24601NoMore

Thinks s/he gets paid by the post

- Joined

- Dec 8, 2015

- Messages

- 1,166

Considering a Revocable Living Trust to hopefully simplify estate transition..

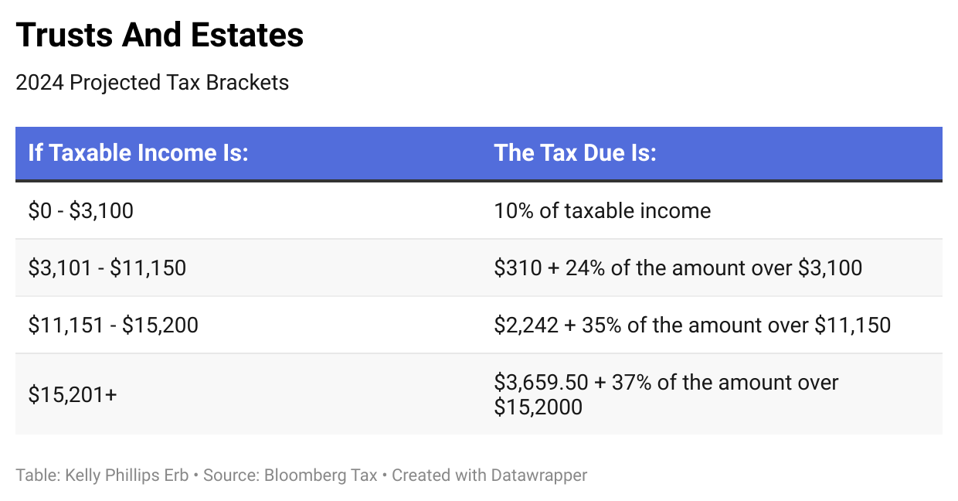

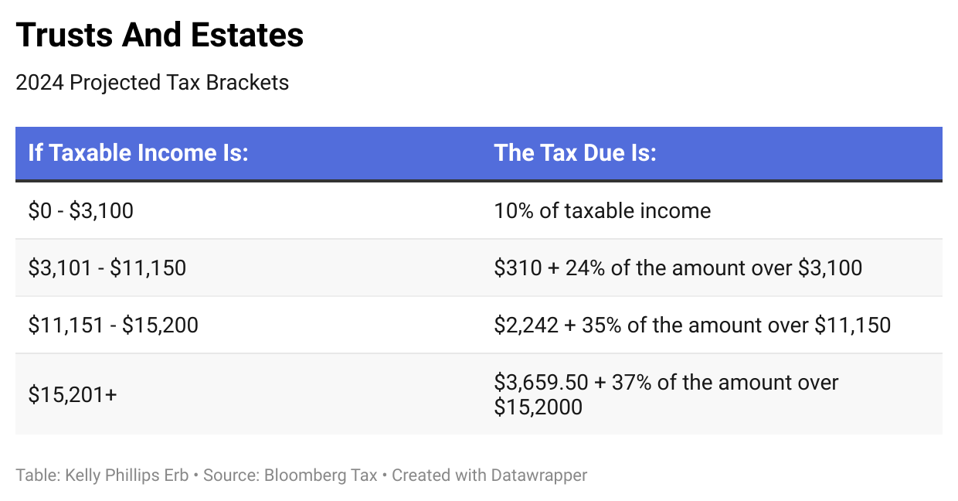

One thing I've run into is that Federal tax rates on income generated by a RLT and not paid directly to beneficiaries in the same tax year are way higher than the tax rates paid by individuals if the same assets were held outside of a trust.

For example - we have a number of CDs that we reinvest dividends back into. Assuming we're in the 12% marginal tax bracket, those dividends would be taxed (Federal) at 25% less (!) if those CDs were held outside of a Trust, vs inside of it. That appears to be because of the tax rates for income generate by a Trust and not paid out to the beneficiaries..

Am I missing something here, or is that indeed how income generated by a Trust vs. income generated by assets held in taxable accounts differs in terms of tax liability?

Other questions..

- What about dividends from a MYGA purchased with after-tax dollars held in a Trust? If those are re-invested, what rate is that dividend income taxed at?

- How about Qualified Dividends in a taxable account? Do they maintain the same 0%/15% rates if generated inside of a Trust vs. in a Brokerage Taxable account?

So confusing..

TIA for any/all help..

One thing I've run into is that Federal tax rates on income generated by a RLT and not paid directly to beneficiaries in the same tax year are way higher than the tax rates paid by individuals if the same assets were held outside of a trust.

For example - we have a number of CDs that we reinvest dividends back into. Assuming we're in the 12% marginal tax bracket, those dividends would be taxed (Federal) at 25% less (!) if those CDs were held outside of a Trust, vs inside of it. That appears to be because of the tax rates for income generate by a Trust and not paid out to the beneficiaries..

Am I missing something here, or is that indeed how income generated by a Trust vs. income generated by assets held in taxable accounts differs in terms of tax liability?

Other questions..

- What about dividends from a MYGA purchased with after-tax dollars held in a Trust? If those are re-invested, what rate is that dividend income taxed at?

- How about Qualified Dividends in a taxable account? Do they maintain the same 0%/15% rates if generated inside of a Trust vs. in a Brokerage Taxable account?

So confusing..

TIA for any/all help..