explanade

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 10, 2008

- Messages

- 7,442

I tried QLP a couple of times before they went subscription.

I subscribed at the start of the year mostly using the Mac version.

I subscribed at the Quicken Deluxe level.

So I tried installing the Windows version and importing a QTX file from my Mac Quicken file.

It screwed it up badly, got all the bank accounts okay but didn't get my brokerage account balances right at all. It overestimated my net worth, gave me way more shares in some stocks, more than doubling my investment balances.

Tried it twice, never got any better.

So I wanted to mainly try out the QLP but it appears QLP doesn't exist any more.

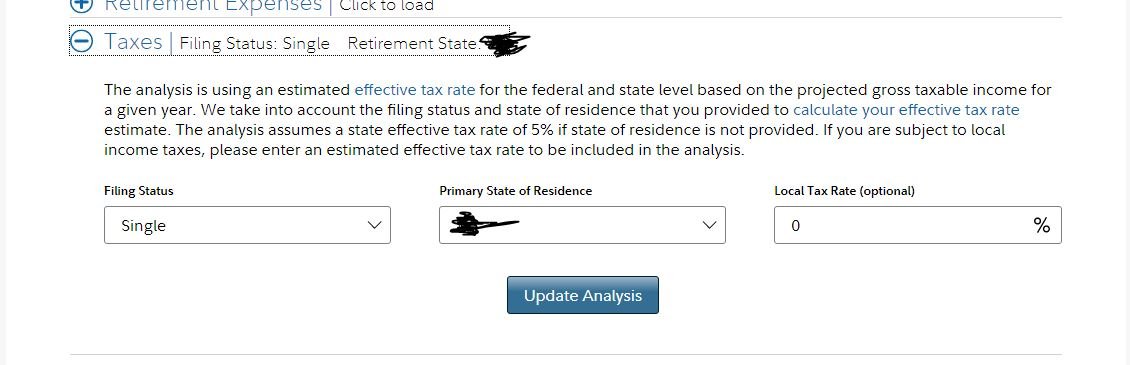

Instead there's something called Retirement Calculator and it's just a simple panel and you can only enter maybe a half dozen variables, like return, inflation rate, estimated tax rate.

Pretty useless, the numbers it generated.

So I'm wondering if you have to subscribe to a higher level to get access to QLP.

Anyone try using it after they went subscription or maybe they got rid of it altogether?

Subscriptions were suppose to let them add features, not remove them.

I subscribed at the start of the year mostly using the Mac version.

I subscribed at the Quicken Deluxe level.

So I tried installing the Windows version and importing a QTX file from my Mac Quicken file.

It screwed it up badly, got all the bank accounts okay but didn't get my brokerage account balances right at all. It overestimated my net worth, gave me way more shares in some stocks, more than doubling my investment balances.

Tried it twice, never got any better.

So I wanted to mainly try out the QLP but it appears QLP doesn't exist any more.

Instead there's something called Retirement Calculator and it's just a simple panel and you can only enter maybe a half dozen variables, like return, inflation rate, estimated tax rate.

Pretty useless, the numbers it generated.

So I'm wondering if you have to subscribe to a higher level to get access to QLP.

Anyone try using it after they went subscription or maybe they got rid of it altogether?

Subscriptions were suppose to let them add features, not remove them.