We've had a number of posts on startups like Lending Club and Prosper, for example the back half of this thread: http://www.early-retirement.org/forums/f27/ten-year-early-retirement-update-63174.html#post1236240

I'm also seeing a lot of P2P discussions in the personal-finance blogs that I track, so I've spent some time reading about the various screens and filters and techniques and limits. Eventually I ran across the Lend Academy blog (Getting Started With Lend Academy ) with more advice on the mechanics.

Yeah, I know. If you're so smart about P2P lending then why are you blogging about it instead of pricing your second yacht (and your third supermodel) for the Cannes Film Festival? But he's sharing free advice, and maybe blogging about it helps him improve his own techniques.

I've already decided that picking individual stocks is a waste of my time. Stock-picking diversification means that I'd need to scale it up to a minimum of 30 (if not 50), and then the tracking time mounts to the point where you've traded employment for self-imposed slavery. It's far easier to buy index funds for only 70% of the return with about 2% of the labor.

Another concern is scale. I'm not going to waste my time achieving 15% APY if I'm only investing $20K. Sure, that's $3000/year, but I make more from that in a year by investing $100K in a dividend stock index fund and going surfing. I've also made more than $3000 by selling a couple of call options, which required just enough labor to make me wonder whether it was worth my time. Luckily I was curious enough to muster the self-discipline to finish the education required for the options experiment, and now the additional incremental returns only require 10-15 minutes of labor with zero tracking effort.

But what if I could achieve 15% APY by investing $100K-$500K? Now you have my attention, although I certainly would lack diversification in the rest of my portfolio.

While Lend Academy is probably one of the best resources on the Internet, its advice just doesn't scale:

Reading the details of 40 different loans, each for $25? How much time are we honestly going to spend on each loan, and how well are we going to remember those details? And what if there's a question to ask, or if we actually have to read the details of 150 loans before we find 40?

As that grows past $25/loan to no more than 1% of the portfolio, now we're reading the details of over 100 different loans (or maybe 375+ to find those 100). That problem's not 2.5x as challenging as 40 loans-- it's at least a squared factor, if not cubed.

If I'm going to spend that much time reading the details of individual loans then I might as well revert to picking stocks. But I've already concluded that passive index investing offers much more return per unit of effort than picking stocks, and I fear that the same is true of P2P lending.

Once again, it's hard to justify the results by the risk-- or by the level of required effort.

If you have a better resource, please post it here. And if you have a better way to scale up to the $100K-$500K level without an outsize investment in picking & tracking labor, then you probably should start your own blog!

I'm also seeing a lot of P2P discussions in the personal-finance blogs that I track, so I've spent some time reading about the various screens and filters and techniques and limits. Eventually I ran across the Lend Academy blog (Getting Started With Lend Academy ) with more advice on the mechanics.

Yeah, I know. If you're so smart about P2P lending then why are you blogging about it instead of pricing your second yacht (and your third supermodel) for the Cannes Film Festival? But he's sharing free advice, and maybe blogging about it helps him improve his own techniques.

I've already decided that picking individual stocks is a waste of my time. Stock-picking diversification means that I'd need to scale it up to a minimum of 30 (if not 50), and then the tracking time mounts to the point where you've traded employment for self-imposed slavery. It's far easier to buy index funds for only 70% of the return with about 2% of the labor.

Another concern is scale. I'm not going to waste my time achieving 15% APY if I'm only investing $20K. Sure, that's $3000/year, but I make more from that in a year by investing $100K in a dividend stock index fund and going surfing. I've also made more than $3000 by selling a couple of call options, which required just enough labor to make me wonder whether it was worth my time. Luckily I was curious enough to muster the self-discipline to finish the education required for the options experiment, and now the additional incremental returns only require 10-15 minutes of labor with zero tracking effort.

But what if I could achieve 15% APY by investing $100K-$500K? Now you have my attention, although I certainly would lack diversification in the rest of my portfolio.

While Lend Academy is probably one of the best resources on the Internet, its advice just doesn't scale:

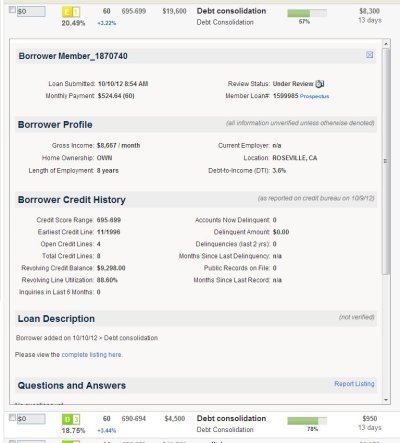

If there was only one word of advice I could give to all new p2p investors it would be this one: diversify. Don’t make the mistake I made and spread your initial investment among two loans. What you want to do is diversify your initial investment as widely as possible. Both Lending Club and Prosper allow a $25 minimum investment in each loan. Take advantage of it. If you are starting off with $1,000 then fund 40 different loans with this money. Only if you are starting with more than $2,500 do I recommend you going over the $25 minimum. Then I would still make sure that no loan is more than 1% (and preferably less) of your total p2p investing portfolio.

I think it is useful to spend some time reading the details of each loan. If nothing else this will give you a feel for the different kinds of borrowers on the platform. I tend to avoid someone who hasn’t bothered to give a good loan description (or any description) and if they have failed to answer investor questions then that is a red flag, too. You can always ask your own questions, keeping in mind of course, that people may not always tell the complete truth.

Reading the details of 40 different loans, each for $25? How much time are we honestly going to spend on each loan, and how well are we going to remember those details? And what if there's a question to ask, or if we actually have to read the details of 150 loans before we find 40?

As that grows past $25/loan to no more than 1% of the portfolio, now we're reading the details of over 100 different loans (or maybe 375+ to find those 100). That problem's not 2.5x as challenging as 40 loans-- it's at least a squared factor, if not cubed.

If I'm going to spend that much time reading the details of individual loans then I might as well revert to picking stocks. But I've already concluded that passive index investing offers much more return per unit of effort than picking stocks, and I fear that the same is true of P2P lending.

Once again, it's hard to justify the results by the risk-- or by the level of required effort.

If you have a better resource, please post it here. And if you have a better way to scale up to the $100K-$500K level without an outsize investment in picking & tracking labor, then you probably should start your own blog!