I apparently have a different take than many here, and am a big believer in International diversification - both in equities and fixed income.

The (likely massive, unprecedented) spending that's likely to happen in the US in 2021 and over the next several years is something we should all be concerned about. We simply don't have the money to spend like is already being talked about, and debt is going to increase like crazy. That's going to put further pressure on an already stressed to the max economic system and lead to likely big increases in inflation. For that reason, I'm "iffy" on US bonds AND US equities this year. (On the one hand, all the spending is going to put a lot of additional $$ into the economy so that may continue to artificially inflate stocks for a little big longer, but at one point, things are IMHO likely to pop and if so, the downside won't be pretty).

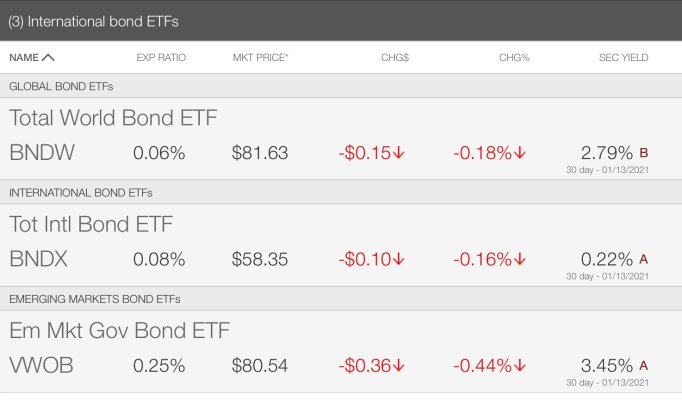

I hold both developed and emerging markets bonds. PFORX is a good core international bond fund albeit with a longer duration (8.23 - similar to Vanguard Total International Bond ETF at 8.5), and you can't go wrong with the managers at PIMCO who arguably are among the best around. It has an adjusted ER of .5 which I realize will give the cost conscious among us pause, but it's worth it, IMHO given the track record of performance which is north of 5% total return for the 1, 3, 5 and 10 year periods. I'll take that kind of consistency from a bond fund all day long, .5% ER or not. It holds 43% Govt, 5.9% Corps, 18.6% Securitized and 14% Cash.

Emerging is a bit trickier. I originally chose Fidelity New Markets Income (FNMIX) and it did well for quite a long time - until it didn't, as many actively managed funds do. I actually picked this back in the days I was focused on yield, as yield is ~4%. But Total Return has been much more variable. 5-year is 6.56%. 10-year, 5.31%. 15-year, 6.55%. But 3-year only 1.57%, 1-year 2.22% and YTD -1.38%. 73% Govt, 18.5% Corporates, 8% Cash. 2 recent manager changes, though - long time manager stepped down end of 2019 and the new lead manager stepped down Sept 2020. Have been thinking of looking for an alternative to this one and sold off some in 2020. Like most actively managed Emerging Market FI funds, high ER of .82.

I also own DBLEX (DoubleLine Emerging Markets) as Gundlach was originally involved in managing it (is not any longer). Performance #s: YTD -0..09; 1-year: 3.68; 3-year: 4.27; 5-year: 7.51; 10-year: 5.12. Duration 3.69. 16% Govt, 75% Corporates, ~8% Cash. High ER of .9%.

Hope that helps..I personally think the US is going to get hit hard economically this year (FI and equities) so am actually thinking of INCREASING my already high International allocations in FI and equities. Probably increase my allocation to Asia and Europe Developed markets as the valuations of both are much more compelling than US at the moment, IMHO.