You are right that there is no 8.5% tax bracket, but you are wrong in using ONLY the marginal tax bracket.

8.5% is the effective rate that I paid on the $386k of Roth conversions that I did over the last 7 years... caalculated as (tax after conversion less tax before conversion) divided by the conversion amount.... and is appropriate since the conversion crosses a number of tax brackets.... some is 0% because it is offset by the standard deduction, some is at 10% and the rest is at 12% (was 15%).

I agree with this. You really have to look at the effective tax rate for your own situation and compare effective tax rates now (during conversions) and later when RMD's kick in.

In my own situation, I'm in the marginal 12% bracket now and when I'm taking RMD's I'll be in the marginal 22% bracket. BUT, very little of my income (at age 70) will be in that 22% bracket, the vast majority will be taxed at an effective rate of less than 10%. You really have to look at the actual taxes paid, not just the marginal rate of the last taxed dollar.

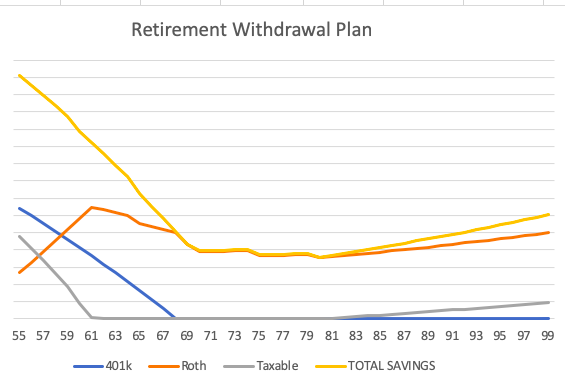

I should note, that I won't have pensions or other income other than retirement accounts and SS. I hope to have a decent mix of SS, Taxable, Tax Deferred, and Tax Free, that I can more or less manipulate my withdrawals to pay the least tax possible each year. At least that's the plan.