winzoid

Confused about dryer sheets

First post here, just joined... Be nice please!

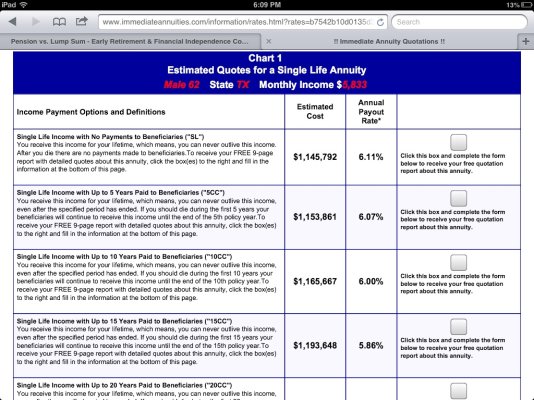

I am about to retire at age 62 and have the choice of a pension that pays about $70k/year or take a $1.2 Million lump sum.

Based on a 4% draw down rate the pension seems to be the better option.

My company is financially strong. The pension is over 100% funded. But still I hear about formerly great companies going broke and defaulting on their pensions.

I'm not worried about leaving money for the kids. They are doing fine.

Any advice? Pension or lump sum?

I am about to retire at age 62 and have the choice of a pension that pays about $70k/year or take a $1.2 Million lump sum.

Based on a 4% draw down rate the pension seems to be the better option.

My company is financially strong. The pension is over 100% funded. But still I hear about formerly great companies going broke and defaulting on their pensions.

I'm not worried about leaving money for the kids. They are doing fine.

Any advice? Pension or lump sum?