Zona

Recycles dryer sheets

- Joined

- Apr 26, 2013

- Messages

- 208

Sorry if this is a question that has been asked before. I’ve searched the forum for “treasury default”, “IEF”, and “bond fund default” but I didn’t see any recent discussion that would answer my question.

I no longer work and DH has just finally retired this year at age 50 (so I think now I can officially call us “retired”!) During our accumulation phase, we have been pretty much 95/0/5 mostly S&P etfs (SPY)/bonds/cash. We had already decided to add a bond or “safe” component and are working our way through reading the ERN Safe Withdrawal series to learn more about it. But because we’ve never owned bonds or bond funds we wanted to understand more about how to hold them, do we want to do a glide path, hold individual bonds, or hold a bond fund like IEF, etc. For our age, risk profile, planned withdrawal rate (3.25%), and long time horizon we were thinking to start moving to a 75/20/5 asset allocation. We were considering IEF (iShares 7-10 year treasuries etf) for the 20% simply because it seemed easier for us to manage and understand. We have not yet pulled the trigger and still need to sell SPY shares in order to at least move out of 95% equities. We would be making any changes in DH’s IRA, so there wouldn’t be any tax consequences to start.

My questions are:

1. I just got caught up on the news that secretary Yellen is warning about the possible default. Not trying to discuss politics, just trying to understand if bond funds would behave the same as individual bonds in such a scenario. I understand that individual bond values go down if there’s a default, would this be the same for the value of a bond fund? Would it be prudent to just sell the 20% and move it to cash for now?

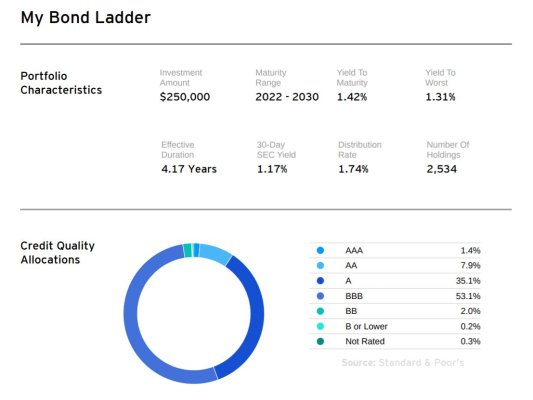

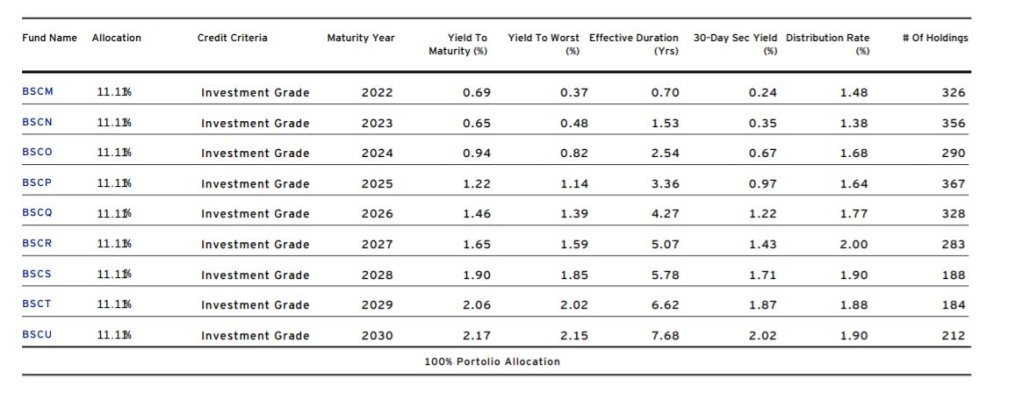

2. We know we probably should have thought about this and made the financial moves before DH retired, but hindsight is 20/20. Really all we are looking to do is find a low-risk vehicle to keep a “safe” portion of our assets to hedge against sequence of returns risk. Would a cd ladder be a better tool for now, and is that something that we would want to hold in an IRA?

I have learned so much from all of you since I joined this forum, so thanks in advance — all thoughts and opinions would be much appreciated!

I no longer work and DH has just finally retired this year at age 50 (so I think now I can officially call us “retired”!) During our accumulation phase, we have been pretty much 95/0/5 mostly S&P etfs (SPY)/bonds/cash. We had already decided to add a bond or “safe” component and are working our way through reading the ERN Safe Withdrawal series to learn more about it. But because we’ve never owned bonds or bond funds we wanted to understand more about how to hold them, do we want to do a glide path, hold individual bonds, or hold a bond fund like IEF, etc. For our age, risk profile, planned withdrawal rate (3.25%), and long time horizon we were thinking to start moving to a 75/20/5 asset allocation. We were considering IEF (iShares 7-10 year treasuries etf) for the 20% simply because it seemed easier for us to manage and understand. We have not yet pulled the trigger and still need to sell SPY shares in order to at least move out of 95% equities. We would be making any changes in DH’s IRA, so there wouldn’t be any tax consequences to start.

My questions are:

1. I just got caught up on the news that secretary Yellen is warning about the possible default. Not trying to discuss politics, just trying to understand if bond funds would behave the same as individual bonds in such a scenario. I understand that individual bond values go down if there’s a default, would this be the same for the value of a bond fund? Would it be prudent to just sell the 20% and move it to cash for now?

2. We know we probably should have thought about this and made the financial moves before DH retired, but hindsight is 20/20. Really all we are looking to do is find a low-risk vehicle to keep a “safe” portion of our assets to hedge against sequence of returns risk. Would a cd ladder be a better tool for now, and is that something that we would want to hold in an IRA?

I have learned so much from all of you since I joined this forum, so thanks in advance — all thoughts and opinions would be much appreciated!

Now we are looking to move 20% of our holdings into something less volatile. I’ll look into the vanguard Well* funds you recommended (I know many forum members hold them, and like them) but I had hoped to simplify future rebalancing by just holding shares of the “bond” asset class individually. Again, thanks for giving me something to think about with those funds.

Now we are looking to move 20% of our holdings into something less volatile. I’ll look into the vanguard Well* funds you recommended (I know many forum members hold them, and like them) but I had hoped to simplify future rebalancing by just holding shares of the “bond” asset class individually. Again, thanks for giving me something to think about with those funds.

I own or have owned both Vang. Well*s. I like what they did for my portfolio. YMMV

I own or have owned both Vang. Well*s. I like what they did for my portfolio. YMMV