Free To Canoe

Thinks s/he gets paid by the post

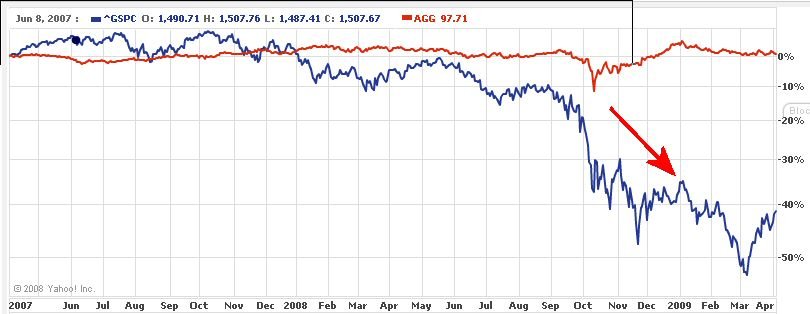

Time to see how we are doing.

My numbers for the quarter: -8.6%.

My quarterly thoughts:

Emerging Market is a good thing, not a bad thing (this quarter).

Pssst Wellesley is something to whisper about this quarter.

What the h*ll happen to my REITs (again this quarter)?

Free (still) to Canoe

My numbers for the quarter: -8.6%.

My quarterly thoughts:

Emerging Market is a good thing, not a bad thing (this quarter).

Pssst Wellesley is something to whisper about this quarter.

What the h*ll happen to my REITs (again this quarter)?

Free (still) to Canoe