bank largesse, I'm wondering if there is not too much optimism on the forum? |

I agree with your post, although I suspect many here won't.

I'm only 10% in the market, and thats mostly good dividend payers (T, BP, XOM, BMY ect..)

I see the markets at near record high, and I see more downside than upside right now. My window of time to be in the market is closing, so I don't want to go through a 30% and lose a decade in the market.

We are very conservative with our money, mostly in CD's and treasuries, but that will throw off plenty of interest to pay most of our living expenses , and when I start with SS at 62 (another subject the forum has many opinions) that, a small pension and DW SS, we will have more fixed income than we can spend. No reason for me to be heavy in the market anymore.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

05-17-2019, 05:47 AM

05-17-2019, 05:47 AM

|

#22

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2016

Posts: 9,523

|

Not overconfidence for me in the markets but what I am overconfidence in is time that I have in the markets crash. For me I'm setup to most likely will never having to cash in my investments so my confidence is in my recovery time. I have not much confidence in the markets staying on this path but confidence is the long haul and weathering any storm.

|

|

|

05-17-2019, 06:39 AM

05-17-2019, 06:39 AM

|

#23

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2009

Posts: 2,985

|

Quote: Quote:

Originally Posted by jjflyman

I agree with your post, although I suspect many here won't.

I'm only 10% in the market, and thats mostly good dividend payers (T, BP, XOM, BMY ect..)

I see the markets at near record high, and I see more downside than upside right now. My window of time to be in the market is closing, so I don't want to go through a 30% and lose a decade in the market.

We are very conservative with our money, mostly in CD's and treasuries, but that will throw off plenty of interest to pay most of our living expenses , and when I start with SS at 62 (another subject the forum has many opinions) that, a small pension and DW SS, we will have more fixed income than we can spend. No reason for me to be heavy in the market anymore.

|

While not as light in equities I too agree with the post. I see no need to go over my current allocation of 40% equities. Actually I measure it as a fixed number of shares. The percentage means little to me. If it grows, fine. If it doesn't I still have enough. My first equity investments were in 1973 and over time I've endured some rather long dry spells. Meanwhile I find my current cash flow of interest/dividends, ss and small pension about as stress free as I can get.

__________________

Took SS at 62 and hope I live long enough to regret the decision.

|

|

|

05-17-2019, 06:46 AM

05-17-2019, 06:46 AM

|

#24

|

|

Thinks s/he gets paid by the post

Join Date: Jan 2007

Location: Minneapolis

Posts: 1,172

|

I think the majority of posts on this thread proves the OP's point.

|

|

|

05-17-2019, 06:59 AM

05-17-2019, 06:59 AM

|

#25

|

|

Moderator

Join Date: Oct 2010

Posts: 10,725

|

Quote: Quote:

Originally Posted by Cut-Throat

I think the majority of posts on this thread proves the OP's point.

|

Did anyone fact check the market taking 25 years to recover from 1929? Posts like this sometimes use "facts" from clickbait articles that turn out to be less than complete. The "correct" measure would be reinvested dividends and inflation adjusted.

If by overconfident one means I don't think the next downturn will span 25 years, then I am overconfident. I wouldn't be surprised if it took 10 years, though.

|

|

|

05-17-2019, 07:32 AM

05-17-2019, 07:32 AM

|

#26

|

|

Thinks s/he gets paid by the post

Join Date: Aug 2005

Location: Crownsville

Posts: 3,746

|

My understanding is that the Dow Jones hit a new record sometime in 1929. And, it didn't break that record again until sometime in 1954. That's the only metric they're going for a "market recovery". But, it glosses over the fact that it's still possible to make money, even before the Dow Jones breaks a new record.

For instance, in my own case, my portfolio started losing money at some point in 2000. I think it was late 2000, though. In 2001 I actually hit a new peak, around Memorial Day, but then it started to drop again. I was already negative for the year when the 9/11 tragedy struck, although oddly, by the end of the the year, I was still above, say, 9/10 levels. It was still a down year overall, though. Same for 2002. But then 2003 was a turnaround, and 2004/5/6/7 it kept going up. I'd say I was "fully recovered" (that is, made back my losses from returns, not simply adding more money to make the overall balance higher), sometime in 2004, early 2005 at the latest.

I hit a new peak in October 2007. Bottomed out in November 2008. By November 2009, I was at a new peak, although not "fully recovered", as additional investing helped push that total up. But, by early 2010 I'd say I was fully recovered, in the sense of gaining back my losses, as well.

But, it wasn't until around March or April of 2013 when the SP500 got back to its October 2007 peak, around the 1560 range. going back to the previous recession, it looks like the SP500 peaked around 1500 in July of 2000. It didn't get back to that level until roughly May of 2007.

|

|

|

05-17-2019, 07:42 AM

05-17-2019, 07:42 AM

|

#27

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2007

Location: Upstate

Posts: 2,951

|

Quote: Quote:

Originally Posted by jjflyman

I agree with your post, although I suspect many here won't.

I'm only 10% in the market, and thats mostly good dividend payers (T, BP, XOM, BMY ect..)

|

It is ironic that your "safe" stocks might be anything but. Full disclosure: I own T directly and BP/XOM via XLE. Let's just discuss your very first example: AT&T. While T looks inexpensive on a PE ratio, it's revenues are under pressure on a number of fronts. The landline business is dead, wireless now has low growth and is under pricing pressure due to competition. The Direct TV sat business is going down the drain. They have close to $200B in debt that they have to service on an operating income of about $33B, so that is 6X. They have a negative book of about $16/share due to assets they've had to write down/depreciate.

I'm not saying that AT&T is going out of business, nor am I saying it is a bad investment. What I am saying is that just because something pays a good dividend doesn't mean it doesn't have LARGE risk. The fact at T's yield is 6.45% TELLS YOU that there is risk here.

|

|

|

05-17-2019, 07:55 AM

05-17-2019, 07:55 AM

|

#28

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2013

Location: Limerick

Posts: 5,655

|

I think analyzing one index (the Dow) from one point in 1929 to another point in 1954 is misleading. That would only be valid if you never invested any more funds and took out all dividends. Many people here take advantage of market lows by investing more money and reinvesting dividends. Some do it by adding new money and others by rebalancing. During the 2000-2001 and 2008 markets I increased my equity investments to take advantage of the fire sale. You also need to use larger indexes to measure the true temperature of the market.

|

|

|

05-17-2019, 08:00 AM

05-17-2019, 08:00 AM

|

#29

|

|

Moderator

Join Date: Oct 2010

Posts: 10,725

|

Quote: Quote:

Originally Posted by Dash man

I think analyzing one index (the Dow) from one point in 1929 to another point in 1954 is misleading. That would only be valid if you never invested any more funds and took out all dividends. Many people here take advantage of market lows by investing more money and reinvesting dividends. Some do it by adding new money and others by rebalancing. During the 2000-2001 and 2008 markets I increased my equity investments to take advantage of the fire sale. You also need to use larger indexes to measure the true temperature of the market.

|

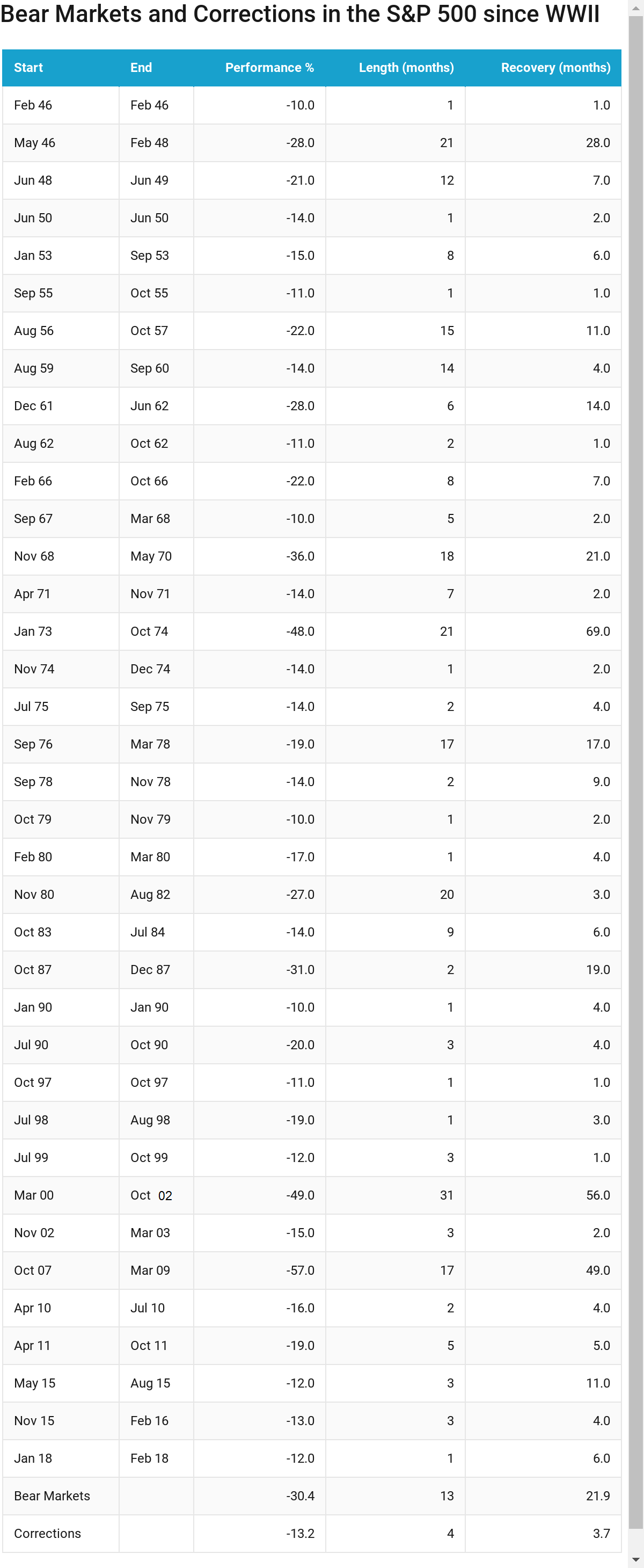

Exactly my point. Here's an image that indicates 7.5 years is more appropriate for worst expectations.

|

|

|

05-17-2019, 08:06 AM

05-17-2019, 08:06 AM

|

#30

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2016

Posts: 9,523

|

Quote: Quote:

Originally Posted by Dash man

I think analyzing one index (the Dow) from one point in 1929 to another point in 1954 is misleading. That would only be valid if you never invested any more funds and took out all dividends. Many people here take advantage of market lows by investing more money and reinvesting dividends. Some do it by adding new money and others by rebalancing. During the 2000-2001 and 2008 markets I increased my equity investments to take advantage of the fire sale. You also need to use larger indexes to measure the true temperature of the market.

|

I totally agree with your thinking. Need to compare apple to apple.

sengsational >> Thanks for the facts, excellent illustration chart.

|

|

|

05-17-2019, 08:13 AM

05-17-2019, 08:13 AM

|

#31

|

|

Full time employment: Posting here.

Join Date: Jan 2010

Posts: 540

|

I try and take what I believe to be a conservative point of view and assume that at any time my equity investments could take a 50% hit and not recover for 25 years. I doubt that this will happen, but obviously it could. If it only takes 10 years to recover then I am happy. But if it takes 25 years, I would be OK with that too. I would therefore say I am not overconfident.

|

|

|

05-17-2019, 08:16 AM

05-17-2019, 08:16 AM

|

#32

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

@jimbob, something to remember is this: If the guy writing those predictions actually knew anything useful he would have used it to make himself rich and to buy himself a nice private island. He would not be out hustling for clicks and peddling an investment advice letter.

That is not to say that his guess this time might be right but with all the hustlers out there, someone will always have guessed right. All the guesses are just that. Guesses.

|

|

|

05-17-2019, 08:20 AM

05-17-2019, 08:20 AM

|

#33

|

|

Recycles dryer sheets

Join Date: Jan 2018

Posts: 229

|

You've all been successfully trolled. Just joined the forum, first post is a link to a dumb article on a nonsense subject, and JimBob is nowhere to be found. I'm guessing JimBob is Lance Roberts, aka the author of the linked article.

Nicely done sir.

|

|

|

05-17-2019, 08:20 AM

05-17-2019, 08:20 AM

|

#34

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2018

Location: Tampa

Posts: 11,298

|

Quote: Quote:

Originally Posted by OldShooter

@jimbob, something to remember is this: If the guy writing those predictions actually knew anything useful he would have used it to make himself rich and to buy himself a nice private island. He would not be out hustling for clicks and peddling an investment advice letter.

That is not to say that his guess this time might be right but with all the hustlers out there, someone will always have guessed right. All the guesses are just that. Guesses.

|

Big +1.

__________________

TGIM

|

|

|

05-17-2019, 08:28 AM

05-17-2019, 08:28 AM

|

#35

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2013

Location: Les Bois

Posts: 5,761

|

Quote: Quote:

Originally Posted by DFDubb

You've all been successfully trolled. Just joined the forum, first post is a link to a dumb article on a nonsense subject, and JimBob is nowhere to be found. I'm guessing JimBob is Lance Roberts, aka the author of the linked article.

Nicely done sir.

|

What the.......

__________________

You can't be a retirement plan actuary without a retirement plan, otherwise you lose all credibility...

|

|

|

05-17-2019, 08:36 AM

05-17-2019, 08:36 AM

|

#36

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2015

Posts: 1,166

|

Quote: Quote:

Originally Posted by DFDubb

You've all been successfully trolled. Just joined the forum, first post is a link to a dumb article on a nonsense subject, and JimBob is nowhere to be found. I'm guessing JimBob is Lance Roberts, aka the author of the linked article.

Nicely done sir.

|

I share OP's overall concern and observations that there may, indeed, be some / a lot of over-confidence in stocks. Not unexpected after a long bull market and rapidly rising portfolio values.

Not sure why anyone would think this was a "dumb article on a nonsense subject" (or trolling) when discussing what actual recovery times from peak would be. That's risk we all need to be aware of, and in general it appears the expectations are that we can recover from a nasty bear in 2-3 years. As the chart in the article linked by OP shows, that's not the case..seeing, in reality, that it can be multiple DECADES (not "2-3 years") to get back to "even" is a very pertinent point and one that it does not appear is often realized..

SOME with high equity positions can wait 20+ years to get back to "even". As a recent ER'er, I'm not one of those people. Heck, for all I know, we may not even HAVE 20 years left. And that's a key point in the article for those who have taken the time to read it..TIME is a very real factor when you are in retirement. (Imagine how you'd really feel if your portfolio value is underwater from peak for 20+ years..I for one would feel absolutely awful and miserable - and would want to swear off stocks forever as soon as I got back to "even"..I suspect that would not be an uncommon reaction..)

For those in their 20s, 30s or even 40s - high equities are probably fine. But for many of us in our 50s and later..YMMV, but high equities IMHO could be playing with fire, and I do agree with both the article and OP's initial observation..

PS & ETA: I thought it was a very good and insightful article. Does a nice job of clearly conveying the real risk of equities and is also a good counter-balance to the "stocks have returned, on average, 8-10% (or whatever it is) annually since 1920" that we constantly hear. Not saying it's not a sales pitch by the author (say, for annuities), but whatever the reason he wrote it - it has some very compelling data and points and is well worth the read, IMHO.

|

|

|

05-17-2019, 08:36 AM

05-17-2019, 08:36 AM

|

#37

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2008

Location: On a hill in the Pine Barrens

Posts: 9,720

|

Quote: Quote:

Originally Posted by DFDubb

You've all been successfully trolled. Just joined the forum, first post is a link to a dumb article on a nonsense subject, and JimBob is nowhere to be found. I'm guessing JimBob is Lance Roberts, aka the author of the linked article.

Nicely done sir.

|

It happens. The length of the post threw me off. JimBob seemed like such a whimsical name, that he had to be legit.

|

|

|

05-17-2019, 09:03 AM

05-17-2019, 09:03 AM

|

#38

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2008

Location: On a hill in the Pine Barrens

Posts: 9,720

|

Quote: Quote:

Originally Posted by copyright1997reloaded

It is ironic that your "safe" stocks might be anything but. Full disclosure: I own T directly and BP/XOM via XLE. Let's just discuss your very first example: AT&T. While T looks inexpensive on a PE ratio, it's revenues are under pressure on a number of fronts. The landline business is dead, wireless now has low growth and is under pricing pressure due to competition. The Direct TV sat business is going down the drain. They have close to $200B in debt that they have to service on an operating income of about $33B, so that is 6X. They have a negative book of about $16/share due to assets they've had to write down/depreciate.

I'm not saying that AT&T is going out of business, nor am I saying it is a bad investment. What I am saying is that just because something pays a good dividend doesn't mean it doesn't have LARGE risk. The fact at T's yield is 6.45% TELLS YOU that there is risk here.

|

I noticed that he is 10% invested in stock market. He may have meant to say that his dividend payers are safer.

We inherited VZ, T, and CMCSA. For various reasons I consider them safer than, say, FTR, OMI and GE. Telcomm are slow growers too, and have headwinds, so they do have challenges, as you say, but that is true of all companies. Every investment has risk, as I know too well.

|

|

|

05-17-2019, 09:18 AM

05-17-2019, 09:18 AM

|

#39

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Apr 2012

Posts: 6,180

|

I read the article the OP posted. I also read the article that it linked to about investing for retirement conservatively ( https://realinvestmentadvice.com/the...inancial-plan/). Perhaps I get a different view of what they are saying that waht others see.

I believe they are emphasizing "do not let anticipations of market growth get in the way of the basics of saving more and spending less for retirement". In other words, if you are depending solely on stock market growth to build your retirement savings, you may be in trouble.

I can see this point. For us saving was more of a factor than market growth. Being able to save at a high rate meant that, during bear markets (I have been investing since 1984 so have seen a lot), not only did we not need to touch our investments, but we were still able to save and put some of those savings into the market.

I also see their point in "planning for the worst". I would not feel comfortable having 100% of our financial assets in the market, even with a pretty good pension. I have 40-45% because it is a level I am comfortable with that a bear market would not impact our retirement life. In addition, a large cash amount that does not force us to sell equities during down times. We will not make market returns, but we do not need to at this point.

To me, they are more concerned with those who think putting money in the market is like putting it in a bank account where one does to add to it, or rebalance, it just grows steadily. I really do not believe they are trying to scare folks off of the market, or forecast "gloom and doom", but are trying to strike a balance and remind folks of potential long term risks *and* potential ways to mitigate that risk.

__________________

FIREd date: June 26, 2018 - "This Happy Feeling, Going Round and Round!" (GQ)

|

|

|

05-17-2019, 09:20 AM

05-17-2019, 09:20 AM

|

#40

|

|

Thinks s/he gets paid by the post

Join Date: Aug 2006

Posts: 1,558

|

Quote: Quote:

Originally Posted by copyright1997reloaded

It is ironic that your "safe" stocks might be anything but. Full disclosure: I own T directly and BP/XOM via XLE. Let's just discuss your very first example: AT&T. While T looks inexpensive on a PE ratio, it's revenues are under pressure on a number of fronts. The landline business is dead, wireless now has low growth and is under pricing pressure due to competition. The Direct TV sat business is going down the drain. They have close to $200B in debt that they have to service on an operating income of about $33B, so that is 6X. They have a negative book of about $16/share due to assets they've had to write down/depreciate.

I'm not saying that AT&T is going out of business, nor am I saying it is a bad investment. What I am saying is that just because something pays a good dividend doesn't mean it doesn't have LARGE risk. The fact at T's yield is 6.45% TELLS YOU that there is risk here.

|

Yeah, people think of AT&T as a “safe” stock, but there is huge risk inherent in their business. Fundamentally, they borrow huge money to build a network and earn that money back over time. The risk in that is if there is a technology jump that quickly makes their network obsolete and they are unable to service the debt they took to build that network. The chance of this is probably impossible to estimate with any accuracy, IMO.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|