walkinwood

Thinks s/he gets paid by the post

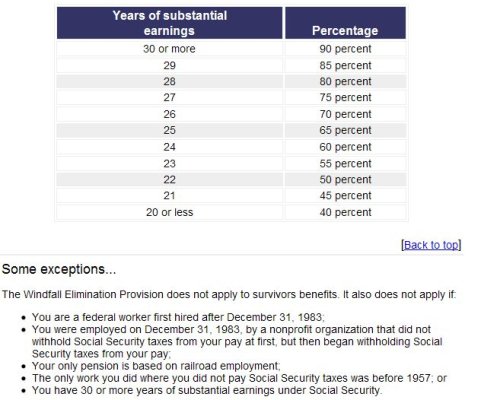

The Nov. Issue of the Journal of Financial planning has an article on the effects of little known SS offsets. It addresses 2 offsets - the Government Pension Offset (GPO) and the Windfall Elimination Provision (WEP).

"The people potentially affected by these benefit offsets are the workers who receive a pension from employment in which they did not pay Social Security taxes, or the workers, their spouses, and widows/widowers who had employment both in a job that paid Social Security taxes and employment in a job that did not."

Potentially Devastating Social Security Offsets

The JoFP keeps article online only for the current month, so if you find it interesting, download and save it.

It does not affect me, so I haven't read it in detail.

"The people potentially affected by these benefit offsets are the workers who receive a pension from employment in which they did not pay Social Security taxes, or the workers, their spouses, and widows/widowers who had employment both in a job that paid Social Security taxes and employment in a job that did not."

Potentially Devastating Social Security Offsets

The JoFP keeps article online only for the current month, so if you find it interesting, download and save it.

It does not affect me, so I haven't read it in detail.