NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

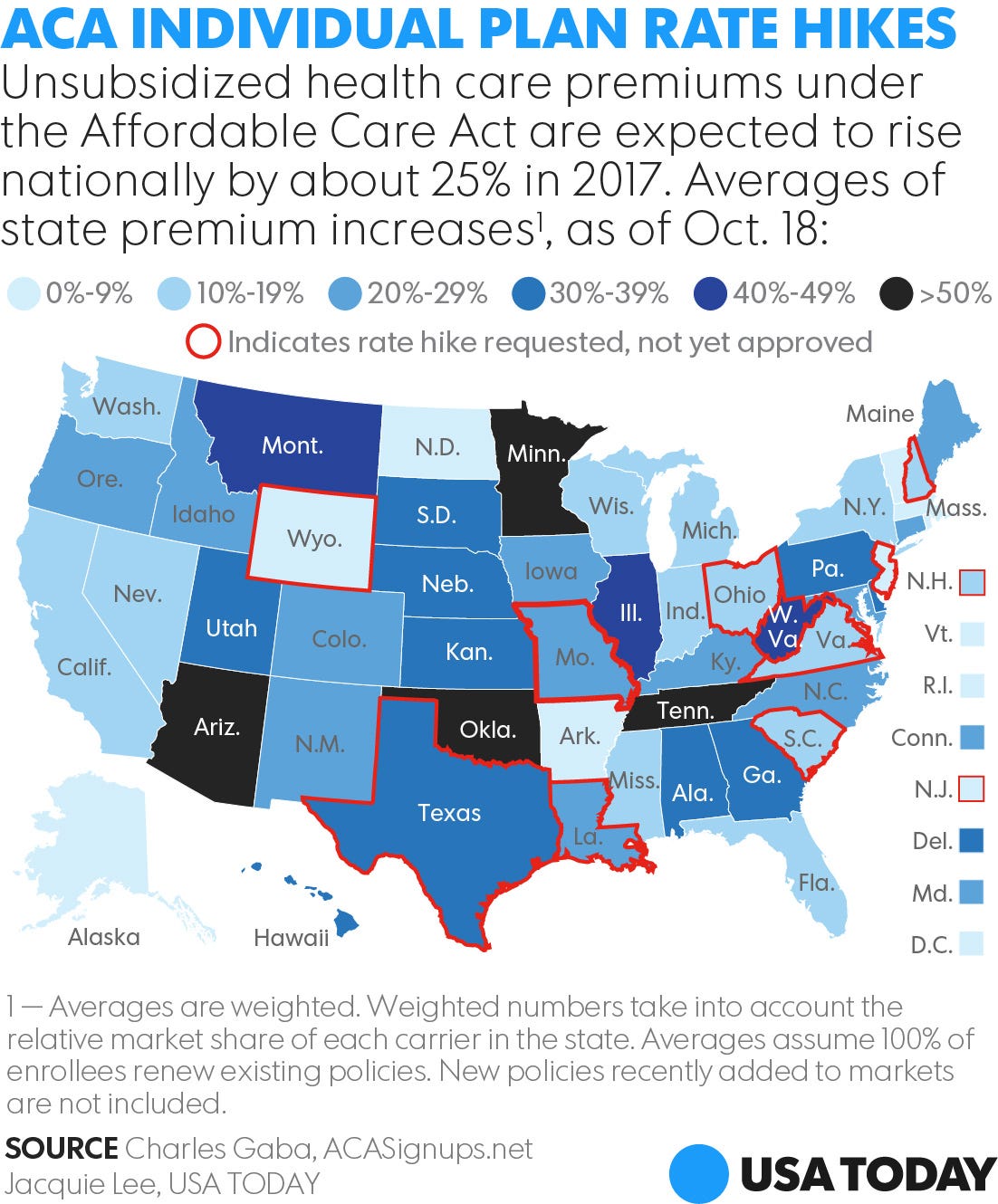

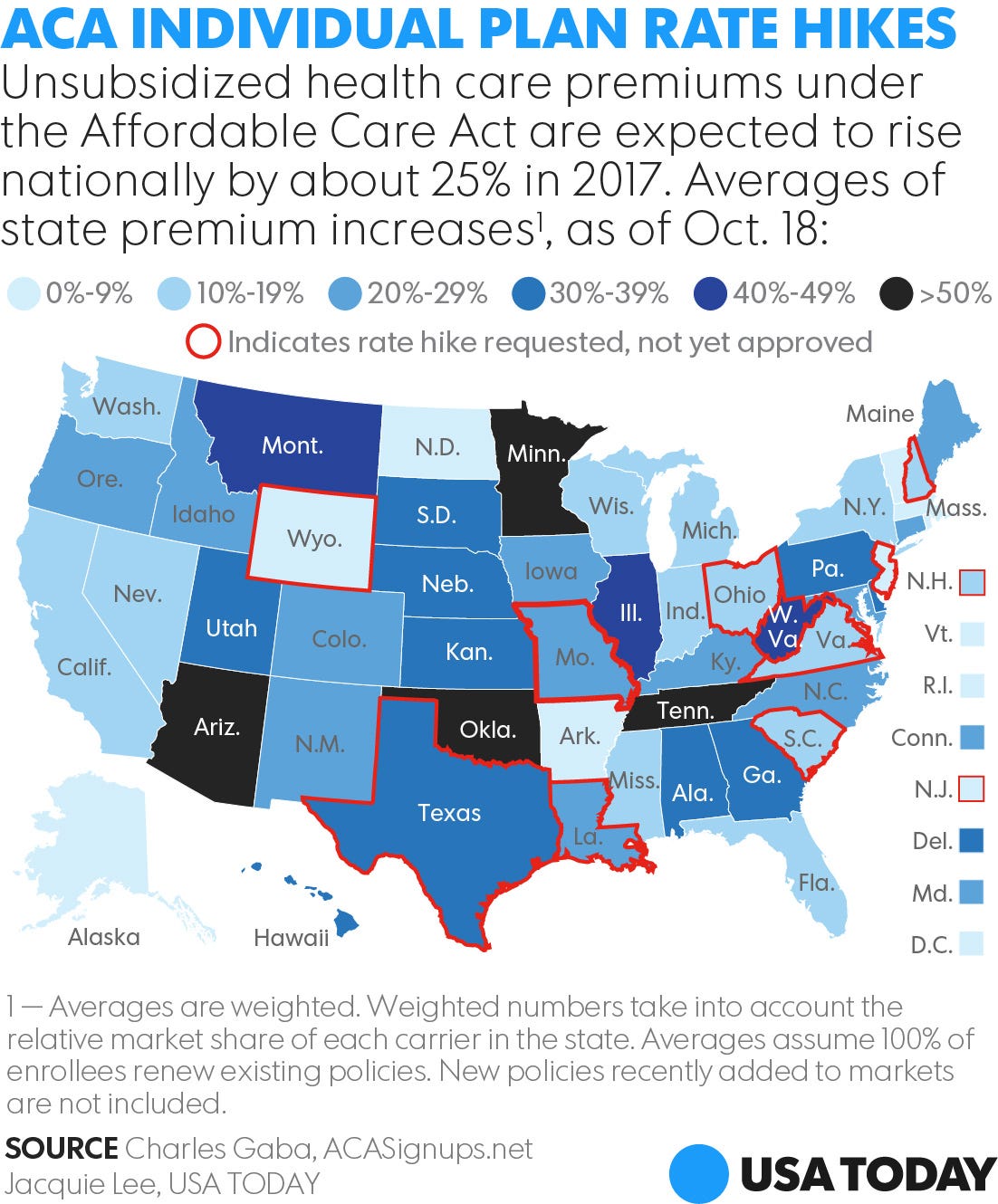

The government has acknowledged that ACA premium increase is about 25% over the nation. It varies wildly from state to state, as shown in a map I link from USA Today.

I live in one of the states colored black in the map. It says ">50%".

How much greater than 50% for a 60-year old like ourselves? It was shocking! More on this later.

Map from: Regulators approve higher health premiums to strengthen Obamacare insurers, published 10/18/2016.

I live in one of the states colored black in the map. It says ">50%".

How much greater than 50% for a 60-year old like ourselves? It was shocking! More on this later.

Map from: Regulators approve higher health premiums to strengthen Obamacare insurers, published 10/18/2016.