audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

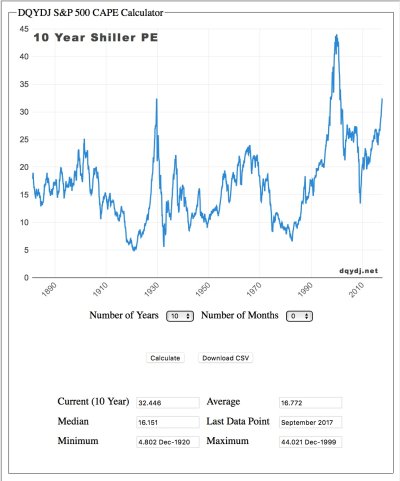

Current CAPE10 according to Shiller PE Ratio is 30.62 - an extreme level by historical standards.

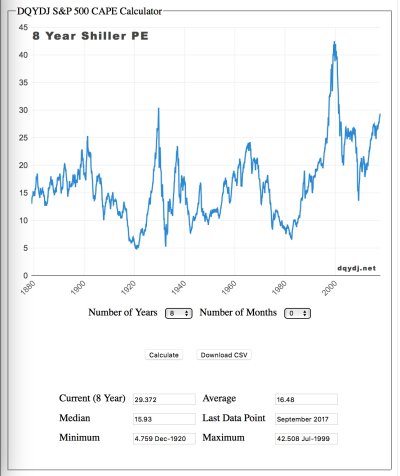

There have been a few discussions about the CAPE metric and whether removing the 2008-2009 years will help. This will happen naturally in a couple of years - but how much will it really help? One way to do this is to do an average over 8 years rather than 10 which removes the uber low earning years of 2008 and 2009. I have attached a comparison below of the curves for CAPE10 and CAPE8 from https://dqydj.com/shiller-pe-cape-ratio-calculator/ *

It has the general result of shifting the curve and the median down slightly. But it does not miraculously “fix” the ramp up into nosebleed territory since late 2016, and it still indicates that numbers above 26 are very rich indeed.

Another issue that is brought up is how accounting rules (GAAP) have changed, particularly This argument is mainly to point out that the long-term average is probably no longer relevant. I have read a few articles that indicate you would need to subtract a few points - say 2 or 3 - post 2001, to accommodate this change. With current values so high, subtracting 3 points means you are still really high.

Kitces wrote an article a back in 2012 reviewing some of the various arguments about CAPE10 and changes in accounting over the decades and concluded that:

Personally, I don’t try to determine what the “long term average” of CAPE10 should be, and use that as the gage. I don’t completely believe in the revert to mean philosophy for periods long ago. I tend to look at the last three decades of the curve and compare relative values. Eyeballing it I have picked >=25 as the "overvalued" level and <=18 as the "OK to invest more aggressively", making 21.5 the center of that band. CAPE10 has been above 21 during most of the past three decades.

* there is a 2 point discrepancy between what dqydj.com lists as current CAPE10 and what the multipl.com site gives. Can't answer that one.

There have been a few discussions about the CAPE metric and whether removing the 2008-2009 years will help. This will happen naturally in a couple of years - but how much will it really help? One way to do this is to do an average over 8 years rather than 10 which removes the uber low earning years of 2008 and 2009. I have attached a comparison below of the curves for CAPE10 and CAPE8 from https://dqydj.com/shiller-pe-cape-ratio-calculator/ *

It has the general result of shifting the curve and the median down slightly. But it does not miraculously “fix” the ramp up into nosebleed territory since late 2016, and it still indicates that numbers above 26 are very rich indeed.

Another issue that is brought up is how accounting rules (GAAP) have changed, particularly This argument is mainly to point out that the long-term average is probably no longer relevant. I have read a few articles that indicate you would need to subtract a few points - say 2 or 3 - post 2001, to accommodate this change. With current values so high, subtracting 3 points means you are still really high.

Kitces wrote an article a back in 2012 reviewing some of the various arguments about CAPE10 and changes in accounting over the decades and concluded that:

https://www.kitces.com/blog/adjusting-portfolios-based-on-valuation-are-we-expecting-too-much/To which all I can reply is… who cares!? Even with the author’s own adjustments, the CAPE is screaming that the market is overvalued. Perhaps after*the market falls 35%, where the author’s CAPE suggests the market is “fair value” and Shiller’s P/E10-based CAPE suggests the market is still 7.6% overvalued, we can debate whether the market really has to fall another 7% (after the first 35%), or if it’s done. Either way, both methodologies “predict” at least a nearly 35% overvaluation, implying severely substandard returns in the coming years! ........... Are we really going to debate the last 7% of a 42% market decline? Are we completing missing a raging forest fire by focusing on the health of the individual trees?

Personally, I don’t try to determine what the “long term average” of CAPE10 should be, and use that as the gage. I don’t completely believe in the revert to mean philosophy for periods long ago. I tend to look at the last three decades of the curve and compare relative values. Eyeballing it I have picked >=25 as the "overvalued" level and <=18 as the "OK to invest more aggressively", making 21.5 the center of that band. CAPE10 has been above 21 during most of the past three decades.

* there is a 2 point discrepancy between what dqydj.com lists as current CAPE10 and what the multipl.com site gives. Can't answer that one.