ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

So under that logic, all of us with a paid off house should immediately borrow to max LTV against our house, then invest the money (assuming <3% loan)?

Because that's the same logic, and yes by the math it makes sense. But it most definitely is not just a math question.

No, it is still a personal decision.

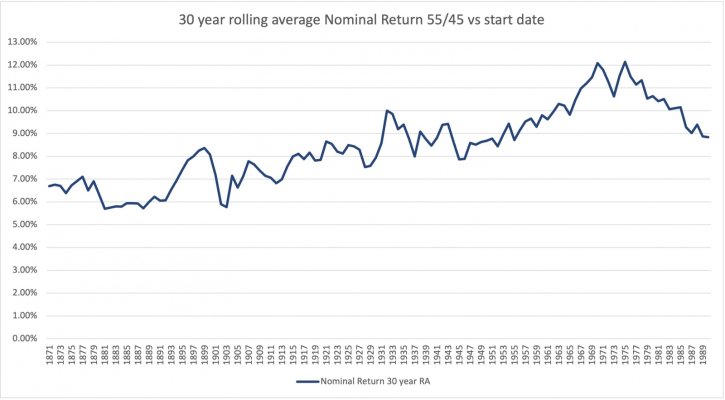

But one should recognize that maximizing a <3% fixed 30 year loan (w/o incurring PMI or other expenses), and investing that long term, has a very, very likely chance of being a good financial move, and very likely to be very good. And only a small chance of it being neutral (based on history). It's never been <[-] 3%[/-] 7.75% (see below edit/add) for any 30 year period.

But, it's not just simple math - it involves probability and statistics, and an uncertain future. But that's true of all investing. The arbitrage looks very attractive, but that doesn't mean that someone can't look at those numbers and say - "No Thanks".

But one should not deny the numbers.

edit/add:

For some perspective, here's some info I had from a post I made a while back:

Maybe someone can come up with more recent/better sources, but these show 20 and 30 year rolling average total returns for the stock market:

https://awealthofcommonsense.com/2016/05/deconstructing-30-year-stock-market-returns/

https://www.crestmontresearch.com/docs/Stock-20-Yr-Returns.pdf

From what I can see, only three 20 year periods dropped below 5%, and only one barely below 4% (out of 78).

Thirty year returns were all above 7.75%

And the average returns of course, are way higher. Historically, investments have beat a 3.5% mortgage over all 20 year cycles, and even the very worst had double the return over 30 year cycles. It's no guarantee, the future could be worse than the worst of the past, but if you don't take the bets that a clearly in your favor, you are unlikely to get ahead.

-ERD50

Last edited: