You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ridiculous CD rates - where now

- Thread starter bobbee25

- Start date

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

If interest rates go up the value of bonds and bond funds will go down. I don’t think you’d want to sell after rates rise. A fund might mitigate the effect of rising rates.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Bond funds are not a substitute for CDs. Don’t take on more risk to chase yield.

And it’s almost impossible to anticipate interest rate changes. Nobody knows.

And it’s almost impossible to anticipate interest rate changes. Nobody knows.

+1Bond funds are not a substitute for CDs. Don’t take on more risk to chase yield.

And it’s almost impossible to anticipate interest rate changes. Nobody knows.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,236

Define safe. Bonds have a risk of default. It's usually very low, but if things go really really bad, it may not be so low. All other investments will probably get whacked too. In normal times, a bond fund will give you the protection of numbers to minimize the effect of a few defaults. Investing in individual bonds, you need to do a little research and try to diversify as best you can. I'd bet most of the individual bond investors here have never had one of their bonds default.How safe are short and intermediate bonds, when it looks like the interest rates may go up, sell them ?

If you're just talking about losing money, yeah, bond funds will lose money as rates rise, but the yield will go up as well. You can avoid loss on individual bonds by holding to maturity, but that locks you into that low rate.

You talk about selling if interest rates "may go up". Not so easy to predict, and what are you going to invest in when you do sell? And when do you know that they have stopped going up to get back in?

The problem with talking about bonds is... there are different kind of bonds with different risks.... are you talking about treasury bonds.. corporate bonds....muni bonds.... the list is long and each of those categories you have other choices with risk... short term...long term... ect..ect...

each type of bond has its own way to invest in them...

each type of bond has its own way to invest in them...

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Bond funds are not a substitute for CDs....

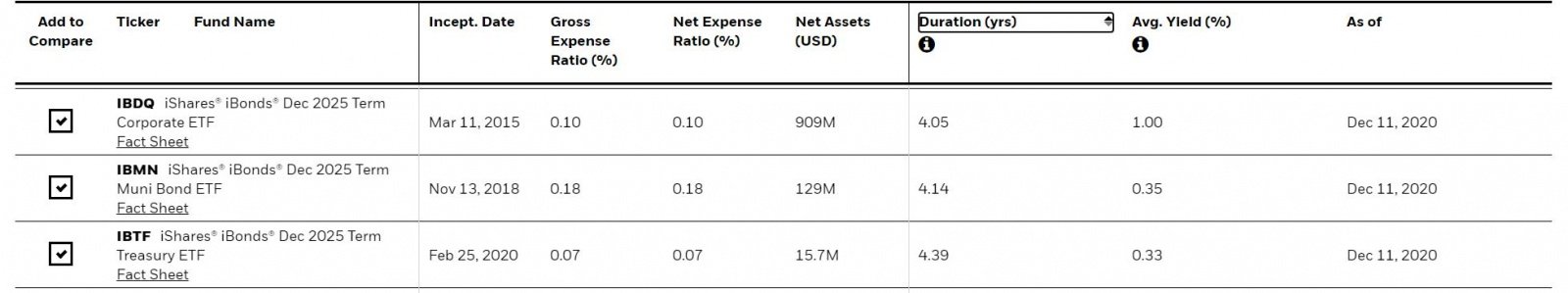

Target maturity bond funds are very similar to CDs in that they invest in bonds that mature in a specific year and they do a terminal distribution in December of the target year. They are in a space between individual bonds and bond funds... but more similar to holding a proportional interest in a portfolio of individual bonds maturing in a specified year. There are treasury, muni and corporate flavors. Obviously the corporate version has a higher yield.... probably ~0.90% vs 0.50% or less for a 5-year CD... but there is credit risk associated with these... for IBDQ, 55% of its holdings are BBB, 35% A and most of AA or better.

Attachments

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Not sure if I would go there... weighted ave YTM is 0.67% and fee is 0.06% so net yield of 0.61% but duration of 2.36 years... so wouldn't a 26 bps increase in rates wipe out a full year of interest? at least in theory?

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The problem with talking about bonds is... there are different kind of bonds with different risks.... are you talking about treasury bonds.. corporate bonds....muni bonds.... the list is long and each of those categories you have other choices with risk... short term...long term... ect..ect...

each type of bond has its own way to invest in them...

+1

I haven't agreed with many of your statements but this is on point.

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

+2 with dixter and +1 with jazz4cash

tenant13

Full time employment: Posting here.

I converted SOME of my cash to USDC stable coin at Coinbase and distributed it between 3 lending platforms: Celsius (10.51% https://celsius.network/rates/) , BlockFi (8.6% https://blockfi.com/rates/) and Nexo (10% https://blockfi.com/rates/). It works for me and all 3 have been paying interest diligently as per their terms.

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I suppose you're right. For some reason, I came up with around a 2% 30 day yield.

I admit to not really understanding bond fund yield. There are several metrics. Since I’m not buying bonds for capital gains, I only pay attention to distribution yield. I get a distribution yield on SLQD is 2.4% which is impressive. I’m using a single state muni fund with which has similar distribution yield and maturity but I get that tax free bump.

Hope you guys/gals have been on the right end of the Fed pumping the corporate bond market.... I have been trading bonds for over 40 yrs and I have never ever seen the above par valuations I am seeing these days... incredible... I'm seeing 40%...50% and higher ... I even found one last week a bond within a division of Disney that was 90% above par... so someone bought that bond for $1000 and its now at $1900/bond... what a deal for someone...

I tested a high yld treasury bond the last few months by buying the bond a day after the coupon payout and just held it till the next coupon payout and sold it the next day... its kinda scary buying a treasury at 47% above par just to hold it for the coupon and sell it back at the same valuation... but it is doable... lots of money to be made these days...

I tested a high yld treasury bond the last few months by buying the bond a day after the coupon payout and just held it till the next coupon payout and sold it the next day... its kinda scary buying a treasury at 47% above par just to hold it for the coupon and sell it back at the same valuation... but it is doable... lots of money to be made these days...

I've got a coinbase (regular, not pro yet). Can you talk about the basics re staking cryptocurrencies? Any tips, cautions? I've got about 25K spread out over various coins with 30% of it BTC on regular coinbase. Considering doing some staking but want to be sure I understand the risk vs. rewardI converted SOME of my cash to USDC stable coin at Coinbase and distributed it between 3 lending platforms: Celsius (10.51% https://celsius.network/rates/) , BlockFi (8.6% https://blockfi.com/rates/) and Nexo (10% https://blockfi.com/rates/). It works for me and all 3 have been paying interest diligently as per their terms.

I've got a coinbase (regular, not pro yet). Can you talk about the basics re staking cryptocurrencies? Any tips, cautions? I've got about 25K spread out over various coins with 30% of it BTC on regular coinbase. Considering doing some staking but want to be sure I understand the risk vs. reward

I'm interested also, but perhaps this should be a separate thread.

I looked into blockfi.com recently, and the fees scared me away.

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I tested a high yld treasury bond the last few months by buying the bond a day after the coupon payout and just held it till the next coupon payout and sold it the next day... its kinda scary buying a treasury at 47% above par just to hold it for the coupon and sell it back at the same valuation... but it is doable... lots of money to be made these days...

I don't think I've ever seen the terms "high yield" and "treasury bond" used together....what exactly does it refer to? High yield is generally used for less than investment grade (e.g. "junk") bonds but treasury bonds would not fall into that category. And how can a bond priced 47% above par produce a high yield?

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Target maturity bond funds are very similar to CDs in that they invest in bonds that mature in a specific year and they do a terminal distribution in December of the target year. They are in a space between individual bonds and bond funds... but more similar to holding a proportional interest in a portfolio of individual bonds maturing in a specified year. There are treasury, muni and corporate flavors. Obviously the corporate version has a higher yield.... probably ~0.90% vs 0.50% or less for a 5-year CD... but there is credit risk associated with these... for IBDQ, 55% of its holdings are BBB, 35% A and most of AA or better.

How safe are the Target maturity bond funds ?

What do you mean by safe? Safe from what?

stephenson

Thinks s/he gets paid by the post

- Joined

- Jul 3, 2009

- Messages

- 1,610

I gave up on fixed for now - bought ATT between $28-29 and just pretend it’s a 7% bond.

Yeah, I know, I know.

Yeah, I know, I know.

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I bought a couple stocks like that. Then they cut the divvy by half but I’m still happy getting >3%.

GravitySucks

Thinks s/he gets paid by the post

I have a ladder of the corporates. They've behaved like most good corporate bond funds. No complaints.How safe are the Target maturity bond funds ?

Black Rock offers different risk levels on the target date funds, from High Yeild to Treasuries. You can pick the risk level you wish.

Koolau

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

We occasionally end up with us much as half a year's spending in the check book at one time. Usually happens after our yearly RMD (or whatever I'm calling it this year since I took it but didn't have to.) The nice wahine and tutus at the bank always suggest a CD when that happens. But our in-and-out flow can be spectacular, though "spotty" so it makes no sense to me to go for even a 3 mo CD or similar. Besides the interest is too paltry to even bother. I'd keep it under the mattress before I'd give the banks the pleasure of tying up my cash for so little interest. But, I'm not bitter! Besides, I love the folks at the bank - 90 degress off topic, but I would miss going to the bank if I decided to bank online. YMMV

Besides, I love the folks at the bank - 90 degress off topic, but I would miss going to the bank if I decided to bank online. YMMV

Besides, I love the folks at the bank - 90 degress off topic, but I would miss going to the bank if I decided to bank online. YMMV

Besides, I love the folks at the bank - 90 degress off topic, but I would miss going to the bank if I decided to bank online. YMMVMontecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I don't think I've ever seen the terms "high yield" and "treasury bond" used together....what exactly does it refer to? High yield is generally used for less than investment grade (e.g. "junk") bonds but treasury bonds would not fall into that category. And how can a bond priced 47% above par produce a high yield?

Can only assume he meant "high coupon".

Similar threads

- Replies

- 35

- Views

- 2K

- Replies

- 17

- Views

- 727