You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Poll: Future Tax Rates Will Be Higher

- Thread starter Midpack

- Start date

Income taxes will fluctuate over time, probably increasing for a period of time given our current situation... at least for middle to higher income individuals. For lower income individuals I expect them to be the same. Over the long term I think taxes will remain relatively steady and my retirement plan assumes no tax increase over the duration of my life.

You may be right, but some observations:Total federal taxes have stayed between 15% - 17.5% of US GDP since the 50's despite endless rhetoric and copious amounts of hand wrenching and bloviating. They move above 17.5% late in economic growth cycles, and fall below 15% when we fall into recession. My guess is taxes will remain in that range for the rest of my life.

-- We've experienced tremendous GDP growth during the cited period, which enabled tremendous growth in government "income" over that period. Few people see a continuation of that.

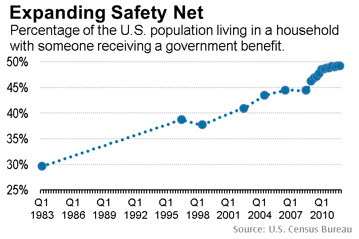

-- Demographics: End of the baby boom = relatively fewer tax payers and relatively more recipients of government services.

-- Under US Treasury department projections (here, page 5, chart 5), even if our taxes are enough to cover all non-interest spending (IMO, a pretty rosy assumption), interest on our existing debt will require even more borrowing to cover the interest. In the words of the report " The continuous rise of the debt-to-GDP ratio after 2025 indicates that current policy is unsustainable."

So, something will have to give. We haven't shown much stomach for either decreased spending or increased taxes so far.

FUEGO

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 13, 2007

- Messages

- 7,746

For my own model, I assume taxes will stay about the same. I only pay $1500-2000 per year (mostly state taxes) so even a doubling wouldn't be a big deal. No need to get overly conservative in all the different model assumptions when the overall model (FIREcalc and the 4% rule) is fairly conservative (works in 95% of historical scenarios).

From a macro level, we're running about a $500 billion annual budget deficit. Taxes would obviously have to increase to get to a balanced annual budget (unless we keep spending flat and the economy grows to a point where the tax base expands enough to increase tax receipts). Will fiscal discipline and a balanced budget ever happen? Call me a skeptic.

From a macro level, we're running about a $500 billion annual budget deficit. Taxes would obviously have to increase to get to a balanced annual budget (unless we keep spending flat and the economy grows to a point where the tax base expands enough to increase tax receipts). Will fiscal discipline and a balanced budget ever happen? Call me a skeptic.

Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

So with the way the poll is going, (taxes are going to go up) maybe it would be best to start taking IRA and 401k distributions now rather than waiting for RMD's to kick in, especially if you will be pushed into higher brackets. Of course tax deferred money could be treated differently and taxed less.............. (or more  )

)

Always been a consideration I guess!

Always been a consideration I guess!

Last edited:

The labor force is growing and projected to continue @ 0.5% per year for the next decade.-- Demographics: End of the baby boom = relatively fewer tax payers and relatively more recipients of government services.

W2R

Moderator Emeritus

So with the way the poll is going, (taxes are going to go up) maybe it would be best to start taking IRA and 401k distributions now rather than waiting for RMD's to kick in, especially if you will be pushed into higher brackets. Of course tax deferred money could be treated differently and taxed less.............. (or more)

Always been a consideration I guess!

This is the 7th year during which I have been taking regular monthly payments out of my TSP (=401K) account, to lower my account balance in anticipation of RMDs/SS.

I think your idea is worth considering.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,233

Income tax for the 15% bracket people. Confident? I didn't and won't say that. I'm hoping to get Roth conversions done so I won't get hit with a higher rate in case it happens, but I'm not expecting it enough to plan for it. Meaning, I may choose to go for the ACA subsidy over getting my IRA completely converted.What Federal-State-Local taxes are you confident won't increase over the next 30 years?

Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I started taking mine two years ago which I hope will keep me in a lower bracket by the time RMDs kick in. If they don't adjust the brackets or change the rules. AgainThis is the 7th year during which I have been taking regular monthly payments out of my TSP (=401K) account, to lower my account balance in anticipation of RMDs/SS.

I think your idea is worth considering.

Last edited:

Of course it depends on what is meant by taxes, but I'll look at US federal as a proxy for general tax policy.

By historical standards, they aren't that high.

For example in 1962 the top rate was 91% on income over 3m (2013 dollars). In 1951, it was 91% on income over 1.7m.

You have to go back to 1930 to get to top tax rate of 20%.

Between 1930 and 1980 it was normal to have federal tax rate top at 70-90%.

From 1980-1990 it went from 70% to 25% and then back up to 39% by 1993...

Has stayed around that since then.

My guess is it has to do with wealth distribution, country's growth, employment, etc.

After 1929 rich people weren't all that popular , unemployment was high and the economy sucked so taxes on high earners went way up. I think today's environment isn't quite like that but the wealth disparity is causing similar attitudes and so you could see top rates creep up to 70-90% again.

, unemployment was high and the economy sucked so taxes on high earners went way up. I think today's environment isn't quite like that but the wealth disparity is causing similar attitudes and so you could see top rates creep up to 70-90% again.

That said... who knows how it manifests . For example... removing cap on SS taxes probably effects few people on this forum whereas treating cap gains as normal income has a large impact to most people.

. For example... removing cap on SS taxes probably effects few people on this forum whereas treating cap gains as normal income has a large impact to most people.

Source: http://taxfoundation.org/article/us...-2013-nominal-and-inflation-adjusted-brackets

Sent from my HTC One_M8 using Early Retirement Forum mobile app

By historical standards, they aren't that high.

For example in 1962 the top rate was 91% on income over 3m (2013 dollars). In 1951, it was 91% on income over 1.7m.

You have to go back to 1930 to get to top tax rate of 20%.

Between 1930 and 1980 it was normal to have federal tax rate top at 70-90%.

From 1980-1990 it went from 70% to 25% and then back up to 39% by 1993...

Has stayed around that since then.

My guess is it has to do with wealth distribution, country's growth, employment, etc.

After 1929 rich people weren't all that popular

That said... who knows how it manifests

Source: http://taxfoundation.org/article/us...-2013-nominal-and-inflation-adjusted-brackets

Sent from my HTC One_M8 using Early Retirement Forum mobile app

Last edited:

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We're drifting (thread topic) a little here --- but I don't put a lot of stock in tax rates alone, especially the top tax brackets. Deductions have expanded considerably over the decades, few individuals (or corporations) pay anything like the tax rates themselves. Look at effective tax rates over time, though that's a little harder to find...Of course it depends on what is meant by taxes, but I'll look at US federal as a proxy for general tax policy.

By historical standards, they aren't that high.

For example in 1962 the top rate was 91% on income over 3m (2013 dollars). In 1951, it was 91% on income over 1.7m.

You have to go back to 1930 to get to top tax rate of 20%.

Between 1930 and 1980 it was normal to have federal tax rate top at 70-90%.

From 1980-1990 it went from 70% to 25% and then back up to 39% by 1993...

Has stayed around that since then.

My guess is it has to do with wealth distribution, country's growth, employment, etc.

After 1929 rich people weren't all that popular, unemployment was high and the economy sucked so taxes on high earners went way up. I think today's environment isn't quite like that but the wealth disparity is causing similar attitudes and so you could see top rates creep up to 70-90% again.

That said... who knows how it manifests. For example... removing cap on SS taxes probably effects few people on this forum whereas treating cap gains as normal income has a large impact to most people.

Source: U.S. Federal Individual Income Tax Rates History, 1862-2013 (Nominal and Inflation-Adjusted Brackets) | Tax Foundation

Sent from my HTC One_M8 using Early Retirement Forum mobile app

Last edited:

Danmar

Thinks s/he gets paid by the post

Tax rates are certainly increasing in Canada. My max marg combined fed and provincial rate has gone from 39% in 2014 to 48% this year. This is on incomes over about $200,000. Doesn't Seem as high in US? Tax deductions are credits are immaterial.

-- Demographics: End of the baby boom = relatively fewer tax payers and relatively more recipients of government services.

The labor force is growing and projected to continue @ 0.5% per year for the next decade.

Relatively fewer . . . Relatively more. Maybe it would have been clearer if I'd said: More retirees (and others) depending on relatively fewer workers.

(note--percentages are before the start of the ACA subsidies)

Last edited:

This makes sense to me. This is like dollar cost averaging vs trying to guess when to invest money. Trying to guess if taxes will be higher also requires us to guess which ones will rise, and when they change. What are the odds we will get this right? If most taxes are income based, it seems safer to me to spread the flow of income over time as smoothly as possible.This is the 7th year during which I have been taking regular monthly payments out of my TSP (=401K) account, to lower my account balance in anticipation of RMDs/SS.

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I believe future tax rates will effectively be higher, either by adding in more brackets or increasing the rate per bracket, or removing common deductions or increasing the dividend rate and capital gain per bracket.

I've seen it in IL and I'm sure IL is not done raising the rates and the feds will join in too.

I've seen it in IL and I'm sure IL is not done raising the rates and the feds will join in too.

Well, not necessarily. For example, paying taxes now for a trad Ira > Roth conversion in anticipation of higher income tax rates in the future may not help much if other taxing means such as Federal VAT get implemented. The promise not to tax Roth's is kept but... I apologize, that's a tangent.May be, but the net effect is the same for planning.

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I was making a broader point, all taxes/fees overall, not just Fed income taxes or the merits of Roth conversions.Well, not necessarily. For example, paying taxes now for a trad Ira > Roth conversion in anticipation of higher income tax rates in the future may not help much if other taxing means such as Federal VAT get implemented. The promise not to tax Roth's is kept but... I apologize, that's a tangent.

papadad111

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2007

- Messages

- 1,135

Agreed. Something has to give. Collectively, we like nice stuff, and that has to be paid for, sooner or later (usually later).

Yep. A hole generation of people who like nice stuff and like to not work for it ... Why work when they can get it for free...

The under-savings of an entire generation ( now retiring) will have to be provided for somehow.

With the average 401K balance of 55-65 year olds at just $120K it would surprise me if we don't see the Medicare tax go up as a starter.

We already saw the surcharge as ACA was implemented.

Where I think the debate will be is not if, but when we expect to see increases and on what

Examples: Long term cap gains could go back to 20% or higher. In the 1950s I think they were more than 35%. National sales tax. Higher marginal tax bracket. A surcharge tax on retirement accounts...many things can change.

We also will see more loopholes closed - such as file and suspend. We could see changes to means testing for SS, Medicare, and even ACA .... Many many ways to fund the guvmint ..

Gives good credence to spreading your money in pre and post tax accounts, taking some gains from time to time, doing Roth conversions etc etc etc..

Last edited:

Of course you are right. When taking into account the universal imponderables related to taxation I stand corrected. Thank youI was making a broader point, all taxes/fees overall, not just Fed income taxes or the merits of Roth conversions.

Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Yes it could get much worse. SS benefits and Medicare premimuns are already means tested as you probably know. Depending on how much earned income you have, up to 85% of your SS benefits are taxed. Have to much total income and your Medicare monthly premiums can double, triple or more.We could see changes to means testing for SS, Medicare, and even ACA .... Many many ways to fund the guvmint ..

Last edited:

Why would Federal income tax levels increase? Don't we vote for congressmen/women, and they pass the tax laws? In the political climate that has developed over the past 20 years, who is going to get elected if they admit that they would vote for higher taxes, or re-elected if they actually do vote for higher taxes? At what point will the attitude change and the US electorate start voting for representatives who are going to increase tax rates?

I see the need for higher taxes in order to pay our bills. I just don't see a path to higher taxes that is voluntary and doesn't involve some sort of crisis with the National debt.

I see the need for higher taxes in order to pay our bills. I just don't see a path to higher taxes that is voluntary and doesn't involve some sort of crisis with the National debt.

Last edited:

Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

How can you tell when a politician is lying?Why would Federal income tax levels increase? Don't we vote for congressmen/women, and they pass the tax laws? In the political climate that has developed over the past 20 years, who is going to get elected if they admit that they would vote for higher taxes, or re-elected if they actually do vote for higher taxes?

Last edited:

nash031

Thinks s/he gets paid by the post

The largest single forcing functions for increased tax rates in the history of income tax in the US are the World Wars. I don't foresee that type of expenditure being required in the future from social programs, etc., and certainly not in a step-wise manner.

Thus, I expect my effective tax rate (consistent with income... if my income spikes, obviously that might change) will remain in the neighborhood of 15% +/- 2% for the remainder of my life.

I don't see the same certainty in massive personal income tax hikes coming. I think it is likely that the government seeks ways to obtain more in corporate taxation.

Interestingly, we had fairly low federal income tax rates prior to WWII, and it seems that once we developed the military-industrial complex and the expenditures that go with it, we've just kind of "gotten used to it", much like gasoline prices relative to crude pricing. We're paying way more now considering the price of oil than we were last time it was this low. In 2002 (last time oil was $43/bbl) we paid about $1.55 per gallon of regular in CA. Today? Average is $2.78. Inflation adjusted gas should be closer to $2.00, but we're used to paying way more, so they can price it accordingly!

Thus, I expect my effective tax rate (consistent with income... if my income spikes, obviously that might change) will remain in the neighborhood of 15% +/- 2% for the remainder of my life.

I don't see the same certainty in massive personal income tax hikes coming. I think it is likely that the government seeks ways to obtain more in corporate taxation.

Interestingly, we had fairly low federal income tax rates prior to WWII, and it seems that once we developed the military-industrial complex and the expenditures that go with it, we've just kind of "gotten used to it", much like gasoline prices relative to crude pricing. We're paying way more now considering the price of oil than we were last time it was this low. In 2002 (last time oil was $43/bbl) we paid about $1.55 per gallon of regular in CA. Today? Average is $2.78. Inflation adjusted gas should be closer to $2.00, but we're used to paying way more, so they can price it accordingly!

Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

There are often threads in which an OP assumes higher taxes in the future, followed by several others posting 'future taxes are unknowable' - as if it's foolish to plan for any increase. While the specifics are indeed unknowable, assuming taxes will be higher over the next 30 years seems like almost a given to me.

Does anyone think future taxes on a given income will go lower?

Note I mean higher net taxes, not how/where the increases will come. Higher rates, lower thresholds, reduced benefits/COLAs, new fees/taxes, sales taxes, Fed/state/county/city - there are endless sources/"disguises."

Even if we know with absolute certainty that the statement "taxes will go up" is true, planning for that fact is near impossible without also knowing many other details:

Tax rates go up but my income goes down because social security benefits were cut

Taxes go up because they introduced a carbon tax that partially offset the income tax

Taxes go up because payroll taxes were lifted to fund SS & Medicare but income tax rates stay the same or decline

Taxes go up because capital gains & dividend taxes are lifted

Taxes go up because of a new a wealth tax

Taxes go up because rates have become more progressive with increases at the top and decreases at the bottom

Taxes go up because tax advantaged accounts are now taxed

Taxes go up because itemized deductions are severely reduced while rates are lowered as a partial offset

Taxes go up because of a new VAT tax

Taxes go up because all income tax brackets are lifted

-----

Nearly every item on this list has the backing of some political faction, with the possible exception of the very last one. And yet it's the last item that most folks seem to assume when planning for future tax increases.

Last edited:

Similar threads

- Replies

- 14

- Views

- 846

- Replies

- 0

- Views

- 211

- Replies

- 45

- Views

- 4K