|

|

12-04-2019, 02:52 PM

12-04-2019, 02:52 PM

|

#281

|

|

Recycles dryer sheets

Join Date: May 2017

Posts: 83

|

rkser,

Glad to hear it ! The software seems to be very flexible with ways to work around special situations like yours.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

12-04-2019, 03:30 PM

12-04-2019, 03:30 PM

|

#282

|

|

Full time employment: Posting here.

Join Date: Oct 2007

Posts: 621

|

Now I am stuck at the taxable Interest on the 1040,

I do not how the software is coming up with a much higher projected figure, but the Bank & CD interest is 1/4 th of what is shown on 1040.

Maybe it will correct itself as & when the year end Bank 1099s come in, but now the projected taxable income & the Tax are very inflated.

|

|

|

12-05-2019, 02:25 PM

12-05-2019, 02:25 PM

|

#283

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2006

Location: Denver

Posts: 3,519

|

Midpack,

I think this is evident, but to be sure - in your 3 scenarios (no conversions, conversions to 22%, and to 24%), the amount of after-tax (federal) annual spending you specify is the same. Right?

Also, do you have state taxes? Does this software allow that to be taken into consideration?

Fascinating thread.

|

|

|

12-05-2019, 07:21 PM

12-05-2019, 07:21 PM

|

#284

|

|

Full time employment: Posting here.

Join Date: Oct 2007

Posts: 621

|

Fishfactory,

Josh added me in the Google Group of First Capital Users. I am still feeling my way through the software, there is lot to input & to learn its workings.

I am getting incorrect Taxable income projection, at least till I find the right input answer in the You Tube Videos.

|

|

|

12-06-2019, 02:32 PM

12-06-2019, 02:32 PM

|

#285

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2008

Location: NC

Posts: 21,304

|

See below

Quote: Quote:

Originally Posted by walkinwood

Midpack,

I think this is evident, but to be sure - in your 3 scenarios (no conversions, conversions to 22%, and to 24%), the amount of after-tax (federal) annual spending you specify is the same. Right? Exactly the same, I can't imagine doing a fair comparison otherwise.

Also, do you have state taxes? Does this software allow that to be taken into consideration? Yes it asks your state and factors those income taxes in.

Fascinating thread.

|

__________________

No one agrees with other people's opinions; they merely agree with their own opinions -- expressed by somebody else. Sydney Tremayne

Retired Jun 2011 at age 57

Target AA: 50% equity funds / 45% bonds / 5% cash

Target WR: Approx 1.5% Approx 20% SI (secure income, SS only)

|

|

|

12-09-2019, 07:18 AM

12-09-2019, 07:18 AM

|

#286

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

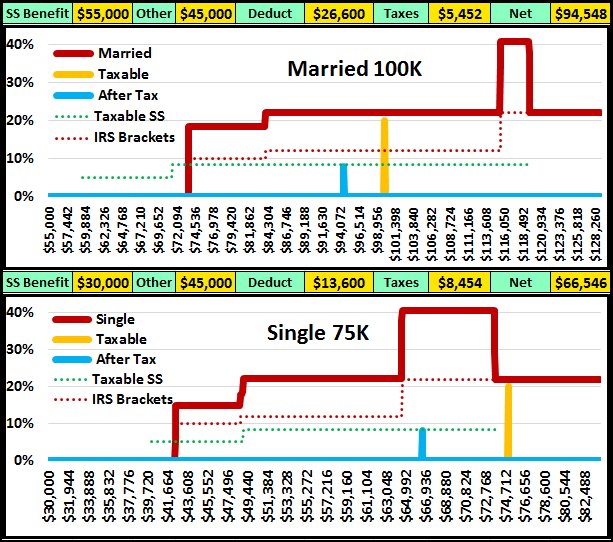

Line 5 on your 1040 tax return can be extremely costly during retirement. Box 5a asks how much did we get from Social Security and box 5b asks how much of your Social Security Benefits are taxable income. Once we reach a certain income level each additional dollar of income causes an additional 50 cents of our SSB to become taxable income, then at a second income level each dollar causes 85 cents to become taxable until 85% of our total benefit has been taxed.

When one dollar of extra income also cause 85 cent of our SSB to also become taxable, your AGI and taxable income increases by $1.85, not just $1.00. 12% of $1.85 is 22.2 cents and 22% of $1.85 is 40.7 cents. Your Marginal Tax Rates, the taxes you pay on the next dollar of income, are 22.2% then 40.7% then back to 22% once 85% of your SSB has been taxed.

One thing that I have learned during retirement is to start doing my tax returns in January. Not the January of the next year after I got my W2s when I was working, but the January of the current year. By the end of January I know how much Social Security I will get that year and how much my yearly pension income will be, plus other guaranteed income like annuities etc. Using this information I can then calculate how much other income I can create from IRA withdrawals, part time jobs, capital gains, etc. before I reach the top end of the 12% Federal Tax Bracket, the 22.2% Marginal Tax Rate.

I redo my tax return every time BEFORE I create extra income. My goal is to know when to switch from IRA withdrawals to Roth withdrawals so that none of my income will be taxed at the 40.7% Marginal Tax Bracket. I also redo my tax return right after Christmas each year to see if I can withdraw extra IRA funds at the 22.2% Marginal Tax Rate to reduce my taxable income needs for the next year.

The primary reason that I can do this is because I did a number of Roth Conversions prior to starting my Social Security benefits. I also used these conversions to do backdoor Roth Contributions. I told my broker to do the Roth Conversion and to withhold zero taxes, then I immediately went on line and filed state and federal estimated tax returns using non-IRA money. 100% of my IRA funds went into my Roth account, not just 70% after tax, a 30% backdoor contribution!

A special note to married couples; this end of year tax check is a good time to do Roth Conversions. Your surviving spouse will be forced to pay taxes at the single tax bracket rates so the amount of extra taxable income before reaching their 40.7% Marginal Tax Rate will be greatly reduced.

Let’s look at some numbers to see how larger Social Security benefit levels can create larger pre 40.7% retirement income levels with lower IRA withdrawals. Note: read the last column like it is a paragraph that explains the other columns.

| Social Security | $54,000 | $60,000 | $70,000 | Larger SSB levels | | IRA / Pen / etc | $61,838 | $60,460 | $58,163 | require less other income | | Gross Income | $115,838 | $120,460 | $128,163 | resulting in more gross income. | | Taxable SS Basis | $88,838 | $90,459 | $93,162 | This increases your "Basis" for | | Taxable SSB | $44,112 | $45,490 | $47,787 | the amount of your taxable SSB. | | Taxable % | 81.69% | 75.82% | 68.27% | Lower % taxed | | Tax Free % | 18.31% | 24.18% | 31.73% | Higher % tax free | | AGI | $105,950 | $105,950 | $105,950 | The target for all of this is the | | Deductions | $27,000 | $27,000 | $27,000 | after standard age 65 deductions | | Taxable | $78,950 | $78,950 | $78,950 | maximum taxable income at | | Fed Tax Bracket | 12% | 12% | 12% | the 12% federal tax bracket. | | Federal Tax Due | $9,086 | $9,086 | $9,086 | Everyone pay the same taxes | | After Fed Tax | $106,752 | $111,374 | $119,077 | but after tax income is higher, | | Overal Tax Rate | 7.84% | 7.54% | 7.09% | and your overall tax rate is lower. | | Hump Width | $2,104 | $6,482 | $13,780 | BUT the 40.7% tax hump is larger | | At 40.7% | $856 | $2,638 | $5,608 | costing more if you didn't plan for it. | | | | | | |

I call the graph line of the 22.2% to 40.7% back to 22% Marginal Tax Rates the Tax Hump, I think that this is what you call the Tax Torpedo on this forum.

A special note here: if you have LTCGs the top end of the 12% standard tax bracket causes those gains to also become taxable at 15% for a total Marginal Tax Rate of 27% without the taxation of your Social Security. This 27% rate becomes 49.95% when each extra dollar of income increases your taxable income to $1.85.

The Tax Hump, Torpedo, becomes 22.2% to 49.95% to 40.7% back to 22%! Even more reason to plan ahead and start your tax returns in January of the CURRENT year, not next year!

__________________

Shirley is a widow, so our viewpoint is from someone who starts "their own" SSB at age 70.

|

|

|

12-09-2019, 08:16 AM

12-09-2019, 08:16 AM

|

#287

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2018

Location: Tampa

Posts: 11,298

|

Quote: Quote:

Originally Posted by Sandy & Shirley

Line 5 on your 1040 tax return can be extremely costly during retirement. Box 5a asks how much did we get from Social Security and box 5b asks how much of your Social Security Benefits are taxable income. Once we reach a certain income level each additional dollar of income causes an additional 50 cents of our SSB to become taxable income, then at a second income level each dollar causes 85 cents to become taxable until 85% of our total benefit has been taxed.

When one dollar of extra income also cause 85 cent of our SSB to also become taxable, your AGI and taxable income increases by $1.85, not just $1.00. 12% of $1.85 is 22.2 cents and 22% of $1.85 is 40.7 cents. Your Marginal Tax Rates, the taxes you pay on the next dollar of income, are 22.2% then 40.7% then back to 22% once 85% of your SSB has been taxed.

One thing that I have learned during retirement is to start doing my tax returns in January. Not the January of the next year after I got my W2s when I was working, but the January of the current year. By the end of January I know how much Social Security I will get that year and how much my yearly pension income will be, plus other guaranteed income like annuities etc. Using this information I can then calculate how much other income I can create from IRA withdrawals, part time jobs, capital gains, etc. before I reach the top end of the 12% Federal Tax Bracket, the 22.2% Marginal Tax Rate.

I redo my tax return every time BEFORE I create extra income. My goal is to know when to switch from IRA withdrawals to Roth withdrawals so that none of my income will be taxed at the 40.7% Marginal Tax Bracket. I also redo my tax return right after Christmas each year to see if I can withdraw extra IRA funds at the 22.2% Marginal Tax Rate to reduce my taxable income needs for the next year.

The primary reason that I can do this is because I did a number of Roth Conversions prior to starting my Social Security benefits. I also used these conversions to do backdoor Roth Contributions. I told my broker to do the Roth Conversion and to withhold zero taxes, then I immediately went on line and filed state and federal estimated tax returns using non-IRA money. 100% of my IRA funds went into my Roth account, not just 70% after tax, a 30% backdoor contribution!

A special note to married couples; this end of year tax check is a good time to do Roth Conversions. Your surviving spouse will be forced to pay taxes at the single tax bracket rates so the amount of extra taxable income before reaching their 40.7% Marginal Tax Rate will be greatly reduced.

Let’s look at some numbers to see how larger Social Security benefit levels can create larger pre 40.7% retirement income levels with lower IRA withdrawals. Note: read the last column like it is a paragraph that explains the other columns.

| Social Security | $54,000 | $60,000 | $70,000 | Larger SSB levels | | IRA / Pen / etc | $61,838 | $60,460 | $58,163 | require less other income | | Gross Income | $115,838 | $120,460 | $128,163 | resulting in more gross income. | | Taxable SS Basis | $88,838 | $90,459 | $93,162 | This increases your "Basis" for | | Taxable SSB | $44,112 | $45,490 | $47,787 | the amount of your taxable SSB. | | Taxable % | 81.69% | 75.82% | 68.27% | Lower % taxed | | Tax Free % | 18.31% | 24.18% | 31.73% | Higher % tax free | | AGI | $105,950 | $105,950 | $105,950 | The target for all of this is the | | Deductions | $27,000 | $27,000 | $27,000 | after standard age 65 deductions | | Taxable | $78,950 | $78,950 | $78,950 | maximum taxable income at | | Fed Tax Bracket | 12% | 12% | 12% | the 12% federal tax bracket. | | Federal Tax Due | $9,086 | $9,086 | $9,086 | Everyone pay the same taxes | | After Fed Tax | $106,752 | $111,374 | $119,077 | but after tax income is higher, | | Overal Tax Rate | 7.84% | 7.54% | 7.09% | and your overall tax rate is lower. | | Hump Width | $2,104 | $6,482 | $13,780 | BUT the 40.7% tax hump is larger | | At 40.7% | $856 | $2,638 | $5,608 | costing more if you didn't plan for it. | | | | | | |

I call the graph line of the 22.2% to 40.7% back to 22% Marginal Tax Rates the Tax Hump, I think that this is what you call the Tax Torpedo on this forum.

A special note here: if you have LTCGs the top end of the 12% standard tax bracket causes those gains to also become taxable at 15% for a total Marginal Tax Rate of 27% without the taxation of your Social Security. This 27% rate becomes 49.95% when each extra dollar of income increases your taxable income to $1.85.

The Tax Hump, Torpedo, becomes 22.2% to 49.95% to 40.7% back to 22%! Even more reason to plan ahead and start your tax returns in January of the CURRENT year, not next year! |

I appreciate your reminders from time to time of this tax hump concept.

It is often an overlooked concept. Many folks worry about the tax torpedo of SS/RMD's pushing them into higher marginal tax brackets.

Your concept is effectively a subset of the tax torpedo "hidden" within lower tax brackets.

__________________

TGIM

|

|

|

12-09-2019, 09:38 AM

12-09-2019, 09:38 AM

|

#288

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2007

Posts: 13,228

|

Quote: Quote:

Originally Posted by Sandy & Shirley

Line 5 on your 1040 tax return can be extremely costly during retirement.

...

|

My abbreviated take on this is that you should figure out whether the max 85% of your SS benefits will be taxed. If not, extra income will be taxed and also push more SS benefits to be taxed--the SS tax hump. At lower income levels, the hump may be less or non-existent, but I haven't done the calcs to figure out where that is.

A good way to avoid this is to have no RMDs, which means converting your tIRA to a Roth before you start taking SS. I think some who are gun shy about not paying Roth conversion taxes now are going to be in for a nasty tax surprise later.

That's not a single determinant for whether and how much to convert, but it certainly is a tie breaker if you think your tax rate in later years will otherwise be the same as you're in now. It's hard to calculate the actual numbers. I've tried but gave up, but I saw enough to convince me to try to convert all of my tIRA by age 70, though not at the expense of the ACA subsidy.

Once you are taking SS it's still worth figuring this out to decide whether to take cap gains, tIRA withdrawals (if you still have a tIRA) or Roth withdrawals as S&S says.

|

|

|

12-09-2019, 10:13 AM

12-09-2019, 10:13 AM

|

#289

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

It is also important to remember MAGI when you are doing your Roth Conversions!

MAGI is not the name of your mother in law! It stands for Modified Adjusted Gross Income which Fed uses to determine how much they are going to charge you for your Medicare coverage. They get this number from your tax return from two tax years prior each year. The year you turn 65 and start your Medicare, they look at your tax return for the year you turned 63. The next year you will be 66 and they look at your age 64 return, etc. So, if possible you should try to do your largest Conversions the year your turn 62 or earlier. If not you have to also consider your extra Medicare costs as part of the cost of the conversion.

__________________

Shirley is a widow, so our viewpoint is from someone who starts "their own" SSB at age 70.

|

|

|

12-09-2019, 10:23 AM

12-09-2019, 10:23 AM

|

#290

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

Related to the Hump or Torpedo or whatever you want to call it is what far too many married couples fail to plan for, The Survivor Penalty!

If you do not plan your inheritance properly, your surviving spouse could have the same income as you did as a married couple while being faced with higher tax rates because they will have to file the same income levels as a single individual instead of a married couple.

In this example we see a married couple with $25,000 and $30,000 Social Security benefits plus additional taxable income of $45,000 from pensions, annuities, IRA withdrawals, etc. Their total annual married income is $100,000 and the top graph shows that their income level is more than $15,000 below their personal 40.7% Marginal Tax Hump. Their federal taxes will be $5,452.

When one of them passes away, the survivor will lose the $25,000 SSB and keep the larger SSB. Assuming that all of their pensions, annuities and other taxable income sources continue for the survivor, the additional income will remain at $45,000. The Widow’s annual gross income will drop to $75,000 and the lower graph shows that her income level will be higher than the top end of her personal 40.7% tax hump created as a single individual vs. a married couple. Her federal taxes will be $8,454!

The Widow is not only losing the $25,000 SSB, but also has to pay an additional $3,002 in taxes!

Note how the dotted green Taxable SS line starts well before and even jumps to 85% before the red married Marginal Tax Rates in the first graph.

Note also that the survivor’s Tax Hump is larger because the 85% taxation of their benefits started well after the start of their single Marginal Tax line and therefore extended further to reach the total 85% taxation of their benefits.

The Economic Growth and Tax Relief Reconciliation Act of 2001 eliminate most of marriage penalties that existed in our tax laws prior to that time. The Income Tax Bracket for middle income married couples are now double those of a Single Individual and the Medicare premiums paid by retired married individuals are also based on double the income levels of single individuals.

Unfortunately, the penalty still exists for the income levels defined in 1983 and 1993 for the taxation of our Social Security benefits!

If the Marriage Penalty for Social Security taxation was eliminated in 2001 the first Married line would be the same as the Domestic Partners line.

__________________

Shirley is a widow, so our viewpoint is from someone who starts "their own" SSB at age 70.

|

|

|

12-09-2019, 11:01 AM

12-09-2019, 11:01 AM

|

#291

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2006

Location: Boise

Posts: 7,882

|

Another part of the what S&S list above as the survivor penalty is that the IRMAA surcharge tiers are at lower income levels for single than for MFJ. So a couple that was paying an IRMAA surcharge at the first tier when MFJ may pay at the second or third tier two years after the first spouse passes.

__________________

"At times the world can seem an unfriendly and sinister place, but believe us when we say there is much more good in it than bad. All you have to do is look hard enough, and what might seem to be a series of unfortunate events, may in fact be the first steps of a journey." Violet Baudelaire.

|

|

|

12-09-2019, 11:38 AM

12-09-2019, 11:38 AM

|

#292

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2008

Location: NC

Posts: 21,304

|

The software I was using factors in actual SS taxes, IRMAA, MAGI, survivor tax impact*, etc. That, and the detail, was the primary benefit to me - there is no way I'd be capable of writing a spreadsheet that includes all the variables and regs.

* though you'd have to use a range of different survivor years to get a sense of impact - e.g. my plan started with a 2 year survivor span at the end but I also did another where one she survived me by 10 years. You can do as many different scenarios as you'd like.

__________________

No one agrees with other people's opinions; they merely agree with their own opinions -- expressed by somebody else. Sydney Tremayne

Retired Jun 2011 at age 57

Target AA: 50% equity funds / 45% bonds / 5% cash

Target WR: Approx 1.5% Approx 20% SI (secure income, SS only)

|

|

|

12-09-2019, 02:25 PM

12-09-2019, 02:25 PM

|

#293

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,373

|

Ah... our one-trick pony is back!

Yes, it is good to remind people that SS is taxed.... however, for many people who are positioned to retire early their income is high enough that it will be taxed at 85% anyway so it is a bit of a moot issue... especially since the income hurdle for that purpose includes 1/2 of social security.

Quote: Quote:

You will pay tax on only 85 percent of your Social Security benefits, based on Internal Revenue Service (IRS) rules. If you:

- file a federal tax return as an "individual" and your combined income* is

- between $25,000 and $34,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000, up to 85 percent of your benefits may be taxable.

- file a joint return, and you and your spouse have a combined income* that is

- between $32,000 and $44,000, you may have to pay income tax on up to 50 percent of your benefits.

- more than $44,000, up to 85 percent of your benefits may be taxable.

- are married and file a separate tax return, you probably will pay taxes on your benefits.

Your adjusted gross income

+ Nontaxable interest

+ ½ of your Social Security benefits

= Your "combined income"

|

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

12-09-2019, 02:37 PM

12-09-2019, 02:37 PM

|

#294

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2007

Posts: 13,228

|

Quote: Quote:

Originally Posted by pb4uski

Ah... our one-trick pony is back!

Yes, it is good to remind people that SS is taxed.... however, for many people who are positioned to retire early their income is high enough that it will be taxed at 85% anyway so it is a bit of a moot issue... especially since the income hurdle for that purpose includes 1/2 of social security.

|

LOL, S&S does seem to have just one topic, don't they?

But note in that chart, the more than $34000single/$45000joint, it says " up to 85%" may be taxed. It means you have at least $1 in the 85% range, but may have some at 50%, and even some untaxed. If I was taking SS (even waiting until 70), my pension, and my expected divs/int/CGs this year, I wouldn't have all of my SS benefits in the 85% taxability range. So I would have some kind of SS hump. Unsure what will happen in 12 years, because the $34K/$45K number hasn't been inflation adjusted while my earnings are. And for all I know they may wind up making all SS benefits taxable.

It can be worth finding a SS taxability calculator or doing a pro forma return to see where one actually falls.

|

|

|

12-09-2019, 02:48 PM

12-09-2019, 02:48 PM

|

#295

|

|

Administrator

Join Date: Apr 2006

Posts: 23,038

|

Our two pensions put us over the 85% taxable level right from the start, so I have never spent a second trying to delve into the oddly fixated S&S posts.

Quote: Quote:

Originally Posted by RunningBum

It can be worth finding a SS taxability calculator or doing a pro forma return to see where one actually falls.

|

Here's a very simple calculation:

For MFJ, start with $44k. Add 85% of your social security benefit. If you make more than that, 85% of your social security benefit is taxable.

Here's the link to the IRS form so you can do your own calculation (it's on page 16):

https://www.irs.gov/pub/irs-pdf/p915.pdf#page=16

Essentially, you put in your assumed social security amount on line 1, your other income on line 4 and then crank through the form

__________________

Living an analog life in the Digital Age.

|

|

|

12-09-2019, 04:08 PM

12-09-2019, 04:08 PM

|

#296

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,145

|

Our current income pushes us into 85% of our SS being taxed. I spent more of my time reviewing cap gains tax thresholds.

__________________

Retired since summer 1999.

|

|

|

12-09-2019, 05:07 PM

12-09-2019, 05:07 PM

|

#297

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

Pb4uski, Ah YES … your one-trick pony is back!

RunningBum, Yes most of my posts relate to avoiding the double taxation of SS and other income.

Audreyh1, The triple taxation of LTCGs, SS and other income creates a marginal tax rate of 49.95%

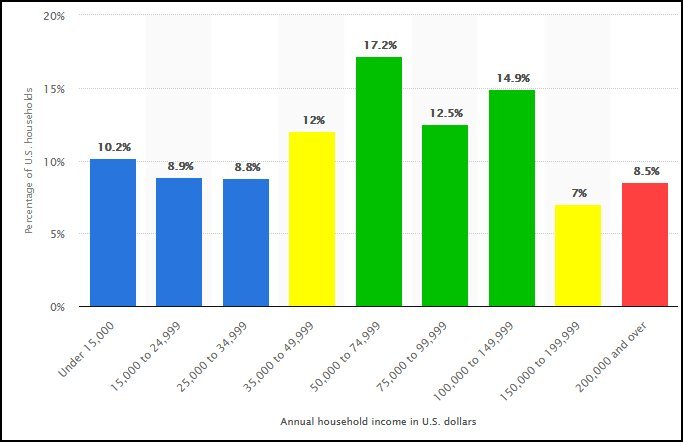

Here is the graph that is provided by statista.com that shows the “Percentage distribution of household income in the United States in 2018”.

I color coded the bars to make my point. Early retirement is not restricted to the 8.5% of income earners represented by the red bar on the right where the 85% taxation of their benefits is something in their rear view mirror. Many of us in the combined 44.6% green bars in the middle also think about and plan for early retirement where the 40.7% Marginal Tax Rate can become a significant factor, and the huge Marginal Tax Rates can even extend into the 19% combined yellow bars on either side.

My posts and my research are aimed at those with middle to upper middle income who can avoid paying taxes on the full 85% of their Social Security Benefits, if they plan properly for that situation.

Case in point: Shirley is a widow. She retired early and is now getting about 80% of her late husband’s SS benefits. Yes, her Hump Taxes are relatively small right now. When she turns 70 she will switch to 130% of her own SS benefits and her personal Hump Taxes will be substantial without the proper planning. That is the reason I started all of my research and I just want to share it with others.

__________________

Shirley is a widow, so our viewpoint is from someone who starts "their own" SSB at age 70.

|

|

|

12-09-2019, 07:54 PM

12-09-2019, 07:54 PM

|

#298

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2008

Location: NC

Posts: 21,304

|

Quote: Quote:

Originally Posted by Sandy & Shirley

Pb4uski, Ah YES … your one-trick pony is back!

RunningBum, Yes most of my posts relate to avoiding the double taxation of SS and other income.

Audreyh1, The triple taxation of LTCGs, SS and other income creates a marginal tax rate of 49.95%

Here is the graph that is provided by statista.com that shows the “Percentage distribution of household income in the United States in 2018”.

I color coded the bars to make my point. Early retirement is not restricted to the 8.5% of income earners represented by the red bar on the right where the 85% taxation of their benefits is something in their rear view mirror. Many of us in the combined 44.6% green bars in the middle also think about and plan for early retirement where the 40.7% Marginal Tax Rate can become a significant factor, and the huge Marginal Tax Rates can even extend into the 19% combined yellow bars on either side.

My posts and my research are aimed at those with middle to upper middle income who can avoid paying taxes on the full 85% of their Social Security Benefits, if they plan properly for that situation.

Case in point: Shirley is a widow. She retired early and is now getting about 80% of her late husband’s SS benefits. Yes, her Hump Taxes are relatively small right now. When she turns 70 she will switch to 130% of her own SS benefits and her personal Hump Taxes will be substantial without the proper planning. That is the reason I started all of my research and I just want to share it with others. |

Would you mind starting your own thread instead of hijacking this one? Moderators?

__________________

No one agrees with other people's opinions; they merely agree with their own opinions -- expressed by somebody else. Sydney Tremayne

Retired Jun 2011 at age 57

Target AA: 50% equity funds / 45% bonds / 5% cash

Target WR: Approx 1.5% Approx 20% SI (secure income, SS only)

|

|

|

12-10-2019, 04:46 AM

12-10-2019, 04:46 AM

|

#299

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2009

Location: Cville

Posts: 1,604

|

While on the topic of the thread and cliffs I finally found the cliff for rental properties. Seems from reading

https://www.irs.gov/pub/irs-pdf/i8582.pdf Starting on Page 9, Passive Income Loss (PAL) is fully phased out at MAGI of $150K. Hard to get the bottom line from these instructions but matching it with my return from last year found magic number for me. So another cliff if you file schedule E then above $150K MAGI kicks you into not claiming a loss on property. Good news for me at least, now that property is producing a profit past losses can be used to offset the profit this year and going forward.

__________________

FIRE 31 Aug, 2018 - Always leave every place better than you found it, always give more than expected or Due

|

|

|

12-15-2019, 06:21 AM

12-15-2019, 06:21 AM

|

#300

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2008

Location: On a hill in the Pine Barrens

Posts: 9,720

|

This may be of interest for the thread topic, or at least half of the topic.

https://www.doughroller.net/financia...om-mark-zoril/

I did not find a mention of this in the thread. The link came from B-Heads.

The first year cost is a bit higher than $96 now, but still afoordable. But I don't think the service fills the income optimization part of the thread topic.

I thought the discussion revealed some insight about paid FPs.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|