It's 90% garbage.

It's like he skimmed the titles and subtitles of 100 beginner amateur invesment blogs and echoed every half-a$$s idea that sounded good -- Without bothering to research or think deeply about any of the ideas.

The "buckets" thing has been discussed by people like Michael Kitces, who have gone through the logic & rationale step-by-step, and have explained how the concept is both: a) erroneous, and b) doesn't do what it is intended to do. It is risk management at the level of understanding of a 3rd grader.

In discussing his plans to defer his pension (and Social Security) for the higher payment, he completely ignores the time value of money. He counts the gain of the eventual higher payments but ignores the immediate cost of the foregone income.

He plans to reduce his stock allocation because of the current high CAPE ratio, but is unaware that even the inventor of CAPE says that it is useless as a timing mechanism.

So obviously he hasn't done any research like googling stuff like "CAPE ratio timing".

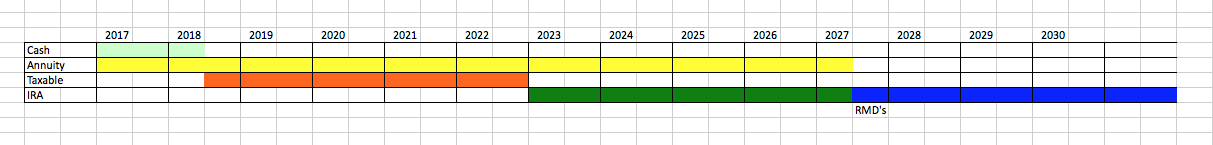

On his "buckets" plan, he presents a static view of the money, and gives zero thought to the dynamics and money flow. Cash bucket has 1-3 years income in cash, so he won't have to sell stocks in a downturn. No discussion about what if a downturn lasts more than 1-3 years. Then the cash bucket is empty and he *has* to sell stocks -- deep in the downturn. He'd have been better off selling stocks down 10% than being forced to sell stocks when they are down 30%. Even if he doesn't empty the cash bucket, he has to refill it when the downturn is over. No discussion about that just an unstated assumption that waving hands and saying "Make it so" will suffice. (Hint: no successful refill strategy has been found. Only handwaving.)

Income bucket has 5 years income. Okay so far. But after a year, the income bucket is down to 4 years. If he wants to keep the same duration, he needs to refill it. Which means he has to sell enough stocks to replace the income he spent. Which means that, in the steady state every year he sells enough stock to equal 1 years of income (after accounting for dividends & interest received.)

So all he's done is sell stocks, but with a side-trip through the income bucket. He spends from the income bucket and then replaces that money from the stock bucket.

That's where all the "bucket" strategies fall apart. When you plot out the money flow, you see it is just smoke & mirrors. The money just moves around. He spends from the income bucket and then replaces that money from the stock bucket.

Same goes for his "One-Off Expense Reserve". He has laid it out as if each of these one-off expenses only happens AFTER the reserve has built up. What happens if in yr 1 he needs a new water heater? It costs $1000 but the account only has $100 for a water heater. What happens if in yr 2 he needs a new car AND a new washer/dryer AND a new computer? And then in yr 3 he needs a new furnace?

So, looks to me like he hasn't actually done any actual research or reading of various authoritative writers (Shiller, Kitches, Swedroe, etc.), just read 500-700 word articles posts from magazines & seekingalpha & blogs.

And he has the implicit assumption that every thing will happen in the order that works great, but has not even considered that things can happen in a bad order. I don't see any realisation that things might not work out the way he plans or any planning for contingencies.