target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

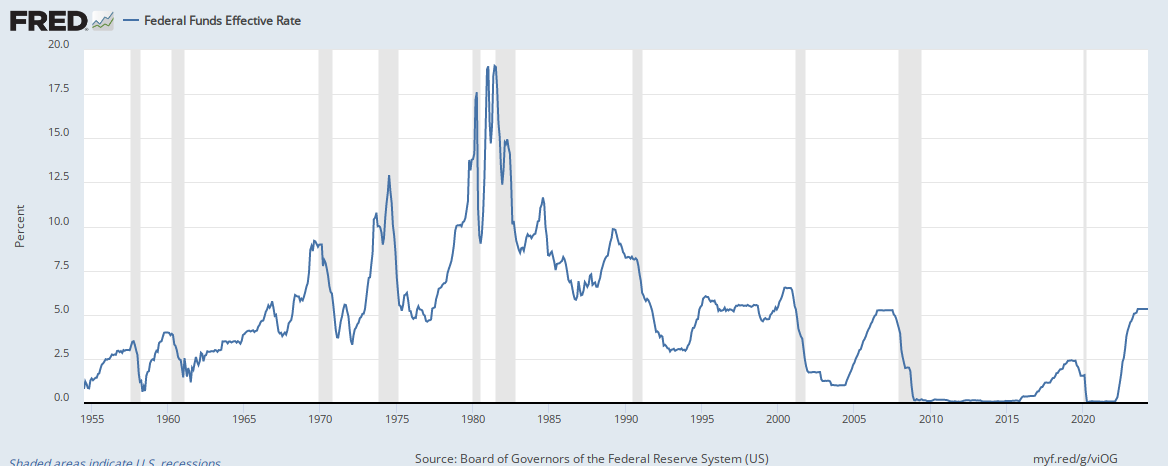

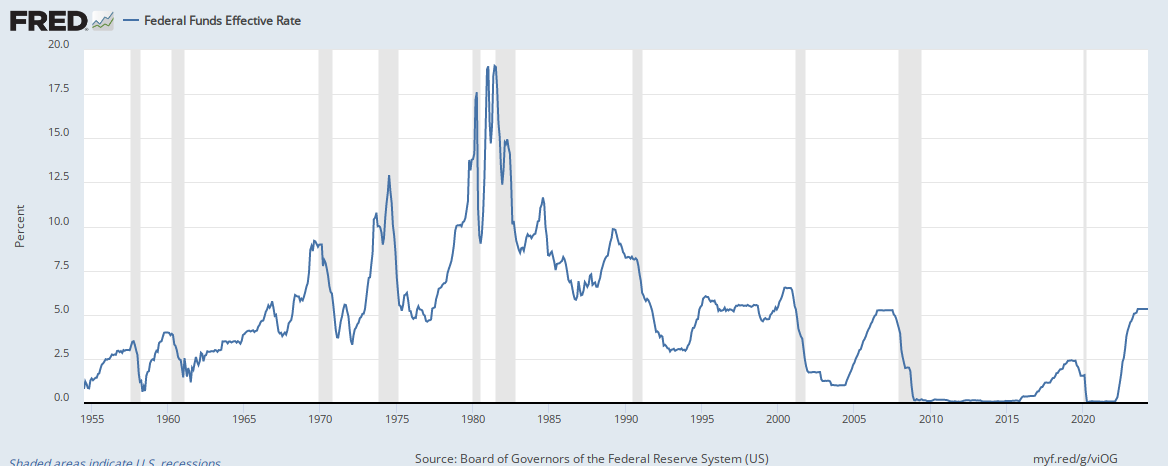

This doesn't help those with the short term problem, but it provides a long-term nostalgic view for those say 65 and older. We experienced almost 20% interest rate when we started careers. Now we hear about -0- or even negative interest rates I'm pretty much numb about what comes next. But we do have decisions coming up.

and that was 2% less than the going bank rates since it was a "in the family" deal

and that was 2% less than the going bank rates since it was a "in the family" deal