orplanner

Recycles dryer sheets

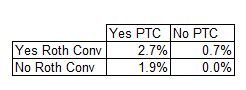

... If the PTC is less than the before credits tax, it should be easy to manage that. But since the PTC can exceed what the before credits tax is, you have to allow what remains of the PTC to be non-taxable income. In other words, if my income generates $3k in before credits income tax, and my PTC is $5k, the model would need to set taxes to zero, and chunk $2k into after tax, but not count it as income. Its like the 2k helped pay my bills. ...

That's a good formulation, with nothing non linear as far as I can tell.

How much money per year are we talking about?

I assume that the PTC stops when Medicare kicks in?

The health insurance premium that we are talking about is a constant known to the user?