eta2020

Thinks s/he gets paid by the post

- Joined

- Sep 13, 2013

- Messages

- 1,248

Oh, absolutely agreed on that!

Every state isn't Illinois though. Some are actually fairly well run by generally honest people. It gets better at the city or county level where there is more citizen oversight over the details. Well, some of them anyway.

Generally I'd agree that one should behave as if a promised pension wasn't going to be there. That simply isn't possible for a lot of people though.

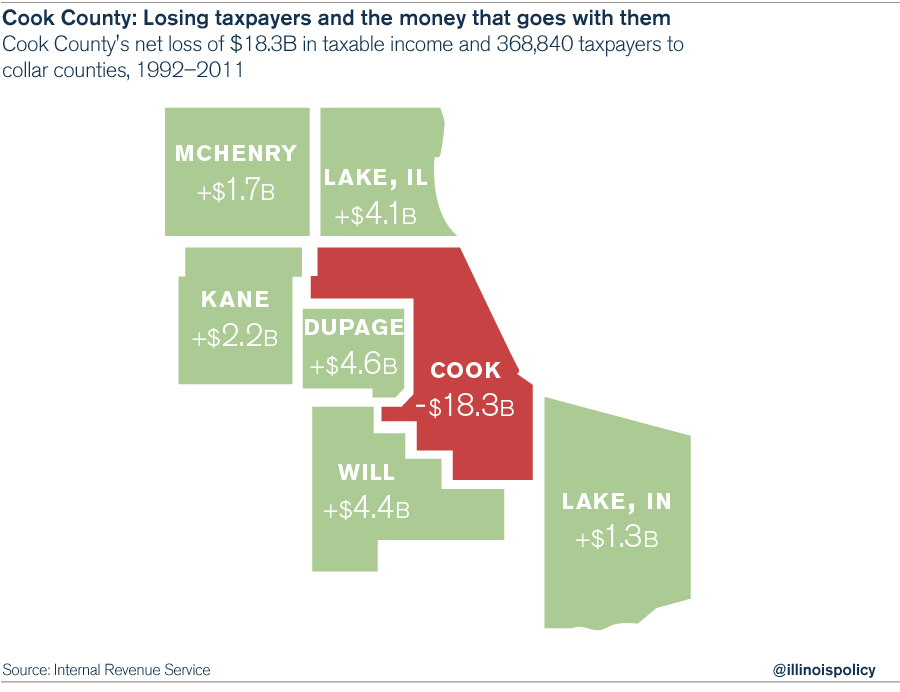

Illinois has declining population and one of the highest real estate taxes in US and more tax hikes coming soon

Probably warning sign.... one is better of working in public sector in prospering growing region of US.

Last edited: