upupandaway

Recycles dryer sheets

- Joined

- Jul 22, 2019

- Messages

- 131

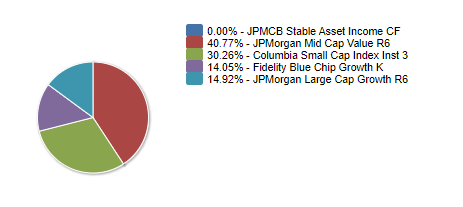

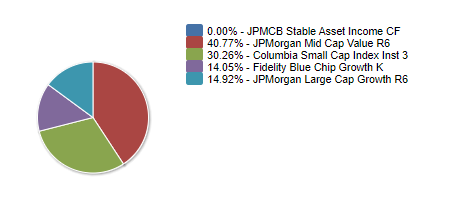

My JP Morgan 401k does not have an S&P 500 or a VTSAX equivalent option. I was previously in the target retirement account but I don't like the AA of those accounts given I still have a long glide path until retirement and I have a fairly high tolerance for risk. I would like to mimic VTSAX with the funds I have available to me. My current AA in this account is way off but I will post it here for a good laugh.

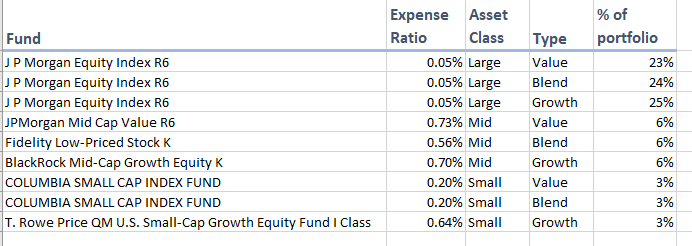

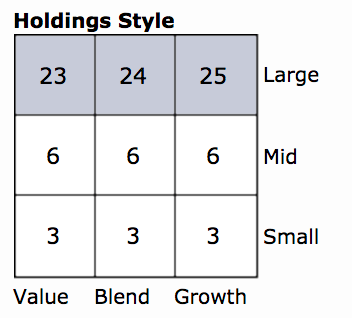

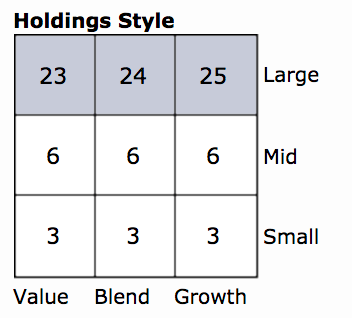

While looking at how to replicate VTSAX I came across an article that provided this morningstar breakdown of the fund.

Here are my specific questions

1. Do I simply adjust my AA into funds available to me that will closely replicate the breakdown above?

2. Do I worry about the expense ratios of the limited choices I have to pick from?

3. Anything else that I may be missing?

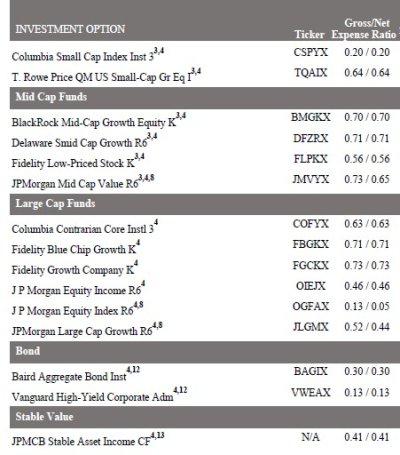

Thanks everyone. I can post the funds I have to choose from if anyone wants to see that.

While looking at how to replicate VTSAX I came across an article that provided this morningstar breakdown of the fund.

Here are my specific questions

1. Do I simply adjust my AA into funds available to me that will closely replicate the breakdown above?

2. Do I worry about the expense ratios of the limited choices I have to pick from?

3. Anything else that I may be missing?

Thanks everyone. I can post the funds I have to choose from if anyone wants to see that.

Attachments

Last edited: