Is there any info on if defaults do occur how long they start after loan initiation? I wonder if you could churn notes on a short timeline and reduce default risk? However this is more work of course I guess you could the auto select option. And the assumption would be a strong secondary market to off load loans.

You can do all sorts of stuff. In some states, they can buy secondary notes already issued, but can't buy new notes, and people frequently dump their LC notes due to death/divorce/whatever. Some people never buy new notes but do a nice little business on salvage.

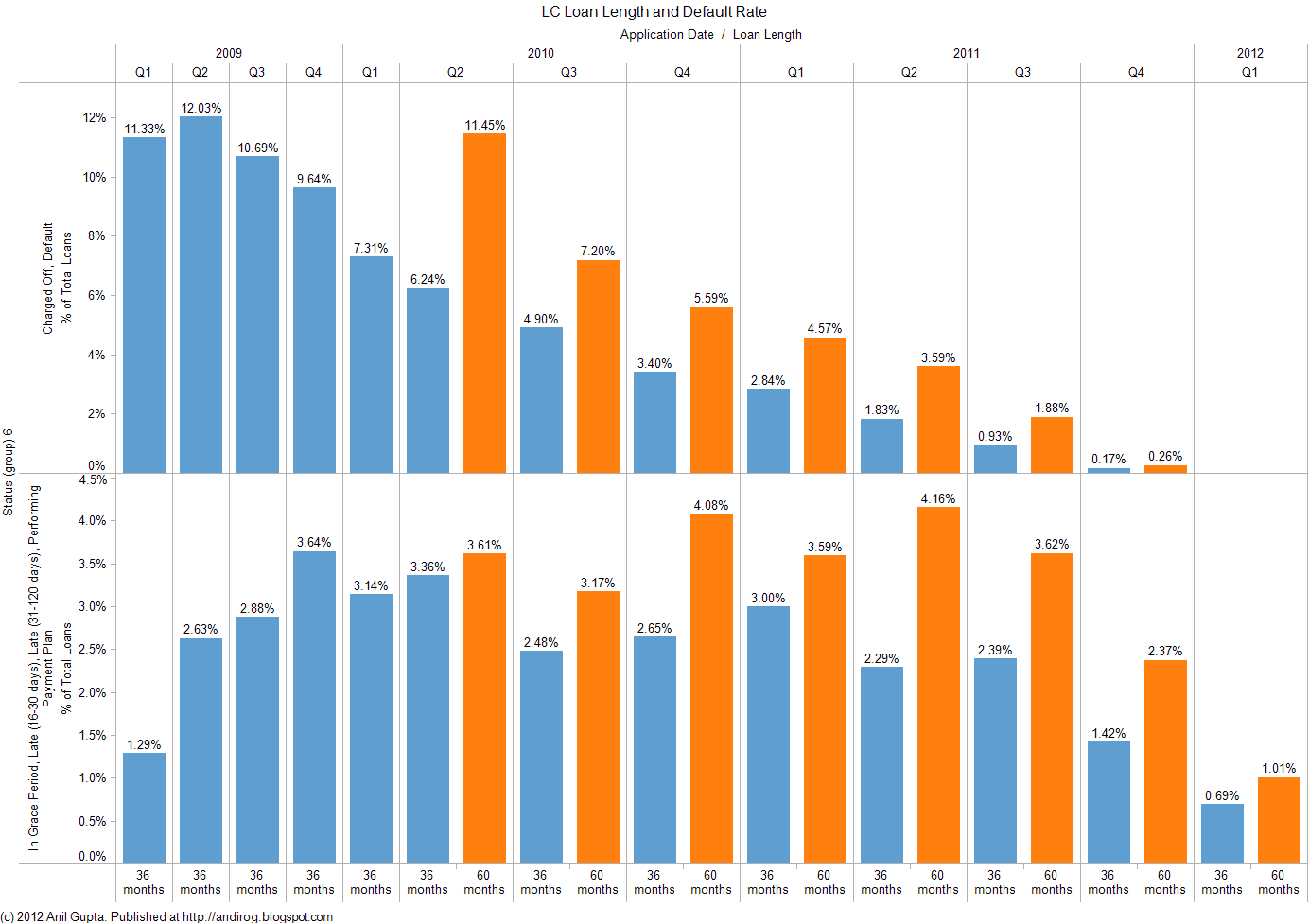

You'll see little default waves for the first 11 months or so until the loans are considered 'seasoned'. You can actually sell a good interest rate seasoned note on the secondary market for more than face value.

You'll see a little blip, in my case about 6-7 notes that went late the first month. Only one never paid, a $5k wedding loan that didn't have any questions asked before I invested, but did after and had I seen those...well...looks like someone was living in moms basement, thought they were getting married, and then their spouse to be saw their comments on LC and ran like hell. A lot of those lates just paid the money back.

Two went into chapter 7 bankruptcy within a couple of months. I'm annoyed that they can do that and not get "eh, thats fraud, so cough up the money or go to jail for a while".

Then things settled with only an occasional late, and I've run at about a 2:1 ratio of people paying all the money back to people who are late. I'm in the 7-11th month window where I'm supposed to get the bulk of my lates, and I've had a bubble of about 10 the last 2 weeks.

By my estimates, if I have 75 defaults this year, I'm just slightly better than average, and I have around 25 right now. Looks like I'll be a lot shorter than 75.

After that, its death, major illness or injury, divorce or significant long term job loss. Over the next 5 years I expect 100-125 notes to go belly up.

Looking strictly at comparing the income to default rate, I've got ~4k in interest right now, ~1K in lates, and they gave me $1000 to try it out. If I keep a ~3:1 ratio of interest to lates, I'll hit around 12%. After recalculating the LC NAR to a real return, it'll probably be around 10%.