ER Eddie

Thinks s/he gets paid by the post

- Joined

- Mar 16, 2013

- Messages

- 1,788

Hi folks. I currently fund my retirement, which began 8 months ago, with dividends and a small pension. As we potentially approach a recession, I'm wondering how my dividends will hold up.

I did some reading on the subject prior to retirement, and here's what I learned:

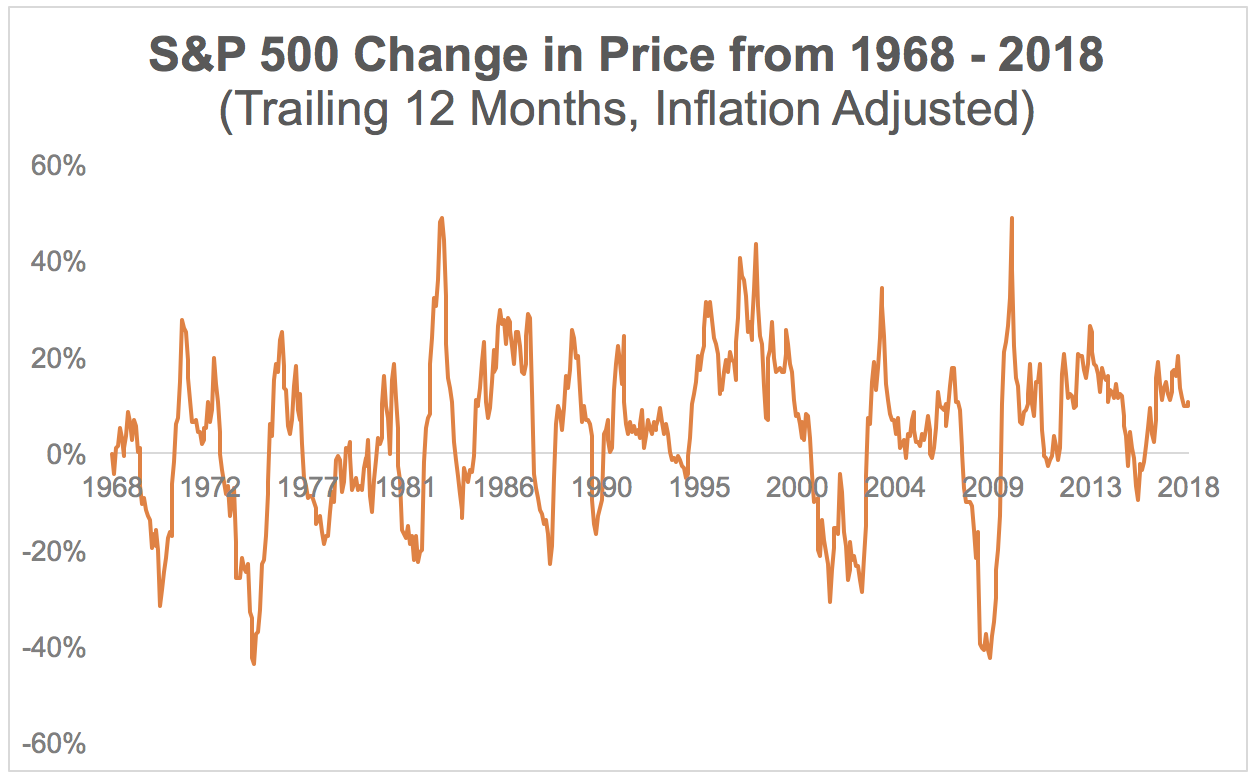

1. Dividends are much less volatile than stock prices. There seem to be several reasons for this: stock prices get detached from the underlying fundamentals of the economy through cycles of irrational exuberance and panic; cutting dividends is one of the last things a company wants to do, since it signals financial stress and reduced confidence in the business; and companies that pay dividends tend to be more mature and steady.

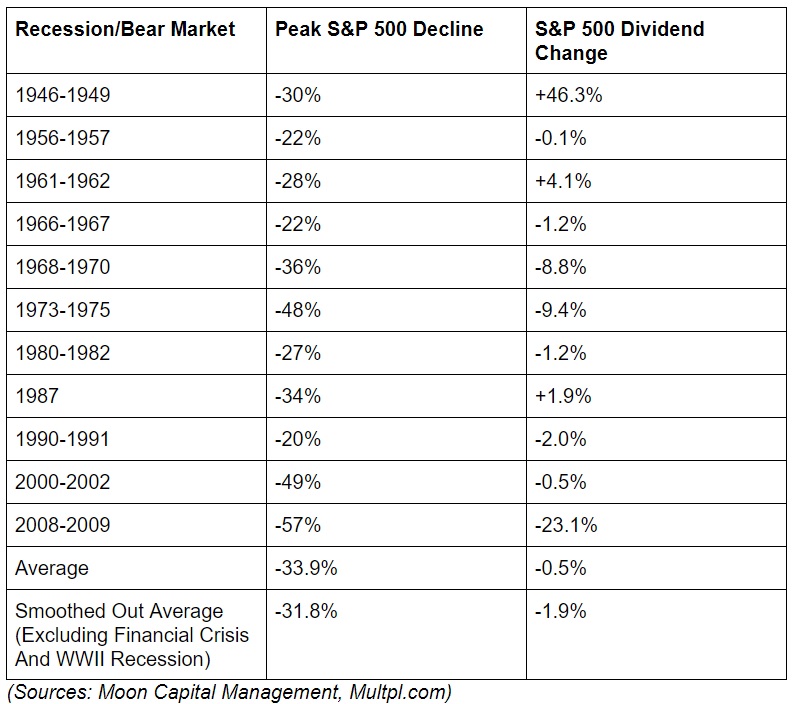

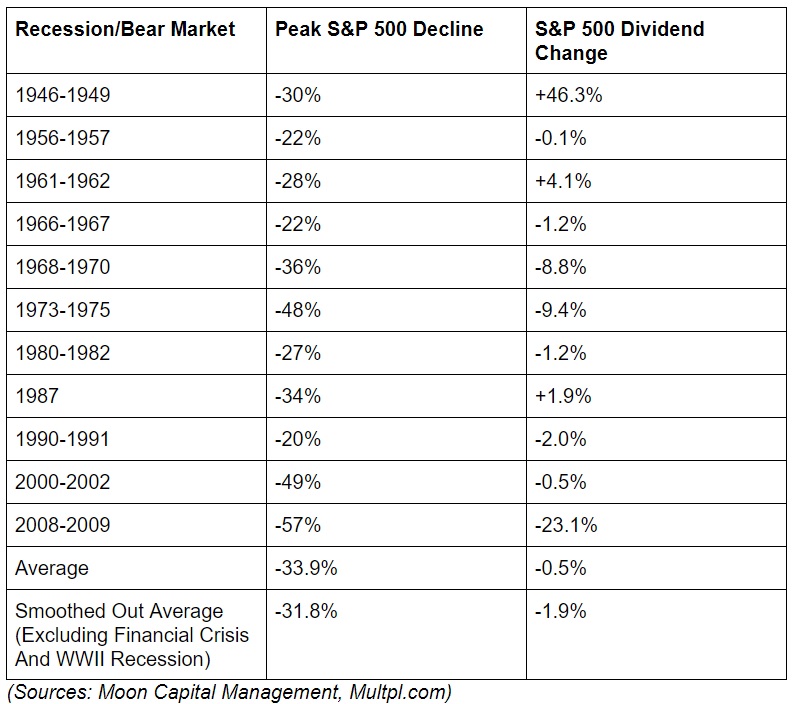

2. There have been 11 bear markets or recessions since WWII. Stocks dropped an average of 34% and dividends dropped an average of 0.5%. However, those figures are probably misleading, since they include two outliers -- the post-WWII recession, where dividends actually increased 46%, and the 2008-2009 recession, where dividends dropped 23%. The 2008-09 recession was considered an outlier because of the financial bailout, which "pressured nearly all strategically important financial institutions to reduce dividends substantially;" it was also statistically somewhat of an outlier, with all the other dividend drops being single digit.

If you take those two out, the overall dividend drop was 1.9%. If you just remove the WWII outlier and leave the 2008-2009 recession in the mix, the average dividend drop becomes 4.0%.

Here are those data:

https://www.simplysafedividends.com...-dividends-during-recessions-and-bear-markets

So I'm thinking I'm fairly safe. A 4% drop in dividend income wouldn't be a problem at all, and I could even weather a 20% drop without much trouble -- although I'd have to keep spending levels steady and forgo extravagant spending, which wouldn't be difficult.

Is there something I'm overlooking or not understanding?

To answer a possible question, I'm not specialized in one type of dividend stock. I'm an index fund investor, so my dividend-yielding stocks are just the usual ones that get lumped in with those.

Thanks in advance for any input. I'm just trying to assess how much dividends drop during a bear market or recession. I've read a little, but I'm not a financial whiz kid, so there may be something I've overlooked.

I did some reading on the subject prior to retirement, and here's what I learned:

1. Dividends are much less volatile than stock prices. There seem to be several reasons for this: stock prices get detached from the underlying fundamentals of the economy through cycles of irrational exuberance and panic; cutting dividends is one of the last things a company wants to do, since it signals financial stress and reduced confidence in the business; and companies that pay dividends tend to be more mature and steady.

2. There have been 11 bear markets or recessions since WWII. Stocks dropped an average of 34% and dividends dropped an average of 0.5%. However, those figures are probably misleading, since they include two outliers -- the post-WWII recession, where dividends actually increased 46%, and the 2008-2009 recession, where dividends dropped 23%. The 2008-09 recession was considered an outlier because of the financial bailout, which "pressured nearly all strategically important financial institutions to reduce dividends substantially;" it was also statistically somewhat of an outlier, with all the other dividend drops being single digit.

If you take those two out, the overall dividend drop was 1.9%. If you just remove the WWII outlier and leave the 2008-2009 recession in the mix, the average dividend drop becomes 4.0%.

Here are those data:

https://www.simplysafedividends.com...-dividends-during-recessions-and-bear-markets

So I'm thinking I'm fairly safe. A 4% drop in dividend income wouldn't be a problem at all, and I could even weather a 20% drop without much trouble -- although I'd have to keep spending levels steady and forgo extravagant spending, which wouldn't be difficult.

Is there something I'm overlooking or not understanding?

To answer a possible question, I'm not specialized in one type of dividend stock. I'm an index fund investor, so my dividend-yielding stocks are just the usual ones that get lumped in with those.

Thanks in advance for any input. I'm just trying to assess how much dividends drop during a bear market or recession. I've read a little, but I'm not a financial whiz kid, so there may be something I've overlooked.

Last edited: