Dolphin Boy

Confused about dryer sheets

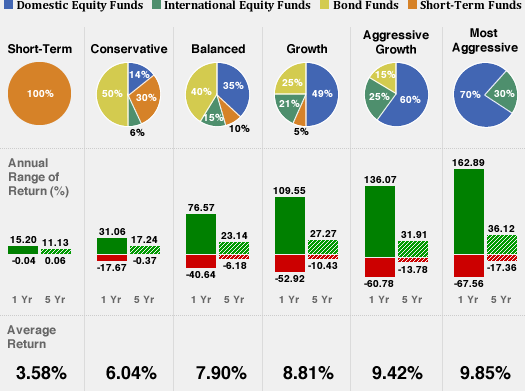

I am retired and need to protect my assets with safe investing. I only need to keep a step or two ahead of inflation, not significantly grow my assets.

I want to sleep easily at night and not have to worry about market gyrations, corrections or worse. Suggestions?

I want to sleep easily at night and not have to worry about market gyrations, corrections or worse. Suggestions?