I started working for a municipal utility electric company that has a pension in 1983 at age 27. During my first year there, a senior co-worker encouraged me to take advantage of the 401K and the 457 plans that were also available. There was some fund matching but I don't really recall what it was.

Anyway, when I started there, I left a job that paid $11 an hour for this one at $7 an hour. And that seems to be something a lot of folks forget about pensions; that it is PART of the compensation, not in addition to pay, but in combination with pay. If I had earned $11 an hour, the extra 30+% pay would have made it easy to save for my retirement, but at $7 an hour, not so much.

At some point in the 90's I think, then pension was 'super funded'. The stock market was doing so well and the funding for the pensions so flush, that the pension management informed the company that they didn't need to continue paying into our pensions. I asked management when I would start seeing that 30+% of my pay on my paycheck that had been going to the pension fund. Of course they just laughed and said it wasn't MY money if the pension management didn't require payments. I disagreed, but kept my mouth shut. Now fast forward to around 2008 when the market started really dropping. Not only was the super funding no longer, but funding as it was wasn't adequate to cover the promised pensions. Whoa! Wait a minute! What did the company do all those years with the funds they were not being required to pay into our pensions? They sure weren't giving it back to me and as a municipal utility, it is, by definition a non-profit governmental agency. What they did was lower the utility rates for the rate payers. They sure were happy. But when required funding returned with a vengeance, these rate payers reaping the benefits of a hot market earlier bitched like hell that keeping the pensions as promised was going to require a rate increase.

In hind site, the utility should have continued to bank and invest the funds all along, even during those super funded years. After all, what goes up must come down.

But like I mentioned, I was advised early in my career to invest in the 401K and 457, which I did with every pay raise until I maxxed out the amount I was allowed to pay in.

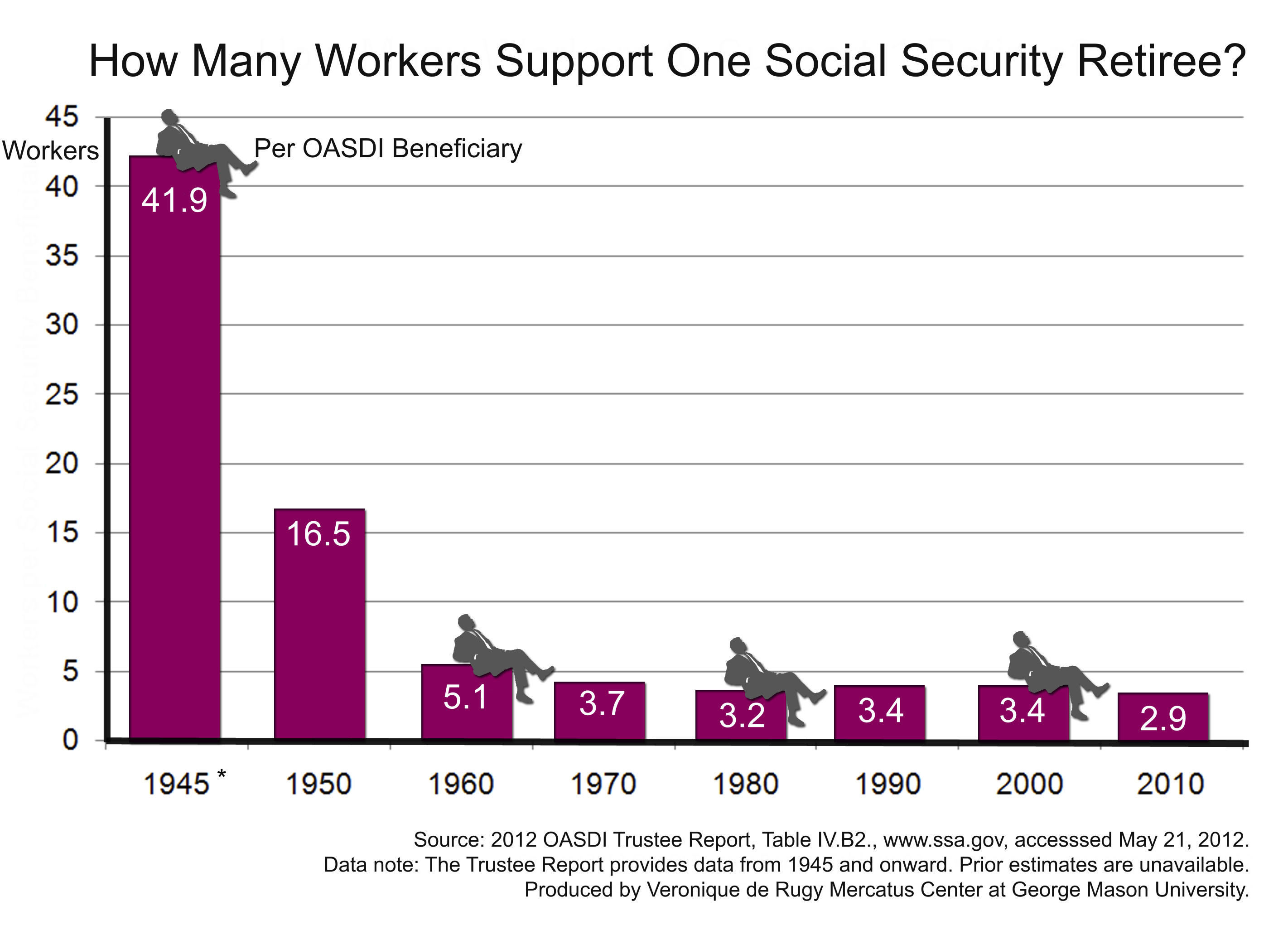

Anyways, I just wanted to point out that pensions were offset by a smaller salary or hourly wage when they were offered where I worked. So anyone thinking it's a gravy train on top of a fat wage is probably mistaken. Figure too, that pensions are based on the employee's hourly wage, reduced to compensate for a match to the pension from the utility, and there's no real way to see a pension as a sole source for funding retirement. It's just one leg of a 3 legged stool. The other legs being the personal savings of a 401K/457 and social security.

Lastly, I'd like to also point out that many pensions were offered to labor intensive work. For me, an electric company, it is rare that anyone over 50 is still climbing poles, let alone in bad weather or other severe conditions. Many wear out their bodies after a couple decades of that type work and either disable out or are terminated because they no longer can perform their daily duties.