W2R

Moderator Emeritus

Not counting increases for inflation, are you planning for a steady annual expense throughout retirement (i.e. 45K per year forever), or a declining expense model (i.e. 50K during the first ten Go-Go years, 45K during the second ten Slow-Go years, 40K during the remaining No-Go years)?

If you're already retired, have your expenses gone up, remained steady, or declined over time?

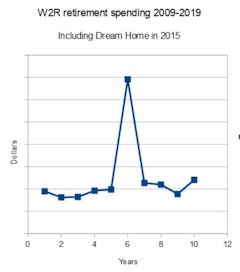

I retired on 11/9/2009, ten years ago, at age 61. The graph below shows my spending record for taxes, medical, everything, including expenses related to buying, re-landscaping, and moving into my Dream Home in 2015.

Overall, I would say that my expenses are slowly increasing by more than inflation, plus I would say that buying a Dream Home in cash can mean a lot more spending that year.

Without the Dream Home, 2015 was very close to the same as 2016.

2019 is just an estimate since we still have two months left.

Growing older is the pits! Lemme tell you. It is, no matter what people tell you. In my opinion, having money to spend on whatever I want helps a lot in dealing with what Father Time does to one's physical self.