Roth conversion

Thanks pb4uski and others for advice here on a plan to move money out of our tIRA's before RMDs hit.- 6 years for us.

2019 is my last year of full time work and 401 K contributions.

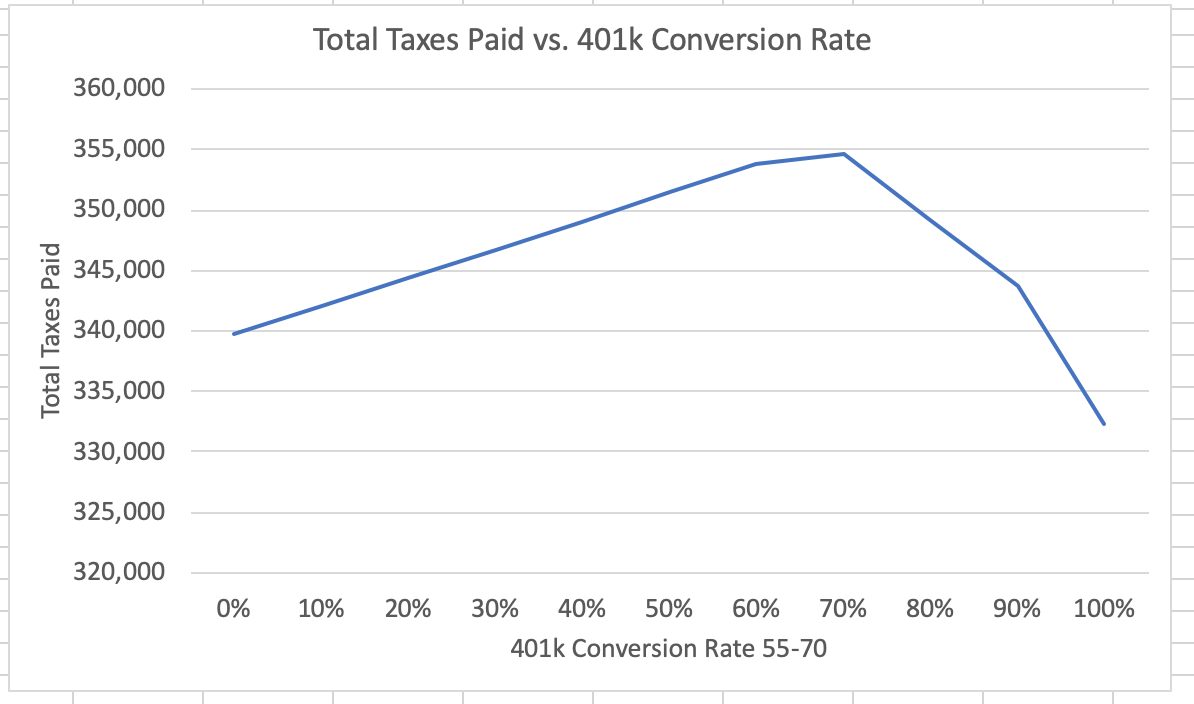

So in 2020, we 'll determine our conversion chart -

Another thought - although we are both in good health, if either of us dies before 70.5, the remaining spouse would be hit with heavier taxes on RMD - So tIRA conversion is also a protective mechanism - just in case.

Thanks again

Thanks pb4uski and others for advice here on a plan to move money out of our tIRA's before RMDs hit.- 6 years for us.

2019 is my last year of full time work and 401 K contributions.

So in 2020, we 'll determine our conversion chart -

Another thought - although we are both in good health, if either of us dies before 70.5, the remaining spouse would be hit with heavier taxes on RMD - So tIRA conversion is also a protective mechanism - just in case.

Thanks again