dirtbiker

Full time employment: Posting here.

- Joined

- Apr 11, 2019

- Messages

- 630

My 401K is through Principal, and I have it all in an S&P 500 ETF with an expense ratio of 0.05%. Perfect for me at this point in my life.

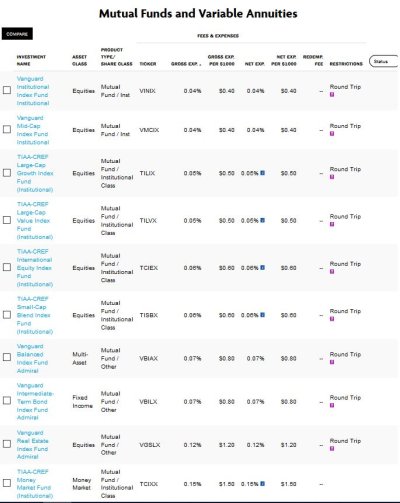

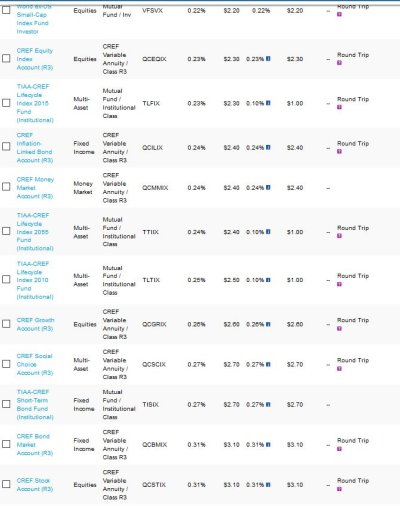

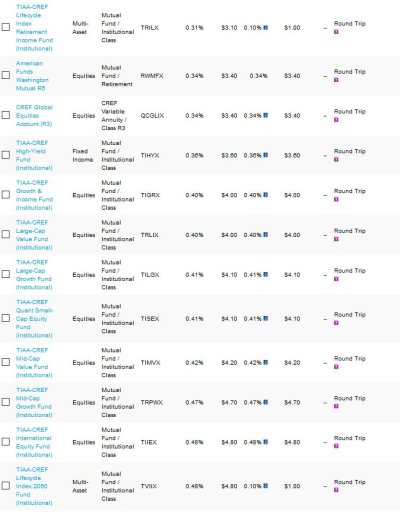

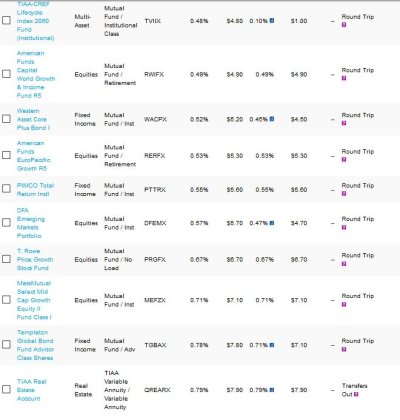

My wife, however, has her 403B through TIAA-CREF, and they have far fewer investment options, all with much higher expense ratios. They range from 0.51% to 1.3%. I hate throwing money away at high expense ratios when high quality ETFs are so cheap.

Are there any options? Can the funds be rolled over into another 401K that has better investment options? Or are we stuck with what they offer us?

My wife, however, has her 403B through TIAA-CREF, and they have far fewer investment options, all with much higher expense ratios. They range from 0.51% to 1.3%. I hate throwing money away at high expense ratios when high quality ETFs are so cheap.

Are there any options? Can the funds be rolled over into another 401K that has better investment options? Or are we stuck with what they offer us?