This isn't like social security though. Not at all. With social security, the payments stop with your death, so the breakeven point matters as to whether taking early or late is better.

With conversions, you money lives on after your death and any unconverted pre-tax funds continue to get taxed. It doesn't matter that you have to reach far into the future, the important thing is to try to pay the least amount of taxes over the duration of the pre-tax funds, until they are drained.

The important things about retirement money is to not run out in your lifetime, to leave as much as you can to heirs, and/or to be able to spend more, right?

With social security, the breakeven is important because if you die before the breakeven it would be better wrt the above things to have started SS early, but if you die past the breakeven it would be better to start SS late.

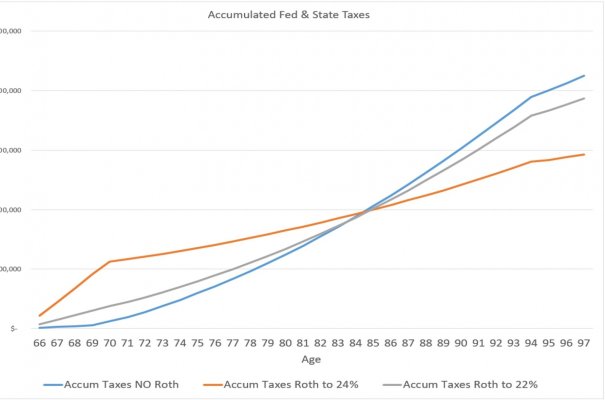

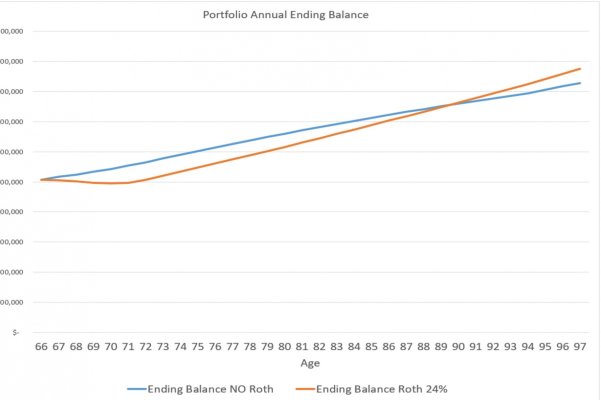

Now let's look at the conversion of pre-tax to Roth issues. Spending is not a factor because you can't spend pre-tax money. You have to withdraw or convert it to be able to spend it. If you defer conversion, and die before the so-called breakeven, you may leave your heirs a larger dollar amount, but you also leave them a larger tax liability. So it really doesn't matter which side of the break even you die on, because with any pre-tax money you pass on, you also pass on the tax liability on it. What you really want to do is for the least amount of taxes to be paid over the duration of the pre-tax fund. If that means converting aggressively early because other things such as SS and pensions push it into a high tax rate later, do it.

The exception to this is if your heirs will be in a lower tax bracket than you are, and leaving them as much as possible is your priority and you figure it is very unlikely you will run out. In this case, converting less aggressively works out better.

The other thing that favors aggressive conversion is the death of a spouse, which puts you into the higher tax rates of a single filer.