Roth Decision Tree

Great idea by someone to refine some Roth conversion decision tree questions. The Kitces article was the best ‘guideline’ that I could find, but it did not boil it down to simple steps and observations for my preference. I am not a CPA, but will take a shot at submitting a straw man for the forum to modify.

Overall Strategy to minimize your taxes when filing single and inheritance:

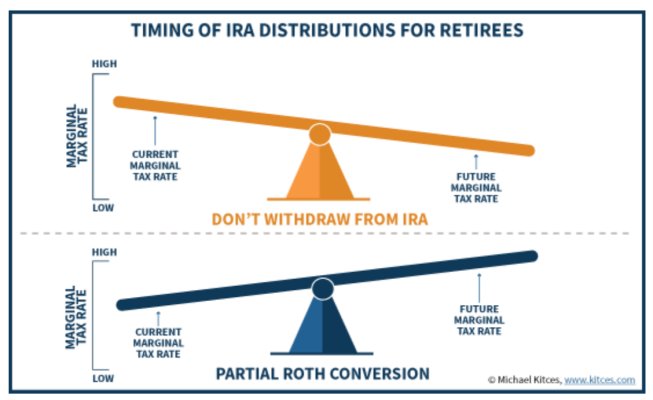

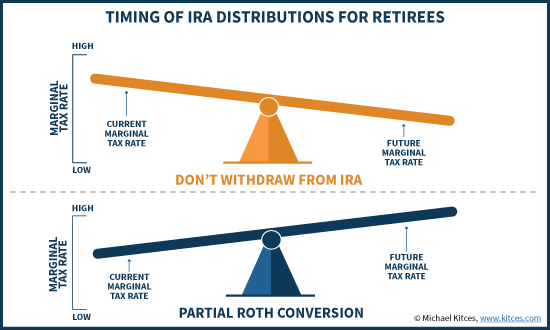

1) Keep IRA to Roth conversion tax rate lower than the future highest expected bracket for Single at age 85, considering Required Minimum Withdrawls from IRAs and all other income.

2) Determine if a maximum conversion will help to minimize effects of tax torpedo for Social Security.

3) Minimize RMD impact and maximizing tax free inheritance by use of an allocation and withdrawl scheme and a minimum Roth conversion. For example; an 80/20 allocation in the Roth and a 30/70 allocation in the IRA. Benefit is that the allocation and higher expected Roth growth is a non-taxable conversion strategy to draw down IRA and grow the Roth.

4) Keep an IRA reserve to fund medical shock events and have additional deductible resources or risk prepaying taxes on what would otherwise be a 0% tax bracket. (Such as deductible expenses for Long Term Care).

Tactical Goal Setting:

1) To determine your maximum conversion tax bracket, identify if you are minimizing taxes for your lifetime and spouse, or if you are minimizing inheritance taxes to children. Don’t convert an IRA to Roth above this tax bracket.

2) Determine your optimal claiming age for Social Security. For many couples, it is 70 for the high wage earner, and 67 (or FRA) for the low wage earner. This will help to establish the optimum time window available for Roth Conversions.

3) Understand your opinion of the future of federal and state income tax. Currently, the tax structure will by law revert in 2026. Personally, I think that the 0% capital gains tax bracket is at risk of being eliminated in the near future, so I want to take advantage of that benefit sooner rather than later.

4) If taking LTCG strategy of 0% taxes, postpone pension/annuity/SS until gains harvest is complete. During LTCG harvest window, consider minimizing Roth conversions during this period to only fill standard deduction, or else every dollar taxed at 12% also pushes LTCG above $80,000 into the 15% bracket for an effective marginal conversion of 27%. LTCG tax rates ‘float’ up over all other income.

5) Keep enough in IRA to fill lower tax brackets when combined with SS, Qdiv, pension/annuity income.

Annual Steps (which can be projected)

1) Determine your living expenses, and marginal tax bracket. Evaluate how much is left in that tax shelf to the start of the next brackets. This is the potential size of your annual IRA to Roth conversion.

2) Project your annual expenses and income at age 80, filing Single and Married.

3) Using above, project your marginal tax rate at age 80, filing Single and Married. This is your Roth conversion ceiling – don’t convert above this tax bracket.

4) In order to stay below the age 80 tax bracket determined above, estimate how much would have to come from a Roth account, how much from IRA and other income (SS and pension). This is the ‘split’ between your IRA and Roth to help estimate total amount for conversion.

5) Add any amount to the Roth that you desire for tax free inheritance.

6) Understand the impact that Roth conversion may have on Net Investment Income Tax and IRMAA. Re-evaluate conversion as needed.

As I have mentioned earlier, iORP is a free online tool, but it lacks sophistication for optimizing certain tax scenarios.