Even with the Federal Reserve aiming a $750 billion fire hose at U.S. corporate debt markets to offset carnage from the pandemic, defaults at speculative-grade companies already are starting to climb as business buckle under their debts.

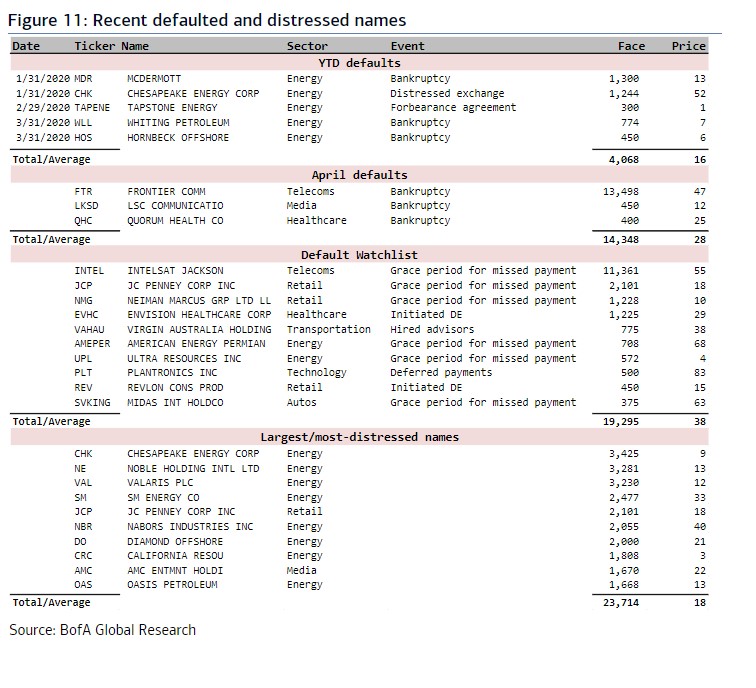

Frontier Communications Corp. US:FTR, LSC Communications Inc. US:LKSD and hospital operatorQuorum Health Corp. in April defaulted on a combined $14.3 billion of speculative-grade (or junk-rated) bonds, a sharp uptick from the $4 billion seen earlier in the year, according to B. of A. Global analysts. ...