zinger1457

Thinks s/he gets paid by the post

- Joined

- Jul 22, 2007

- Messages

- 3,229

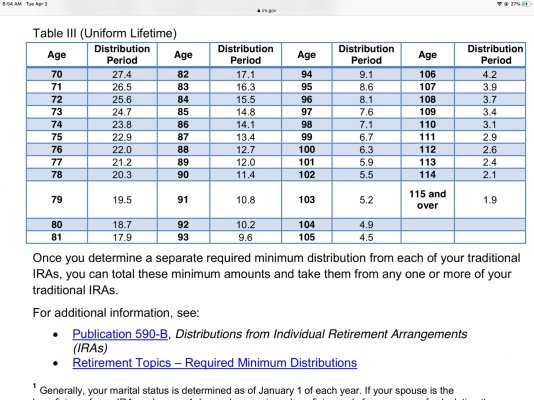

Not a huge change but a bipartisan bill going through the house and senate would raise the RMD age to 72.

https://finance.yahoo.com/news/bipartisan-bills-aim-to-revamp-retirement-saving-125240433.html

https://finance.yahoo.com/news/bipartisan-bills-aim-to-revamp-retirement-saving-125240433.html

The bill would raise the age at which people are required to take distributions from their retirement plan to 72, up from 70.5 years. It would also allow long-term part-time workers to participate in 401(k) plans.

(Which would have been a good April Fools joke if I were posting this yesterday.)

(Which would have been a good April Fools joke if I were posting this yesterday.)