You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Poll:What % of your retirement stash is Taxable vs IRA, tIRA, 401k or Equivalents?

- Thread starter ShokWaveRider

- Start date

Souschef

Thinks s/he gets paid by the post

Out of Steam

Thinks s/he gets paid by the post

- Joined

- Mar 14, 2017

- Messages

- 1,669

Not quite 100% tax deferred, but well above 90%

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

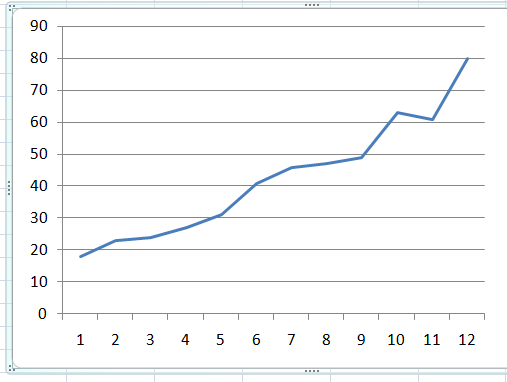

I am at 60%, and have been taking RMD's for 10 years. But, the balance keeps growing.Below is a plot of my RMD's

Yeah, it’s really tough drawing down those IRAs in a long bull market!

I know you’re good at spending BP the proceeds too!

Last edited:

We're on the wrong side of the asset allocation equation compared to everyone here. The only thing that helps is having a large enough nest egg to where it may not matter. DW (67) SS plus my (61) pension is almost enough to cover all expenses. WR is less than 0.5% and may become even less (or 0%) when I start SS for myself (combination of more income plus lower medical premiums @65 - my under 65 medical plan is costly).

Extra Medium

Recycles dryer sheets

3% cash

20% commercial real estate

35% combined 401(k) & Roth

42% taxable

20% commercial real estate

35% combined 401(k) & Roth

42% taxable

Similar threads

- Replies

- 22

- Views

- 2K

- Replies

- 2

- Views

- 2K