W2R

Moderator Emeritus

The market has been booming ever since the 2008-2009 recession. Some of us have kept more or less the same WR, but that provides us with more and more spending money each year.

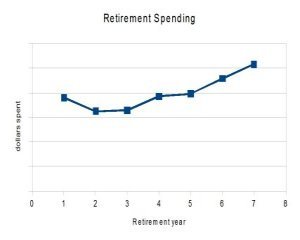

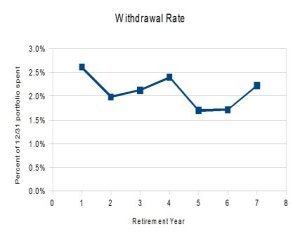

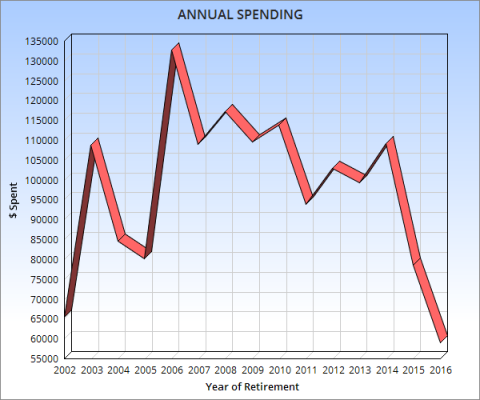

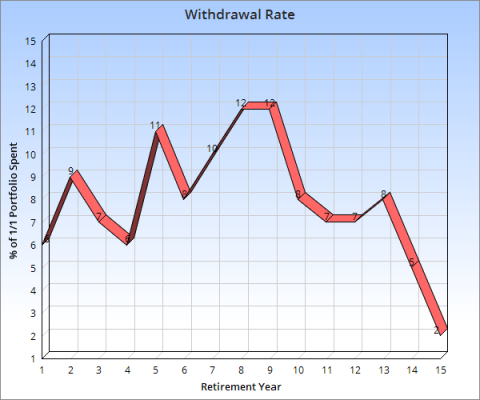

I attached graphs of my spending, and the corresponding percentages of my 12/31 portfolio, for each of my first 7 retirement years. As you can see, I'm spending more or less the same percentage, around 2%, but after the first year the dollars spent have been going up, up, up. Last year I spent 135.8% of what I spent in 2010, in dollars. Yet, the percent of my portfolio spent was down 0.39%.

Yet, the percent of my portfolio spent was down 0.39%.

This produces some uncertainty and anxiety, as I can see myself getting used to a higher standard of living. When the next recession hits, ouch.

How are you handling this situation? I'm going to attach a poll so wait a minute and it will appear.

I attached graphs of my spending, and the corresponding percentages of my 12/31 portfolio, for each of my first 7 retirement years. As you can see, I'm spending more or less the same percentage, around 2%, but after the first year the dollars spent have been going up, up, up. Last year I spent 135.8% of what I spent in 2010, in dollars.

This produces some uncertainty and anxiety, as I can see myself getting used to a higher standard of living. When the next recession hits, ouch.

How are you handling this situation? I'm going to attach a poll so wait a minute and it will appear.

Attachments

Last edited: