You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Quantitative Easing - Effects When it stops

- Thread starter chinaco

- Start date

donheff

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Who knows. To the extent that stimulus money makes a real difference a lot of it will still be coming online after easing ends. My old agency let billions in building contracts many of which haven't even started going up yet -- the money will flow for a long time. So I could make up for the loss. But a lot of this stuff depends on attitudes so if investors and consumer lose confidence as easing ends...

Trawler

Recycles dryer sheets

my guess

On Bonds yields will go to market rates- most likely a bit higher- bond price will bit lower. How much who knows.

Stock prices If I knew I would ER today.

On Bonds yields will go to market rates- most likely a bit higher- bond price will bit lower. How much who knows.

Stock prices If I knew I would ER today.

teejayevans

Thinks s/he gets paid by the post

- Joined

- Sep 7, 2006

- Messages

- 1,691

QE2 is the fed buying our own bonds, once they stop, I got believe that interest rates have to go up to entice others to buy them, cause a chain reaction....unless the world is in such a bad way that safety trumps return.

TJ

TJ

M Paquette

Moderator Emeritus

QE 2 is supposed to end this summer.

What do you think the effect will be on the:

- Bond market

- Stock market

Thoughts, opinions, strategies....

There will be almost no effect on the stock market, as the easing program will phase out as other economic activity picks up. There may be a drag on some financial stocks that have based their near term business on free short term money.

For monitarists, the Fed will stop adding to the money supply as the velocity of money starts to increase. Further along, the increase in velocity of money will require the money supply to be reduced, which the Fed will do by selling those Treasuries bought during QE on the secondary market for cash.

The sales of these Treasuries will put downward pressure on the prices of the notes and bonds, or in other words, will raise the interest rates on them. This is, of course, exactly what most economists and the bond market would expect to happen, so this should be a very calm, measured evolution.

Longer term bond prices have already moved in anticipation of this. Note the rise in interest rates (discount in price) for the 10 year and longer Treasuries, for example.

INHO, I'm not so sure that the stock market won't take a bit of a hit. What QE is doing is dumping massive liquidity into the fiancial markets----and much of it, because of inordinantly low short term interest rates----is being "forced" into the equity markets.

ls99

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 2, 2008

- Messages

- 6,506

QE. I recall seeing QE sunken in Hong Kong harbor.

Oh never mind, different QE. Don't know nothing abut this one.

Oh never mind, different QE. Don't know nothing abut this one.

nvestysly

Full time employment: Posting here.

- Joined

- Feb 19, 2007

- Messages

- 599

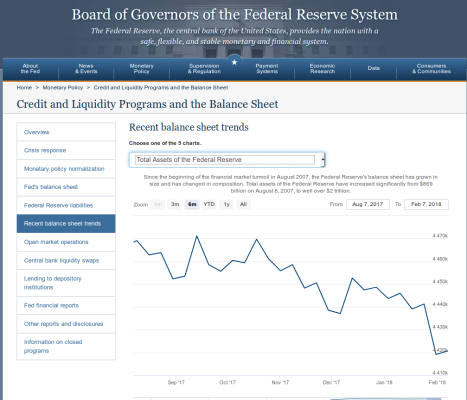

I'm resurrecting this old thread because I think the topic is pertinent as we go into 2018 and beyond. If the moderators think I should start a new thread I'll do so.

I guess at this point the quantitative easing is complete and we're now into the quantitative tightening as some have called it. I suspect the process may have an adverse impact on the stock market.

What are your thoughts?

I guess at this point the quantitative easing is complete and we're now into the quantitative tightening as some have called it. I suspect the process may have an adverse impact on the stock market.

What are your thoughts?

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Tightening will not have inverse impact if it is gradual, transparent, and based on some clearly defined target (like x% inflation). I wish they would quit using the word inflation and use growth instead. The "I" word is scary to most folks.

Debt is money. Maturing debt results in shrinkage of the money supply. The Fed balance sheet shrinking is a reverse QE. No one knows what will be the result since it has never been experienced before. I think it has to negatively impact all asset values.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Not only is the Federal Reserve not purchasing as many treasuries and mortgage-backed bonds now while they are unwinding QE, but the US Treasury is issuing a lot more debt than they have in prior years. So both things put pressure on bonds and thus interest rates.

IMO the huge 2013 rally was asset inflation due to the last QE stage. That had to come out sometime.

And rising rates hurt stocks as they ultimately have to compete with bond and cash yields. Look at which stocks have been hurt the most - REITs, utilities and preferred stocks.

Until now, for the past year, inflation has remained stubbornly below the Fed target. So the equity party continued while the Fed scratched their head at the low inflation readings. Now suddenly the picture is changing and investors have been scrambling.

IMO the huge 2013 rally was asset inflation due to the last QE stage. That had to come out sometime.

And rising rates hurt stocks as they ultimately have to compete with bond and cash yields. Look at which stocks have been hurt the most - REITs, utilities and preferred stocks.

Until now, for the past year, inflation has remained stubbornly below the Fed target. So the equity party continued while the Fed scratched their head at the low inflation readings. Now suddenly the picture is changing and investors have been scrambling.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Actually QE ended in Oct 2014. Over 3 years ago.I'm resurrecting this old thread because I think the topic is pertinent as we go into 2018 and beyond. If the moderators think I should start a new thread I'll do so.

I guess at this point the quantitative easing is complete and we're now into the quantitative tightening as some have called it. I suspect the process may have an adverse impact on the stock market.

What are your thoughts?

Then tightening started as the Fed started raising the Fed funds rate in Dec 2015.

Then they started implementing the QE unwind, or tightening, in Oct 2017, so that program has been going on for a few months, and they are still ramping up. It will take a few years - maybe three.

But until there was some indication of inflationary pressures, the market had not reacted. Now the markets seem to be saying “oh c**p!!!”.

Last edited:

FIREd_2015

Recycles dryer sheets

I'm resurrecting this old thread because I think the topic is pertinent as we go into 2018 and beyond. If the moderators think I should start a new thread I'll do so.

I guess at this point the quantitative easing is complete and we're now into the quantitative tightening as some have called it. I suspect the process may have an adverse impact on the stock market.

What are your thoughts?

As I recall, there was a bit of a lag in asset price inflation after QE started. So I would expect some of the same but in reverse when QE unwind gets some wind behind it. QE drove interest rates to near zero and resulted in credit card, auto loan, and student loan debt all at all time highs. The unwind should drive interest rates up and have some deflationary affect on asset prices.

Here is a link to an interesting article about the QE unwind that just started a couple of months ago:

https://wolfstreet.com/2018/02/01/feds-qe-unwind-accelerates-sharply/

Tadpole

Thinks s/he gets paid by the post

- Joined

- Jul 9, 2004

- Messages

- 1,434

Ten years later and we are still finding consequences of the housing/financial bust to worry about. In the interim, I've gone from a young retiree to an old woman facing her 70th birthday. With very little in the market, I've increased wealth by 50% since I retired. (If I had been fully invested that would probably be close to 100% or more.) I just can't worry about every little coming and going of these never-ending consequences.

nvestysly

Full time employment: Posting here.

- Joined

- Feb 19, 2007

- Messages

- 599

Ten years later and we are still finding consequences of the housing/financial bust to worry about. In the interim, I've gone from a young retiree to an old woman facing her 70th birthday. With very little in the market, I've increased wealth by 50% since I retired. (If I had been fully invested that would probably be close to 100% or more.) I just can't worry about every little coming and going of these never-ending consequences.

Sounds like you Sleep Well At Night (SWAN) and that's good. It's not that I'm tossing and turning, I'm simply interested in how these large-scale monetary policies of global economic powers impact the average Joe/Jane. As an example, there were negative interest rates in other parts of the world - sometimes even cash is not safe. Similarly, inflation can have a very negative impact on cash.

Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

Not only is the Federal Reserve not purchasing as many treasuries and mortgage-backed bonds now while they are unwinding QE, but the US Treasury is issuing a lot more debt than they have in prior years. So both things put pressure on bonds and thus interest rates.

IMO the huge 2013 rally was asset inflation due to the last QE stage. That had to come out sometime.

And rising rates hurt stocks as they ultimately have to compete with bond and cash yields. Look at which stocks have been hurt the most - REITs, utilities and preferred stocks.

Until now, for the past year, inflation has remained stubbornly below the Fed target. So the equity party continued while the Fed scratched their head at the low inflation readings. Now suddenly the picture is changing and investors have been scrambling.

I would love to get a slug into water utilities and they have feel about 15% from tops. But, they are still nosebleed. I need 20-25% more of a haircut to start nibbling. Just depends on which preferred stocks one is in... Mine are hanging in plus 1.5% on this current year, but Im working hard flipping them around to keep the boat from taking on any water.

Similar threads

- Replies

- 38

- Views

- 2K

Latest posts

-

-

-

-

-

-

-

-

-

MYGA Company Ratings. AMBest "A vs A+ vs A++" Does it really Matter?

- Latest: ShokWaveRider

-